Mortgage After Deed-In-Lieu Versus Foreclosure Guidelines

This blog will cover Fannie Mae’s Guidelines on a mortgage after a deed-in-lieu versus foreclosure guidelines. Homebuyers and homeowners can qualify for a conventional loan after a housing event. A housing event is a foreclosure, a deed-in-lieu of foreclosure, or a short sale.

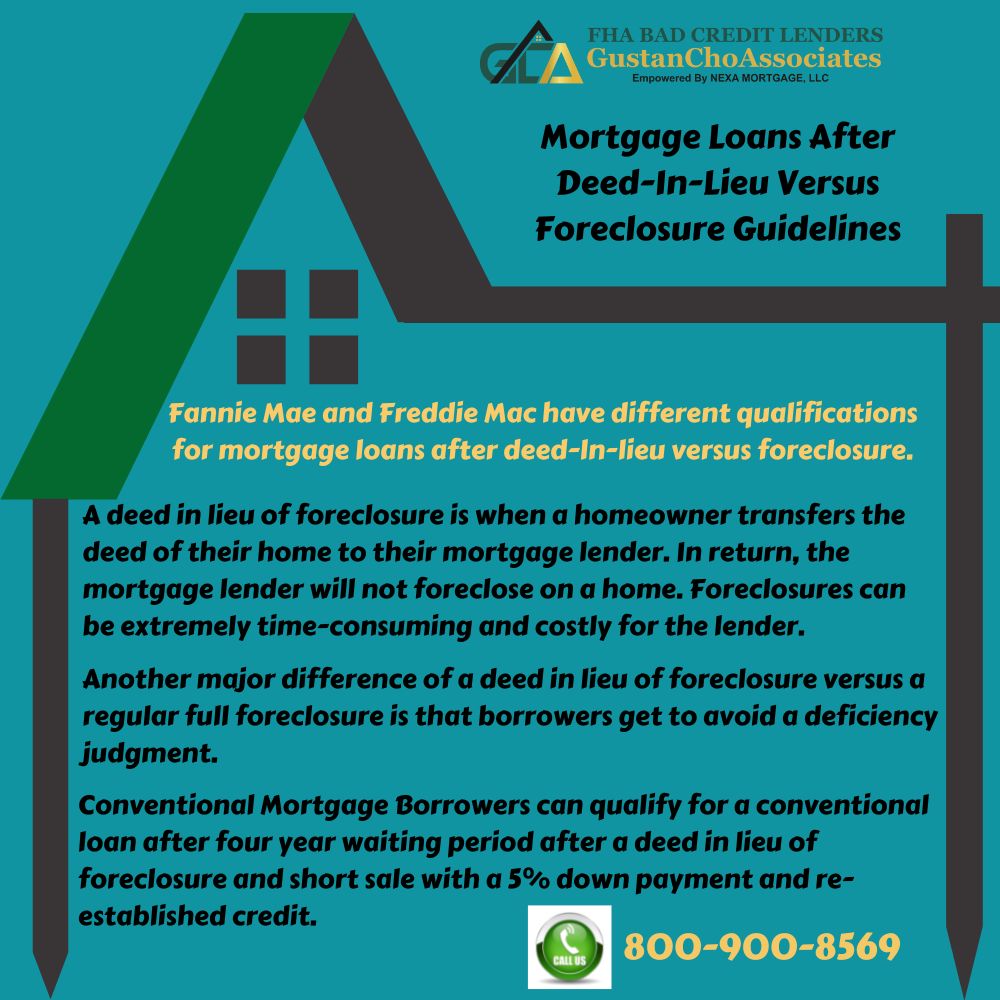

Fannie Mae and Freddie Mac have a waiting period requirement after a housing event. The waiting period differs after a deed-in-lieu of foreclosure and a short sale versus a standard foreclosure. Government loans have the same deed-in-lieu of foreclosure and foreclosure waiting period requirements. This means that government loans treat a short sale and deed-in-lieu versus foreclosure the same and have the same waiting period requirements.

