In this article, we will cover FHA’s two-to-four-unit multi-family purchase guidelines. Homebuyers can qualify for an FHA owner-occupant multi-family purchase home with a 3.5% down payment.

Multi-family purchase is an excellent option for buying an owner-occupant home and having the rental income to offset housing expenses. HUD Multi-Family Mortgage Guidelines only require 580 credit scores and a 3.5% down payment. Potential rental income can be used as qualified income on Multi-Family purchases.

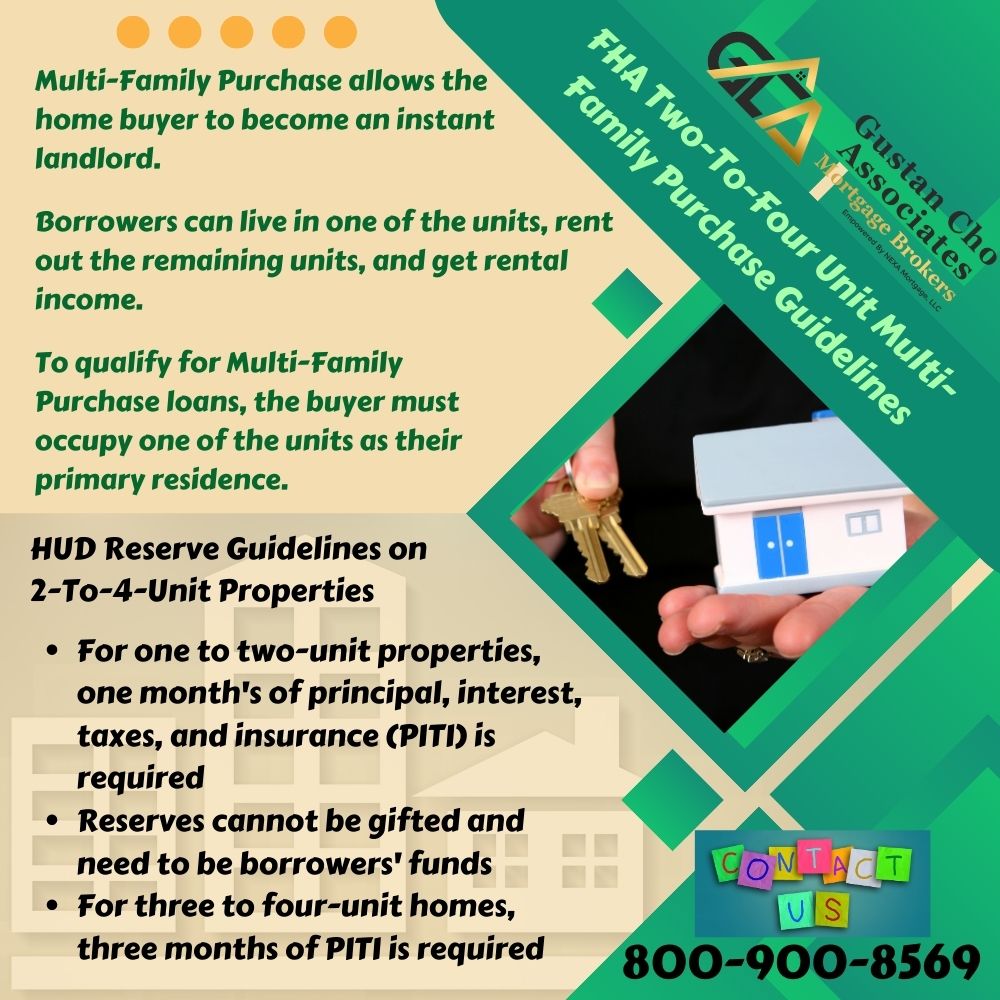

Borrowers can live in one of the units, rent out the remaining units, and get rental income. Multi-Family Purchase allows the home buyer to become an instant landlord. Borrowers must meet all HUD Mortgage Guidelines to qualify for multi-family purchase loans.

Types of Multi-Family Properties Eligible

To qualify for Multi-Family Purchase loans, the buyer must occupy one of the units as their primary residence. For homebuyers who want to invest in real estate, buying a two to the four-unit multi-family building as their first-owner occupant building is a great start.

You need to be an owner-occupant for 12 months and can purchase another primary owner-occupant home. You may not be able to purchase another multi-family building as an owner-occupant home, but you can qualify for a single-family home. This way, you will have a multi-family building as a rental investment property and still qualify for another single-family home with a 5% down payment conventional loan.

This section will discuss the type of properties eligible for two-to-four-unit multi-family homes. Two-unit properties zoned as residential: One unit must be occupied by the owner while the other can be rented out. Three units are residentially zoned properties where one of the units needs to be occupied by the owner as their primary residence. Four units are residentially zoned properties where one of the units needs to be an owner-occupant property.

HUD Reserve Guidelines on 2-To-4-Unit Properties

Multi-family homes are considered higher-risk properties by both FHA and lenders. Mortgage rates on 2 to 4-unit properties are higher than on single-family homes. Due to the higher risk factor, HUD requires reserves on Multi-Family properties. Here are the reserve requirement for multi-family homes:

- For one to two-unit properties, one month’s of principal, interest, taxes, and insurance (PITI) is required

- Reserves cannot be gifted and need to be borrowers’ funds

- For three to four-unit homes, three months of PITI is required

- Manual underwriting files on one unit properties, one month of PITI is required

Alex Carlucci is an expert in multi-unit owner-occupant and investment property at Gustan Cho Associates.

Qualifying For Multi-Family Purchase With A Lender With No Overlays

Many lenders will not honor potential rental income to be used as qualified income as part of their overlays. For example, many lenders will not allow rental income to be used unless the borrower has had landlord experience for at least two years. This requirement is not a HUD guideline. They are lender overlays.

Lender overlays are additional mortgage guidelines above and beyond HUD Agency Mortgage Guidelines. Gustan Cho Associates is a mortgage company licensed in multiple states with no lender overlays on government and conventional loans.

Gustan Cho Associates are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands. Please contact us at Gustan Cho Associates at 800-900-8569. Text us for a faster response. You can email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.