HUD Collection Accounts Guidelines on FHA Loans

This article will cover HUD collection accounts guidelines on FHA loans. HUD is the parent federal agency of the Federal Housing Administration (FHA). HUD is not a lender. HUD, the parent of FHA, is a federal agency insuring FHA loans that goes into default. Private lenders are the institutions that originate, process, underwrite, fund, and service FHA loans. HUD will partially guarantee the loss lenders sustained due to the borrowers defaulting and foreclosing on their FHA loans.

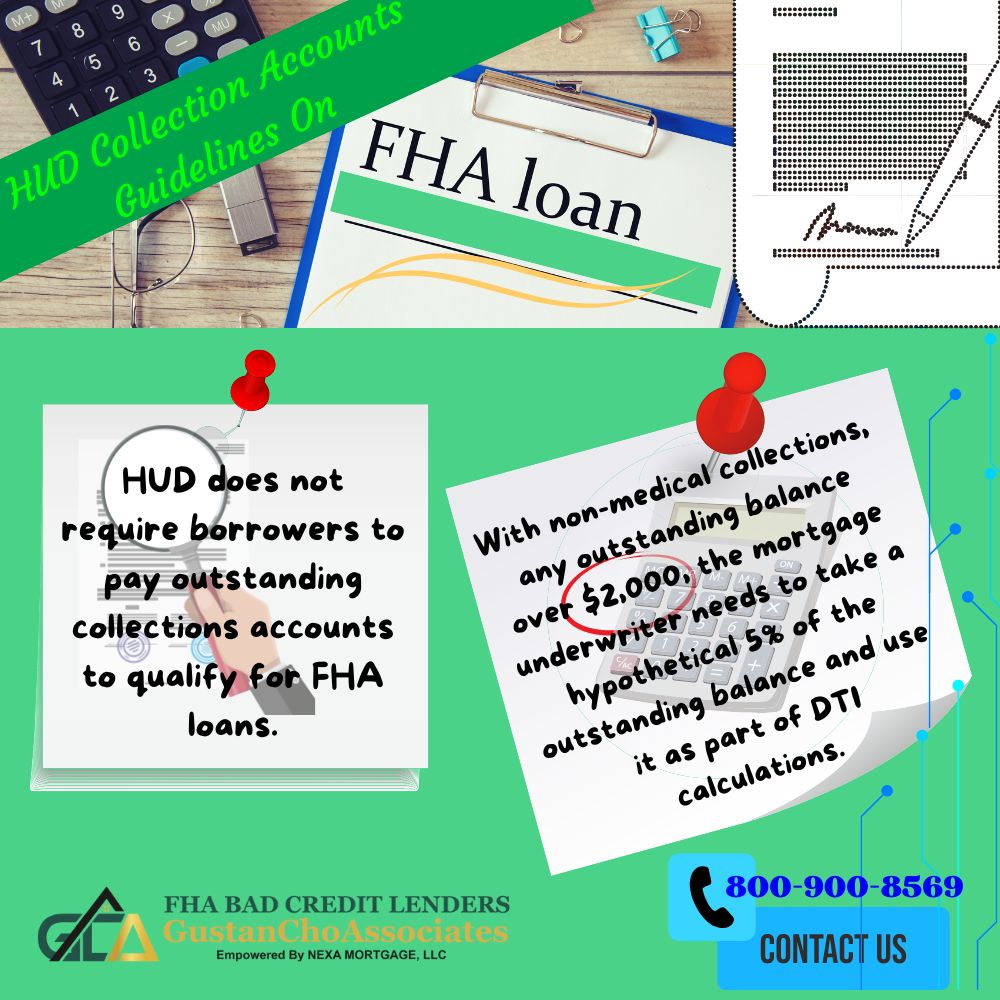

For HUD to insure losses on FHA loans, mortgage companies must abide by the minimum HUD Guidelines on all FHA loans they originate and fund. HUD collection accounts guidelines on FHA loans are lenient. Borrowers do not have to pay outstanding collections and charged-off accounts to qualify for FHA loans.

