Conditional Approval Versus Clear To Close In Mortgage Process

This guide will cover conditional approval versus clear to close in the mortgage process. There are various stages of the mortgage approval process. To get mortgage approval with me, mortgage loan applicants first need to complete an online application at FHA Bad Credit Lenders by clicking APPLY NOW icon on the top right of this website. Complete the four-page 1003. I will then contact the applicant to review the online mortgage application to ensure there are no errors and that all information is as accurate as possible before running the credit.

A loan officer will review the credit report with the borrower to see if there are any errors. The loan officer will go over derogatory items such as late payments, collection accounts, bankruptcy, foreclosure, short sale, or items not reported on the credit report. The mortgage application and credit report will be submitted to our automated underwriting system if everything is in order. If I get approve/eligible,

I know I can get the mortgage loan to the finish line and get the mortgage loan closed if the borrower can satisfy the conditions on the AUS. FHA Bad Credit Lenders are mortgage brokers licensed in 48 states, including Washington, DC, Puerto Rico, and the U.S. Virgin Islands, with no lender overlays. So automated findings are the final approval as long as borrowers can provide documentation of tax returns, W-2s, bank statements, and other proof of the information stated on the mortgage application.

Documents Required To Proceed With the Mortgage Process

Once borrowers provide a real estate purchase contract and the list of documents to process the mortgage, the mortgage file will get processed. A mortgage processor will be assigned to the file. Once the file is processed, it is submitted to underwriting and assigned to a mortgage underwriter. The mortgage underwriter underwrites the mortgage file. The mortgage underwriter will issue a conditional approval if everything is in check.

What Is A Conditional Approval?