Conventional loans have different waiting period requirements on qualifying for a mortgage after deed-in-lieu of foreclosure versus foreclosure. In the following paragraphs, we will cover the waiting period requirements after a short sale, deed-in-lieu versus foreclosure.

Defaulting On A Home Mortgage

When borrowers can no longer afford mortgage payments or want their home, they can request a mortgage lender who can offer mortgage loans after the short sale and deed-in-lieu versus foreclosure.

The waiting period requirements is shorter on a short sale, and deed-In-lieu of foreclosure versus foreclosure. Fannie Mae and Freddie Mac have different qualifications for mortgage loans after deed-ln-lieu versus foreclosure. The waiting period to qualify for mortgage loans after deed-in-lieu versus foreclosure is four years. It is four years after a short sale to qualify for conventional loans. However, the waiting period is seven years after a foreclosure to qualify for conforming loans.

A deed-in-lieu of foreclosure is when a homeowner transfers the deed of their home to their mortgage lender. In return, the mortgage lender will not foreclose on a home. Foreclosures can be extremely time-consuming and costly for the lender.

Benefits Mortgage Loans After Deed-In-Lieu Versus Foreclosure

The biggest advantage of qualifying for mortgage loans after deed-in-lieu versus foreclosure is that homeowners save time and hassles. Homeowners avoid going through the foreclosure process and the auctioning of homes at the sheriff’s sale.

Another major of a deed-in-lieu versus foreclosure is that borrowers get to avoid a deficiency judgment. Lenders will not sue borrowers for the upside-down loss or write-off the lender will get from the sale of property and the mortgage balance owed to the lender.

In lieu of giving the lender the property deed, a lender will not go after a homeowner on any deficits. Whereas with a regular foreclosure, the lender can come after the homeowner for the deficit. The United States Congress has extended a law that benefits homeowners who have gone through a housing event, such as a deed-in-lieu of foreclosure, called the forgiveness of debt act. This act forgives tax forgiveness for the debt that was written off.

Mortgage After Deed-In-Lieu Of Foreclosure Versus Foreclosure

A homeowner will always come out ahead with a deed-in-lieu of foreclosure versus a regular foreclosure. A better alternative to a deed-in-lieu of foreclosure for a distressed homeowner is a short sale.

A short sale is when a lender gives a homeowner permission to sell a home at a value lower than the balance of a mortgage loan. Both short sales and deed-in-lieu of foreclosures have a major negative impact on credit scores. However, although credit scores may drop as much as 200 points initially, credit scores will gradually improve over time.

As a deed-in-lieu of foreclosure and short sale ages, it will have less impact on credit scores. Once the deed-in-lieu of foreclosure is finalized, get three secured credit cards, which will spike up credit scores. Each secured credit card will boost credit scores by at least 30 or more points. Credit scores will rapidly increase as secured credit cards age.

When Can I Qualify For Another Mortgage Loan After Deed-In-Lieu Versus Foreclosure

Conventional Mortgage Borrowers can qualify for a conventional loan after four year waiting period after a deed-in-lieu of foreclosure and short sale with a 5% down payment and re-established credit.

For an FHA loan, foreclosure, deed-in-lieu of foreclosure, and short sale are all 3-year waiting periods from the recorded date of a deed-in lieu of foreclosure and foreclosure. There is a four-year waiting period to qualify for Conventional Loans After a Short Sale. The waiting date starts from the HUD settlement date for short sales.

Home Buyers can qualify for a mortgage after foreclosure. Borrowers who need to qualify for a mortgage after foreclosure and bankruptcy with a mortgage company licensed in multiple states with no lender overlay, please get in touch with us at FHA Bad Credit Lenders at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The FHA Bad Credit Lenders team is available seven days a week, evenings, weekends, and holidays.