Homebuying and Mortgage Process From Application To CTC

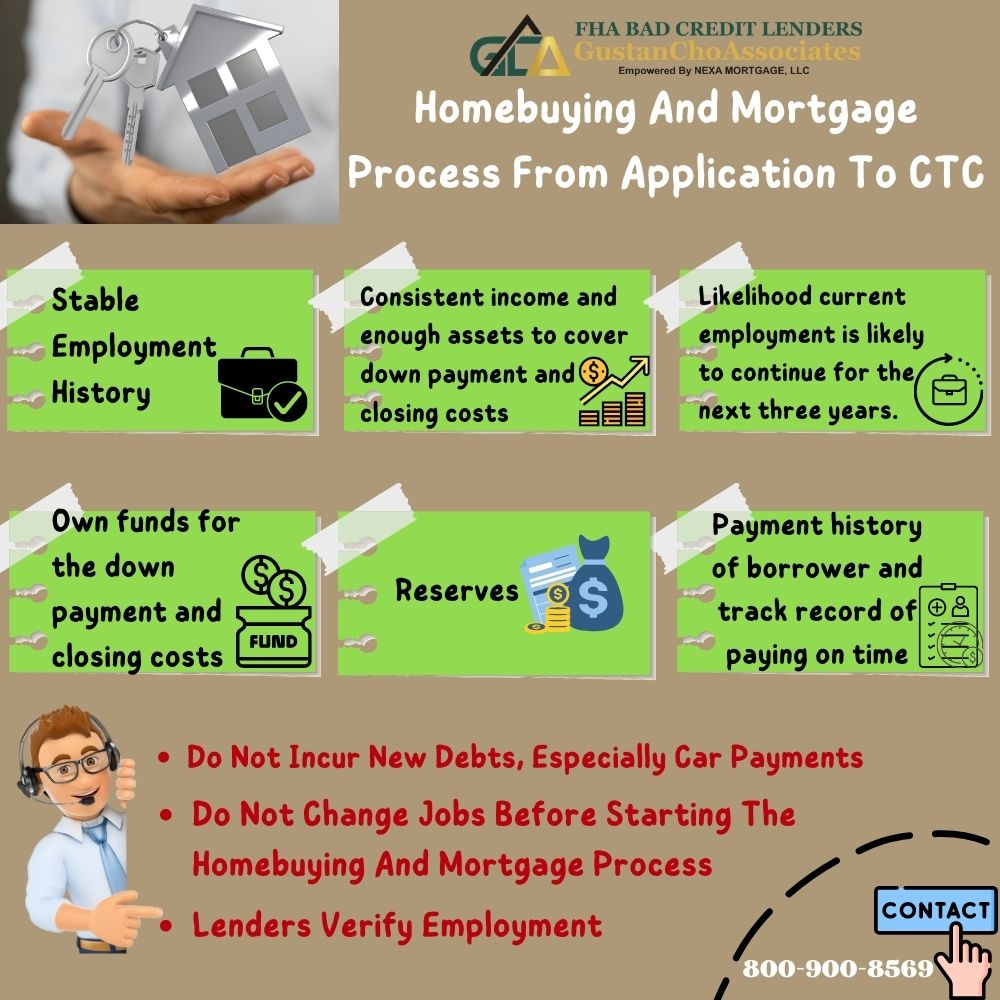

Homebuyers, especially first-time home buyers, should prepare before starting the homebuying and mortgage process. This blog will cover preparing for the home buying and mortgage process. We will cover the do’s and don’ts before the home buying and mortgage process. Mortgage Lenders like to see the following:

- Stable Employment History

- Own funds for the down payment and closing costs

- Reserves

- Likelihood current employment is likely to continue for the next three years.

- Consistent income and enough assets to cover down payment and closing costs

- Payment history of borrower and track record of paying on time

In the following sections, we will cover the steps of the homebuyer and mortgage process from application to closing.

Do Not Change Jobs Before Starting the Homebuying And Mortgage Process

Many home buyers feel confident their jobs or the field of work they are in are secured. This is one of the main reasons they are purchasing a new home.

The economy is hot. Many talented employees are in demand and are constantly being recruited. However, do not change jobs before starting the home-buying and mortgage process.

Do not give notice to an employer of quitting either. This is because when lenders do verification of employment, one of the questions they will be asking is if the likelihood of continued employment for the next three years is likely.

How Lenders Verify Employment During The Mortgage Process

If the employer states that the employee gave notice they will be retiring at the end of the year, this will disqualify the borrower from qualifying for a mortgage.

Borrowers can change jobs and not have to be employed with the same employer for the past two years. However, there may be delays in closing a home loan with changes in employment.

Again, changing jobs in the same field of work in the past two years is not a deal killer. If it can be avoided and delayed until after closing, it will make the homebuying and mortgage process much easier.

Changing W2 Income Wage Earner To 1099 Status During The Homebuying And Mortgage Process

As mentioned earlier, changing jobs is not recommended during the homebuying and mortgage process but is not a deal killer. A deal killer is when a W2 wage earner changes jobs and becomes a 1099 wage earner. If this happens, borrowers must wait two years as a 1099 wage earner to qualify for a home loan.

Every loan program, whether government or conventional, has the same mortgage guidelines on the two-year seasoning of 1099 wage earners.

