HUD Multi-Family Self-Sufficiency Test on FHA Loans

This guide will cover the HUD multi-family self-sufficiency test on FHA loans. Gustan Cho Associates, empowered by NEXA Mortgage, LLC., are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands. The team at Gustan Cho Associates are experts in two-to-four-unit multi-family home financing.

The team at Gustan Cho Associates is experts in helping homebuyers purchase their first two-to-four-unit multi-family homes. Gustan Cho Associates has a lending network of 210 wholesale lending partners.

Our network of five-star wholesale lenders includes wholesale lenders of government and conventional loans with no overlays, non-QM, and alternative lending partners with niche markets in non-QM and alternative financing mortgage programs. The team at Gustan Cho Associates has long since had a national reputation for being able to do mortgage loans that other mortgage companies cannot do. The following paragraphs will cover the HUD multi-family self-sufficiency test on FHA loans.

Talk To a Loan Officer Click Here

HUD Multi-Family Self-Sufficiency Test

Over 80% of our borrowers could not qualify at other lenders due to the lender having overlays or because the borrower got a last-minute mortgage loan denial. Plus, most mortgage companies do not have the mortgage loan options we have at Gustan Cho Associates. Chicago and its suburbs have a substantial number of two-to-four-unit multi-family buildings.

Gustan Cho Associates, with a network of over 210 wholesale mortgage lenders, offers a large selection of wholesale lenders who are experts in working with borrowers with multi-family homes.

Not only do we work with FHA, VA, USDA, and conventional loans, but we also have hundreds of non-QM and alternative mortgage loan options for homebuyers of owner-occupant primary homes, second homes, and investment properties. The following paragraphs will cover the HUD multi-family self-sufficiency test on FHA loans.

