Deferred Student Loans Mortgage Guidelines

In this blog, we will cover deferred student loans mortgage guidelines. Large student loans are one of the biggest barriers to getting approved for a mortgage loan. College education has skyrocketed over the years.

Today, annual costs for a student to attend a 4-year private university can easily exceed $50,000 per year. State universities can exceed $30,000 per year.

This is just undergraduate school. A 4-year bachelor’s degree can cost $300,000 from a private college. Tuition, room and board, and other fees can easily surpass $160,000 from a state university. More than 25 million people attend and pursue higher education. Over two-thirds take out student loans to cover the cost of their education.

With the steep cost of college education, many graduates are full of student loan debt when they graduate from college. Takes them years, if not decades for graduates to pay their student loans

Many college graduates in their 30’s, 40’s, and 50’s are still paying on their college student loans. Almost a quarter of those making student loan payments are in their mid to late 50s.

Deferred Student Loans And Loopholes To Qualify For Mortgage

The impact of college graduates with hefty student loan debts affects their ability to become homeowners.

Deferred Student Loans Mortgage Guidelines are constantly changing depending on loan programs.

A $200,000 student loan debt equals a very nice single-family home purchase. Over half of home buyers in the United States have student loan debt, according to industry experts. Having student loans can impact home buyers from qualifying for a mortgage loan.