Self-employed and 1099 borrowers need two years of federal income tax returns to qualify for mortgage loans. On the flip side. If 1099 wage earners convert to W2 wage earners, there is no two-year seasoning period. If 1099 wage earners get a W2 income job or their current employer turns them into a W2 wage earner, they can qualify for a mortgage immediately.

Importance Of Timely Payments In the Past 12 Months For The Homebuying and Mortgage Process

One of the most important and key factors in getting an approve/eligible per Automated Underwriting System Approval is to have been timely in the past 12 months.

Consumers can have the best credit scores and debt-to-income ratios, but with late payments in the past 12 months, they may not get an automated approval per AUS. All manual underwrites on FHA and VA loans require timely payments in the past 12 months.

Borrowers can have outstanding collections and charged-off accounts and do not have to pay them off. However, they do need to have been timely in the past 12 months.

Do Not Incur New Debts, Especially Car Payments

Car Payments are the biggest monthly payment most consumers have and often affect buying power on a home purchase. Do not purchase a new car during the home buying and mortgage process.

The average new car payment is $400 per month, equivalent to an $80,000 home mortgage. Pay down all revolving accounts to 10% of the credit limit. If larger purchases need to be made with credit cards, try to spread the charges with several credit cards so it does not exceed 30% balance of the available limit.

Maxed-up credit scores can plummet credit scores. Doing so will keep credit scores optimized and as high as possible during the home buying and mortgage process.

The Importance of Having Seasoned Credit Tradelines

Everyone should have at least three credit tradelines. Those who do not get three secured credit cards with $500 credit limits. Not having any credit tradelines will yield low credit scores.

Secured credit cards are the easiest and fastest way to rebuild credit to prepare for a mortgage. It is highly recommended for maximum credit score increase and rebuilding credit, three to five secured credit cards with at least a $500 credit limit and two credit rebuilder account from your local bank or credit union should be opened.

Consumers with more than three credit tradelines do not apply for additional credit cards. Do not apply for any new credit or incur new debt before and during the mortgage process. Under no circumstances close out any revolving accounts even though it is not used.

Monitoring Bank Statements During The Homebuying and Mortgage Process

Do not make non-payroll check deposits greater than $500 to any bank accounts that will be used and listed on the mortgage application unless it can be sourced and a paper trail can be provided documenting the source of the deposit.

It needs to be proven it is the borrower and not a gift if it will be used as qualified funds. Do not have any overdrafts in bank statements in the past 12 months. Lenders will ask for 60 days of bank statements. If borrowers did not have any overdrafts in the past 60 days but did have overdrafts in the past 12 months, mortgage underwriters will find out about it.

The reason being is YTD Overdraft Fees are a line item on all bank statements. So if there is a figure there, borrowers are telling on themselves. Depending on lenders, one overdraft in the past 12 months can and will likely be a deal killer.

How To Deal With Bank Overdrafts

Bank overdrafts are not viewed favorably by mortgage underwriters. Underwriters have underwriter discretion in denying a mortgage loan due to disregard for credit. Bank overdrafts are viewed as being financially irresponsible, so you want to avoid submitting bank statements with overdrafts. Borrowers with overdrafts in the past 12 months do not turn in bank statements. Go to the bank teller:

- get 60 days of bank printouts

- have the teller sign, date, stamp

This works because there is no YTD Overdraft Fees line item on bank statement printouts.

Own Sourced Versus Gift Funds

Lenders prefer their funds from borrowers. Gift Funds are not viewed favorably. However, gift funds are allowed but need to follow guidelines on gifted funds.

If intending on using gift funds for a down payment and closing costs, the donor needs to sign a gift form which. Bank statements from the donor are required to show the transfer of funds to the borrower’s bank statements. All deposits on the donor’s bank statement will be processed and underwritten as if they were borrowers’ accounts.

30 days of the donor’s bank statements are required. Try to save as much as possible before the homebuying and mortgage process. Lenders like to see borrowers’ habit of saving money and assets.

Credit Disputes Before Mortgage Process

Credit Disputes will halt the mortgage underwriting process until the credit disputes are retracted. Most homebuyers often hire credit repair companies before the homebuying and mortgage process.

Credit repair is often unnecessary and, in many instances, causes more damage than good. Borrowers can qualify for a mortgage with outstanding collections and charged-off accounts without paying them off. The Key has been timely in the past 12 months.

Leave the old collections and charged-off accounts alone and be timely on all payments in the past 12 months, and borrowers will get mortgage approval.

Qualifying For Mortgage With A Lender With No Overlays

Homebuyers with less than perfect credit or higher debt-to-income ratios, don’t hesitate to contact us at FHA Bad Credit Lenders at 800-900-8569 or text us for a faster response. You can also email us at gcho@gustancho.com.

The team at FHA Bad Credit Lenders, empowered by NEXA Mortgage, LLC, are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the United States Virgin Islands. WE have a national reputation for its no lender overlays platform on FHA, VA, USDA, and conventional loans.

Over 80% of our borrowers are folks who either got a last-minute loan denial or are stressed during the mortgage process with the current lender. We have no lender overlays on government and conventional loans. All of our pre-approvals are fully underwritten and signed off by our underwriters.