VA Multi-Family Mortgage Lending Guidelines On 2 To 4 Units

This article will discuss VA multi-family mortgage guidelines on two- to four-unit owner-occupant homes. FHA Bad Credit Lenders are experts in VA mortgage guidelines.

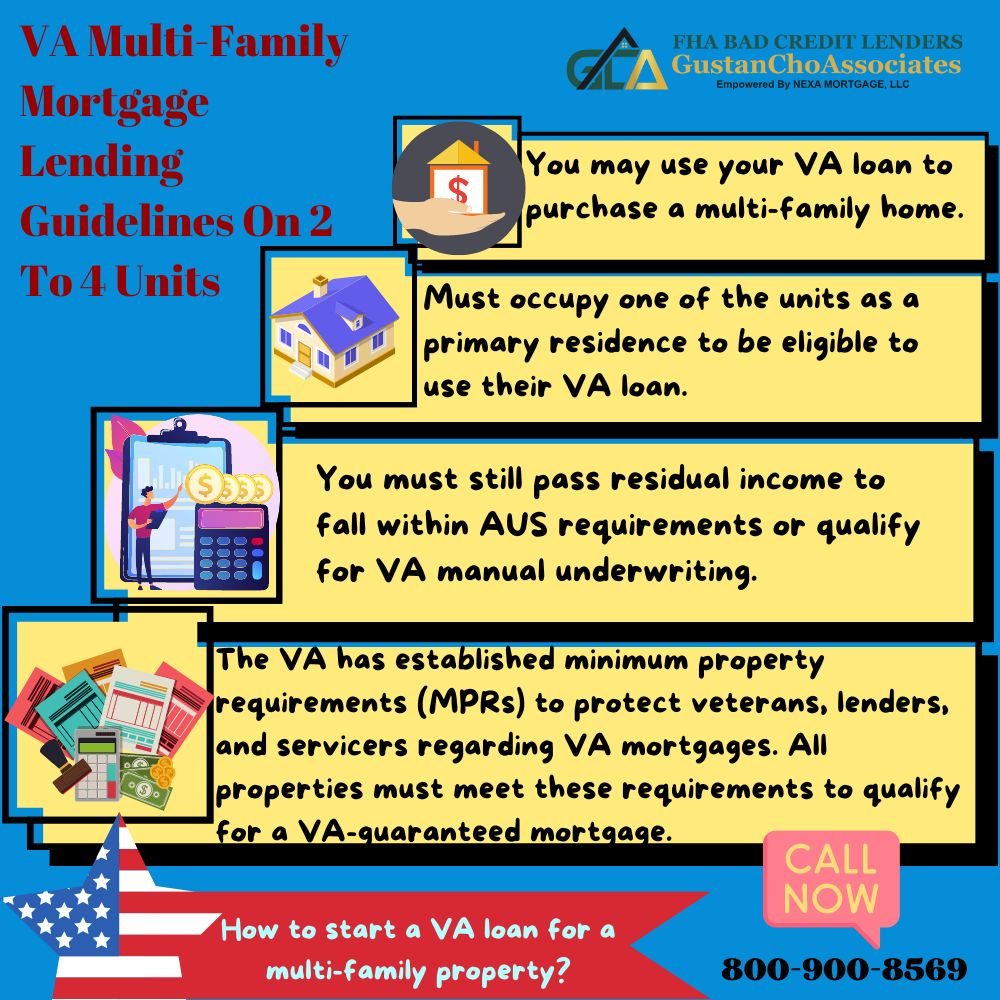

What many veterans are not aware of is the fact you may use your VA loan to purchase a multi-family home. Most veterans understand they may buy a single-family residence but did not know they may buy a 2 to 4-unit multi-family property to generate rental income.

This blog will detail the ins and outs of purchasing a multi-family home with a VA loan. We will dive into the property requirements and how to start the process.

VA Multi-Family Mortgage Guidelines

VA requirements for multi-family properties. The first and most obvious requirement surrounds occupancy. The veteran must occupy one of the units as a primary residence to be eligible to use their VA loan. Other than that, VA guidelines are very similar to single-family residences. You must still pass residual income to fall within AUS requirements or qualify for VA manual underwriting. Please see our AUS BLOG for more. While there is no true credit score requirement for a VA loan, loan qualifications get easier with higher credit scores.

VA Multi-Family Mortgage Property Requirements

Property requirements – Minimum property requirements (MPRs). The VA has established minimum property requirements (MPRs) to protect veterans, lenders, and servicers regarding VA mortgages. All properties must meet these requirements to qualify for a VA-guaranteed mortgage.

VA Home Appraisal Process

The VA appraiser will verify requirements such as no chipping or peeling paint and ensure the property has a solid roof. All these requirements are implemented to ensure the veteran is buying a good home that will last for a long time. When purchasing a multi-family home, it is important to remember that all units must meet minimum property requirements. There is no way around this. The guidelines for multi-family homes change simply because more house is involved for a multi-family.

VA Guidelines on Multi-Family Homes

The VA requires there is a separate service shut-off for each unit. The VA also needs easements or covenants to protect ALL water connections. There must be clear access to all utilities for repairs, even if that requires going through somebody else’s unit. These are all things to remember when considering a multi-family house and utilizing your VA loan.

VA Multi-Family Mortgage Guidelines On Potential Income From Rental Units

Rental Income from Other Units: Rental income with a VA multi-family property is incredibly confusing. Per the VA Pamphlet 26-7 Chapter 4, the lender must verify cash reserves totaling at least six months of mortgage payment (principal, interest, taxes, and insurance).

Mortgage underwriters need to document the veteran’s prior experience managing rental units or background involving both property maintenance and rental. This guideline is incredibly vague, making the underwriter use their judgment to allow this income.

You may use the perspective rental income only if you meet the following requirements. Evidence shows the veteran has a reasonable likelihood of success as a landlord. The veteran has cash reserves totaling at least six months of mortgage payments. Reserves must be veterans’ verifiable assets.

Rental Income on VA Multi-Family Mortgage Guidelines

The amount of rental income to include debt to income purposes is based on 75% of the following:

- Verified prior rental payments collected from the existing unit

- The appraiser’s opinion of the property’s spare monthly rent schedule

Since the guidelines for rental income on the other units of the property are not the most favorable, the veteran needs to have other sources of income to obtain this property.

Below is a link to the guideline referenced.

http://www.benefits.va.gov/WARMS/docs/admin26/pamphlet/pam26_7/ch04.doc

Starting VA Multi-Family Mortgage Process

How to start a VA loan for a multi-family property? The process is the same as purchasing a single-family home, and we will need the same documentation from you to start the process. Please see the list below:

- Last 60 Days Bank Statements – to source money for escrows AND 6 Months PITI Reserves

- Last 30 Days Pay Stubs

- Last Two Years, W2

- Last Two Years’ Tax Returns

- Driver’s License

- Certificate of Eligibility

From there, call us at 800-900-8569, and we will email you an application link. Gustan Cho Associates are experts in VA loans without LENDER OVERLAYS. Most VA lenders will put more stringent requirements on obtaining a multi-family home with your VA benefits. Giving us a phone call with any questions regarding buying a multi-family home is important. We can be reached seven days a week by calling us at FHA Bad Credit Lenders at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. Either Mike or one of his highly skilled loan officers will assist you in purchasing your new multi-family home.