Deferred Student Loans Mortgage Guidelines And How It Impacts Home Buying Power

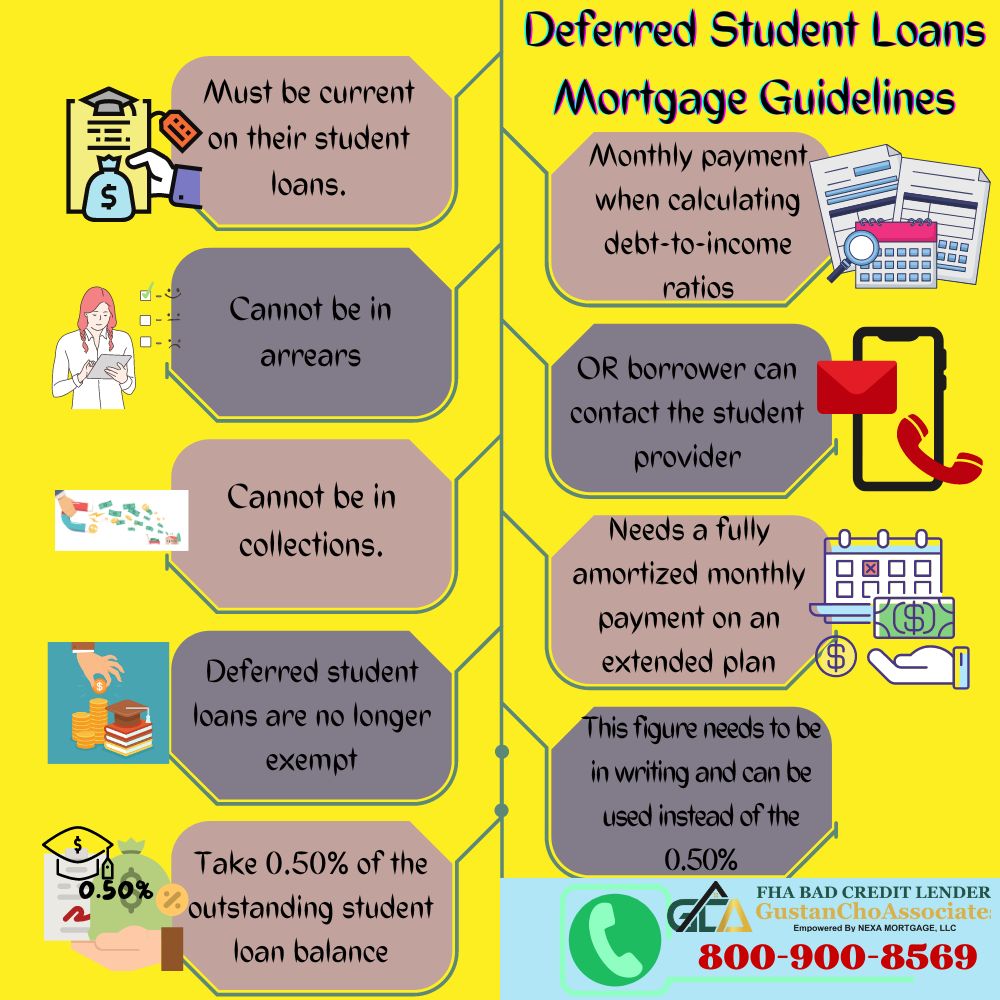

Home Buyers intending to apply for a mortgage loan must be current on their student loans. Government loans, especially student loans, cannot be in arrears and cannot be in collections. Student loans need to be current and in good standing. If the consumer intends to file bankruptcy, federal student loans cannot be included in Chapter 7 bankruptcy.

Government debts cannot be discharged in Chapter 7 Bankruptcy. Consumers will be responsible for federal student loans. Student loans cannot be discharged in bankruptcy.

Student loans can greatly impact a mortgage loan applicant’s debt-to-income ratios. This holds true, especially for college graduates who not just have undergraduate student loans but also graduate or professional school student loans. Debt-to-income ratios are calculated by dividing the total minimum monthly payments by monthly gross income. The proposed PITI (principal, interest, taxes, insurance) is also considered when mortgage underwriters calculate borrowers’ debt-to-income ratios.

Deferred Student Loans Mortgage Guidelines On VA Home Loans

VA exempts student loan payments from the mortgage loan borrower’s debt-to-income calculations. This is only if the student loans have been deferred for at least 12 months. Per Deferred Student Loans Mortgage Guidelines on VA Loans, if the student loans are not deferred for longer than 12 months, then the following guidelines apply:

- Mortgage Underwriters need to take 5.0% of the outstanding student balance and divide that by 12 months

- That figure is used as a hypothetical monthly student loan debt and used for debt-to-income ratio calculations

We will discuss different Deferred Student Loans Mortgage Guidelines with FHA and Conventional loans.

Deferred Student Loans Mortgage Guidelines On FHA Loans

HUD, the parent of FHA, requires the following:

- Deferred student loans are no longer exempt

- Take 0.50% of the outstanding student loan balance and use that figure as a hypothetical monthly payment when calculating debt-to-income ratios

OR borrower can contact the student provider and use the following vocabulary:

- Applying for a mortgage

- My lender needs a fully amortized monthly payment on an extended plan

- The term on the longest extended plan is normally 25 years

- This figure turns out to be around 0.50% of the outstanding student loan balance

- This figure needs to be in writing and can be used instead of the 0.50% of the outstanding student loan balance

Deferred Student Loans Mortgage Guidelines On Conforming Loans

Fannie Mae and FHA allow Income-Based Repayment (IBR) to be used for borrowers. No matter how much the outstanding student loan balance is, as long as the Income-Based Repayment debt payment is reported on the borrower’s credit report, that IBR payment is used as the borrower’s monthly student loan payment.

HUD, Fannie Mae, and Freddie Mac accept income-based repayment to be used for debt-to-income ratio calculations. Borrowers with outstanding student loans that are deferred can make arrangements to have the student loan payment on an IBR payment plan greater than zero monthly paymnet.

I recently had a borrower with $100,000 outstanding student loans, but her IBR monthly payment was $67.00. Without using the IBR payment, she could not qualify for an FHA or Conventional loan. If we had to use 0.50% of the outstanding balance, the borrower could not qualify. We could use the $67.00 monthly IBR payment. For more information on qualifying for home loans with higher debt-to-income ratios due to student loans, don’t hesitate to contact us or text us for faster response at 800-900-8569. Or email us at gcho@gustancho.com.