Understanding the Role of HUD and The FHA Loan Mortgage Process

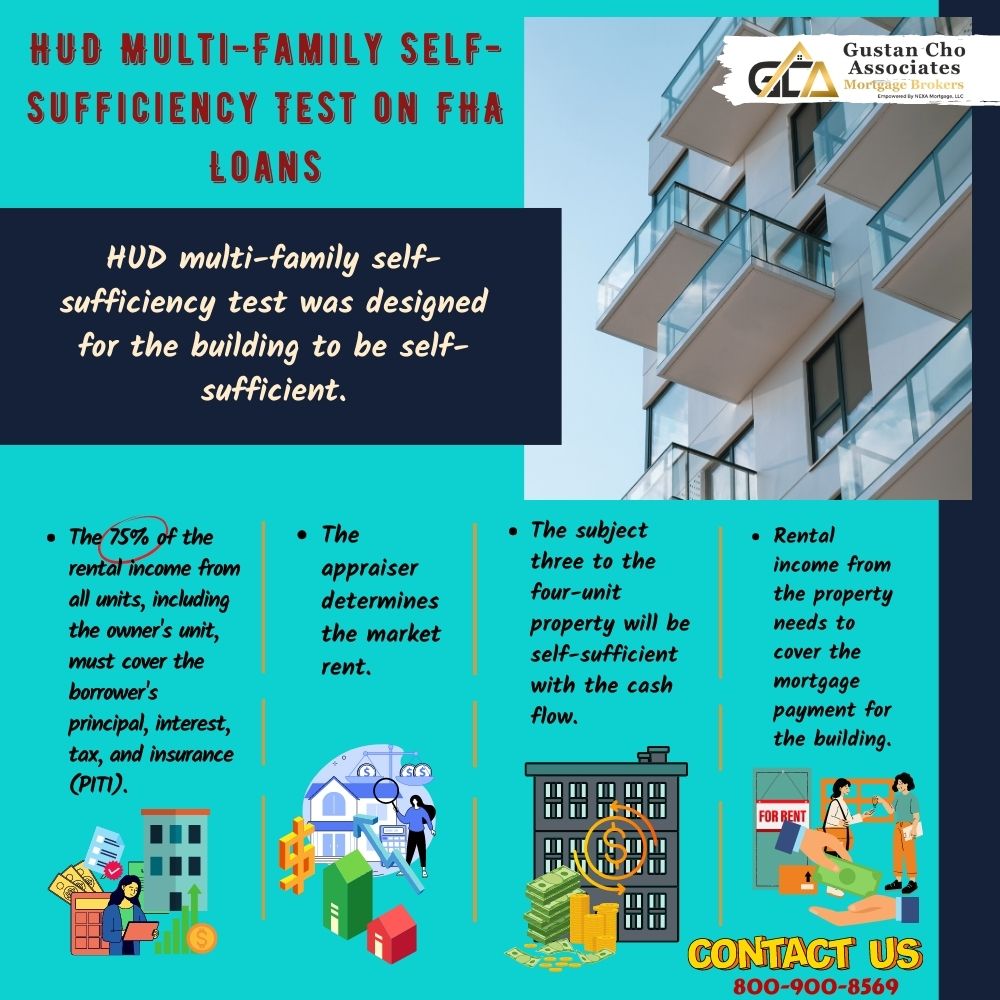

HUD, the parent of FHA, has the most lenient agency mortgage guidelines of any other mortgage loan program. FHA loans are very popular and common among first-time homebuyers, buyers with a high debt-to-income ratio, credit scores down to 500 FICO, and borrowers who need to purchase an owner-occupant two-to-four unit multi-family home. Passing the HUD multi-family self-sufficiency test means that HUD wants to ensure the subject three to the four-unit property will be self-sufficient with the cash flow. The bottom line is the rental income from the property needs to cover the mortgage payment for the building.

Why Are FHA Loans So Popular?

HUD and FHA are not lenders. They have nothing to do with originating, processing, underwriting, funding, or servicing FHA loans.

The role of HUD and FHA is to promote homeownership for first-time homebuyers with little to no credit, and homebuyers with less than perfect credit can purchase a home with little money down and easy financing. HUD, the giant federal agency, is the U.S. Federal Housing Administration. HUD is the agency that creates and sets agency mortgage guidelines on FHA loans. HUD’s role is to act as a federal government mortgage insurance agency to private lenders who originate and fund FHA loans.

How Do FHA Loans Work?

FHA loans are the most popular mortgage loan program for American homebuyers—especially homebuyers of two-to-four-unit multi-family homes. You only need a 3.5% down payment to purchase an owner-occupant primary two-to-four-unit multi-family home with a 580 credit score.

Conventional loans require a 15% down payment for a two-to-four unit multi-family owner-occupant multi-family home. Conventional loans require a 620 credit score.

Due to the government guarantee, private lenders are more than willing to originate and fund FHA loans using their warehouse line of credit. Once the FHA-insured loan closes, the lender sells it on the secondary market. The secondary market will gladly buy FHA loans that are insured. Once they sell the FHA loan on the secondary market, the warehouse line of credit gets paid down, and the process repeats repeatedly.

Understanding the HUD Multi-Family Self-Sufficiency Test for a Two-Unit Property

There is no self-sufficiency test on a two-unit multi-family property. Only three to four-unit properties need to meet the HUD multi-family self-sufficiency test. Homebuyers can purchase a one- to four-unit building for an owner-occupant primary home residence with an FHA loan.

If you purchase a two-unit building, you need to live in one of the units and rent the second apartment to get rental income. You can use 75% of the market rent as qualified income in qualifying for your two-unit multi-family home.

You must meet all the minimum HUD agency mortgage guidelines regarding credit, income, and property standards per HUD agency guidelines. If the duplex has a tenant, the rent the tenant pays is used if it is lower than the market rent determined by the home appraisal.

Understanding the HUD Multi-Family Self-Sufficiency Test for 3 or 4-Unit Properties

All two-to-four-unit multi-family homes require a 3.5% down payment on FHA loans. Buying a three- to four-unit multi-family building gets a little more complicated on FHA loans than a one- or two-unit home. On three to four-unit multi-family homes, you must live in one of the units as your owner-occupant primary home. The remaining units can be used for rental income. 75% of the market rent from the other units can be used as qualified income to count towards your debt-to-income ratio. With a three to four-unit multi-family home, you must pass the HUD multi-family self-sufficiency test.

How Is HUD Multi-Family Self-Sufficiency Test Calculated For 3 To 4 Unit Properties

To pass the HUD multi-family self-sufficiency test for FHA loans, you need to take 75% of all the units in the building, including the owner-occupant primary unit, and 75% of the market rent. The appraiser determines the market rent. The 75% of the rental income from all units, including the owner’s, must cover the borrower’s principal, interest, tax, and insurance (PITI). The appraiser will consider comparable rents in the area and vacancy rate when determining fair market rent for the HUD multi-family self-sufficiency test. Lenders will deduct the vacancy factor from the net rental income. The HUD multi-family self-sufficiency test was designed for the building to be self-sufficient, which means the building could pay for itself if it were to go into default and foreclosure.

Gustan Cho Associates has a national reputation of being able to approve mortgage loans other lenders cannot do. The team at Gustan Cho Associates have helped thousands of borrowers with FHA loans down to 500 FICO and those who could not qualify at other mortgage companies.

If you have any questions about the content in this guide on the HUD multi-family self-sufficiency test for FHA loans or need to qualify and get pre-approved for a mortgage, don’t hesitate to contact us at Gustan Cho Associates at 262-716-8151. Text us for a faster response. You can email us at gcho@gustancho.com. The team at Gustan Cho Associates is available seven days a week, evenings, weekends, and holidays.