Lenders can have overlays that require all derogatory credit tradelines that must be current and paid off. Lender overlays are higher lending requirements by individual mortgage lenders. This holds even though HUD collection accounts guidelines on FHA loans do not require it. The higher lending requirements imposed by lenders are individual lender overlays. FHA Bad Credit Lenders is one of the few national lenders with no overlays on FHA loans. This article will discuss HUD collection accounts guidelines on FHA loans.

Choosing A Lender To Qualify For An FHA Loan

Not all lenders have the same lending guidelines on FHA loans. All mortgage companies need to have their borrowers meet HUD Guidelines. Mortgage companies can have higher standards and guidelines than the minimum HUD guidelines on FHA mortgages. For example, HUD requires a minimum credit score of 580 FICO to qualify for a 3.5% down payment FHA loan.

Most lenders may require a minimum credit score of 620 FICO. This holds even though the borrower meets the minimum 580 credit score requirements per HUD Guidelines.

Borrowers who meet the minimum credit score requirements for a 3.5% down payment FHA home purchase loan may get denied by many lenders with overlays on credit scores. The bottom line is just because a lender may say you do not qualify for an FHA loan does not mean another lender will not say YES. Over 80% of our borrowers at FHA Bad Credit Lenders could not qualify for a home mortgage due to the lender overlays mortgage companies had.

HUD Collection Accounts Guidelines Versus Lender Overlays

This section will discuss the HUD collection accounts guidelines versus typical lender overlays. HUD does not require borrowers to pay outstanding collections accounts to qualify for FHA loans. Many lenders may require that all collections be paid as part of their lender overlays. HUD differentiates collections accounts into two categories:

- Medical collections

- Non-medical collections

With non-medical collections, any outstanding balance over $2,000, the mortgage underwriter needs to take a hypothetical 5% of the outstanding balance and use it as part of DTI calculations. The borrower can enter a written payment agreement if 5% of the outstanding balance is too much in DTI calculations. The amount agreed in the written payment agreement will be used in lieu of 5% of the outstanding balance. Medical collections are exempt from the 5% rule.

HUD Collection Accounts Guidelines And Charged-Offs

Charged-off accounts do not have to be paid to qualify for FHA loans. This holds true no matter how large the charge-off is. Charged-off accounts are normally listed as Profit & Loss on consumer credit reports. The 5% of the outstanding balance does not apply to charged-off accounts. Medical or non-medical charged-off accounts are treated the same.

Credit Disputes On Oustanding Collection Accounts

Credit repair can do more damage to borrowers than most people know. Credit disputes are not allowed on derogatory credit tradelines. You cannot have credit disputes on late payments, collections, or charged-off accounts during the mortgage process. Medical collections are exempt.

Any collection accounts with zero balances are exempt from retraction. Any credit disputes where the credit tradelines are at least two years old and older are exempt from retraction. Credit disputes are not allowed during the mortgage process because the credit bureaus automatically negate the derogatory credit tradelines from the FICO scoring model. This makes consumer credit scores higher when there are credit disputes.

Once the credit dispute is retracted, the consumer credit scores normally drop. Borrowers with many credit disputes may keep those disputes and not retract them if the file is downgraded to a manual underwrite. Many of our borrowers at FHA Bad Credit Lenders are manual underwriting borrowers.

Qualifying For A Mortgage With A Lender With No Lender Overlays

FHA Bad Credit Lenders are experts in manual underwriting. To qualify for FHA loans with bad credit, outstanding collections, and charged-off accounts, please get in touch with us at FHA Bad Credit Lenders at 800-900-8569. Text us for a faster response. Or email us at gcho@gustancho.com. The FHA Bad Credit Lenders team is available seven days a week, evenings, weekends, and holidays. We are one of the very few national lenders with no overlays on government and conventional loans.