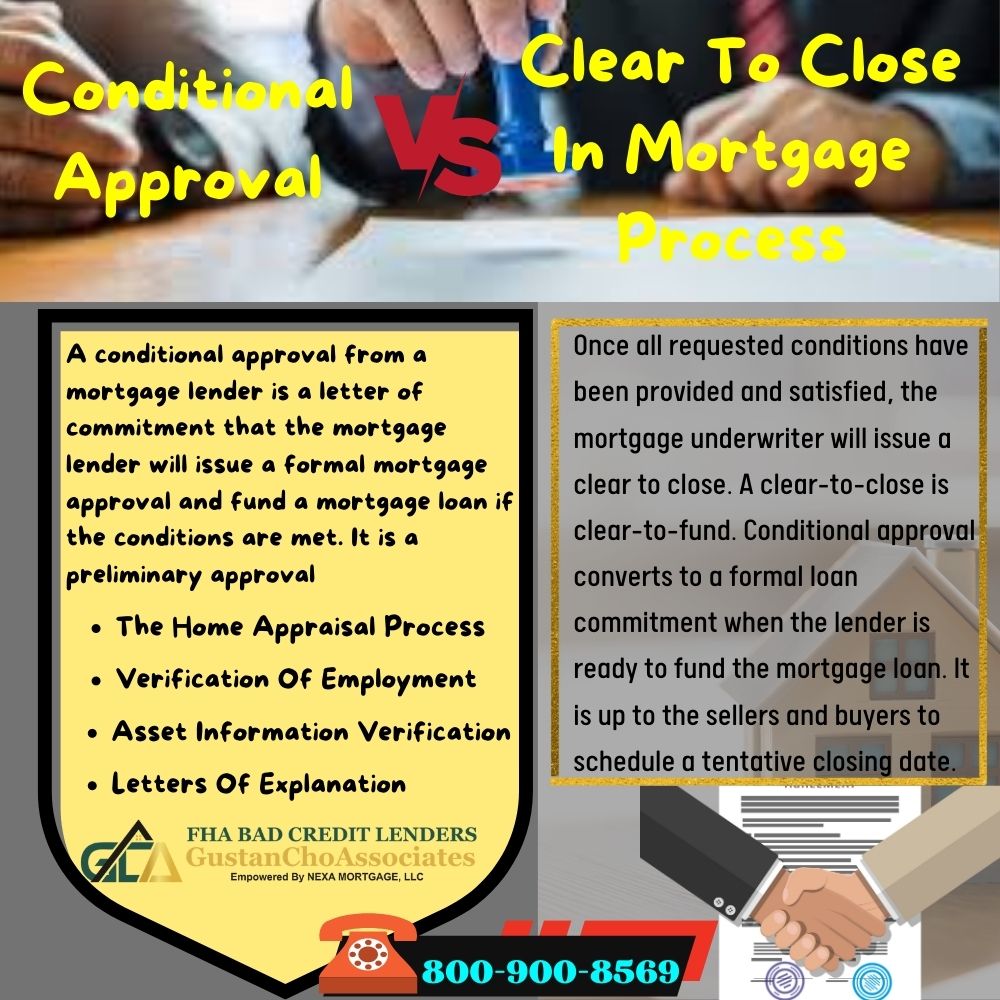

A conditional approval from a mortgage lender is a letter of commitment that the mortgage lender will issue a formal mortgage approval and fund a mortgage loan if the conditions are met. It is a preliminary approval.

There are no guarantees that it will be issued a clear to close. An underwriter must process and underwrite a mortgage loan application for conditional approval.

Conditional approval turns into final approval and is clear to close once all the conditions have been met. The same underwriter who issues a conditional loan approval issues the clear to close.

What Are Conditions On A Conditional Loan Approval?

Some of the conditions that are common in conditional approval are the following:

The Home Appraisal Process

The subject property needs to be appraised and meet the lender’s criteria concerning condition and value. Appraisals normally take less than a week. Once the appraisal is provided to the mortgage underwriter.

The appraisal review department will need to go through an appraisal review, which normally takes 24 to 48 hours. Appraisals can be rushed for a nominal fee. Once the appraisal review is done, the underwriter will require homeowners’ insurance coverage to protect their assets.

Borrowers need to contact an insurance provider and get a bill and the declaration page. Home Buyers do not have to pay for homeowners insurance until at the closing table, and homeowners insurance premium is part of closing costs.

Verification of Employment and Current Paycheck Stub

Although mortgage loan applicants provided W-2s for the past two years and paycheck stubs before the conditional approval.

One of the conditions in conditional approval will be a verification of employment.

Verification of employment is when a lender verbally contacts the human resources department to verify that they are currently working there. Or it might be a form the HR department may have to complete and email or fax back to the lender.

Asset Information Verification

Borrowers need to show recent bank statements with enough funds to close. Any large or irregular deposits need to be sourced and explained via a letter of explanation. If example, here is a case scenario:

- if there is a one-time deposit of $5,000

- that is not part of a paycheck or bonus

- it was from a sale of a vehicle

- a copy of the bill of sale

- copy of the check

- copy of the deposit will need to be provided as well as a letter of explanation

Other Documents Required For Clear to Close

Other documents, such as the following, are required:

- prior bankruptcy papers

- short sale HUD settlement statements

- divorce decree

- child support paperwork

Letters of Explanation Required To Mortgage Underwriters

- charge offs

- collections

- credit inquiries

- late payments will be required

Once all conditions have been submitted, a clear-to-close (CTC) will be issued.

div class=”apply_new_here_4″>Talk To a Loan Officer Click Here

Clear To Close And Home Loan Closing

Once all requested conditions have been provided and satisfied, the mortgage underwriter will issue a clear to close. A clear-to-close is clear-to-fund. Conditional approval converts to a formal loan commitment when the lender is ready to fund the mortgage loan. It is up to the sellers and buyers to schedule a tentative closing date.

Once the title company has scheduled a date, the lender will prepare the HUD, also known as the Closing Disclosure (CD). Mortgage docs and wire will be sent electronically to the title company to close on the mortgage loan. If conditions on the conditional approval cannot be met, the mortgage underwriter will not issue a clear-to-close.

It is important to list it on the initial mortgage application that can be verified. This is because everything stated will need to be verified and can be part of the conditions of the conditional loan approval.