Secured Credit Cards To Re-Establish Credit For a Mortgage

This article will cover using secured credit cards to re-establish credit to qualify for a mortgage. Homebuyers who have bad credit or do not quite meet the minimum credit score requirements to qualify for a mortgage can find some quick fixes. Getting secured credit cards is hands down the easiest and fastest way to rebuild and re-establish your credit.

Consumers with bad credit, no credit, outstanding collections, charged-off accounts, or a recent bankruptcy and a housing event can start rebuilding their credit with secured credit cards. Consumers with bad credit or lower credit scores may need to apply for a secured credit card versus an unsecured credit card. Don’t hire expensive credit repair companies to fix your credit. Any derogatory credit tradelines older than two years old have no impact on your credit scores. Lenders do not care about outstanding collections, late payments, derogatory credit items, or charged-off accounts older than 24 months.

Emphasis has been placed on rebuilding and re-established credit in the past 24 months, with more emphasis on timely payments in the past 12 months. For example, the FHA Bad Credit Lenders team has helped countless borrowers rebuild their credit and get credit scores to over 700 FICO less than one year after the Chapter 13 Bankruptcy discharge date. Start rebuilding and re-establishing your credit to qualify for a mortgage with secured credit cards. We will show you how in this blog.

Maximizing Your Credit Scores To Qualify For A Mortgage

There are minimum credit score requirements to qualify for mortgage loan programs. Credit scores will impact the down payment you need to put down on a home purchase on FHA and Non-QM loans. HUD requires a 580 credit score for homebuyers to put a 3.5% down payment FHA loan.

Homebuyers with under 580 credit scores and down to 500 FICO require a 10% down payment on FHA loans. Borrowers without a 10% down payment can try to boost their credit scores to over 580 FICO, so they only need to put a 3.5% down payment versus a 10% down payment. The team at FHA Bad Credit Lenders can help borrowers boost credit scores.

Non-QM loans normally require a 20% to 30% down payment on a home purchase. However, borrowers with 720 FICO or higher can qualify for a non-QM mortgage with a 10% down payment. Borrowers with higher credit scores can save tens of thousands of dollars by applying for mortgage loans with higher credit scores. Lenders’ pricing mortgage rates are based on the borrower’s credit scores.

How Credit Scores Impact Loan Level Pricing Adjustments On Mortgage Rates

With all mortgage loan programs, credit scores are the biggest factor in how lenders price out mortgage rates. The higher the borrower’s credit scores, the less risk the lender has.

The less risk the lender has, the lower the mortgage rates. It is best to try to optimize and maximize your credit scores before applying for a mortgage. There are many quick fixes for boosting one’s credit scores.

Our loan officers at FHA Bad Credit Lenders are experts in helping borrowers maximize their credit scores. This article will discuss using Secured Credit Cards To Re-Establish Credit To Qualify For a Mortgage.

How Mortgage Underwriters View Credit Scores

Lenders heavily emphasize two of the most important factors when qualifying a borrower for mortgages: credit scores and credit payment history.

Besides credit scores, lenders want to see timely payment history in the past 12 months.No late payments after bankruptcy and foreclosure. Late payments after bankruptcy and a housing event are frowned upon by lenders. One or two late payments after bankruptcy and a housing event may not always be a deal killer.

FHA Bad Credit Lenders has helped countless borrowers who could not qualify for a mortgage elsewhere qualify and close on their loans at FHA Bad Credit Lenders.

How Mortgage Underwriters View Qualified Income

Qualified Income: Mortgage underwriters will only use qualified income. Qualified is income that has been vetted and sourced. Cash income cannot be used as qualified income.

Part-time, bonus, and overtime income are considered qualified income if and only if it has been seasoned for the past two years. The outlook of the borrower receiving part-time, bonus, and overtime income for the next three years look promising and is likely.

Declining self-employment, bonus, part-time, or overtime income may disqualify those sources of income as qualified income. Secured Credit Cards To Re-Establish Credit To Qualify For a Mortgage is the easiest and fastest way of getting prepped up.

Key To Re-Establishing Credit After Derogatory Event

Why secured credit cards? Consumers need established credit tradelines and higher credit scores to get unsecured credit cards. We will discuss Secured Credit Cards To Re-Establish Credit To Qualify For a Mortgage. We will give our viewers some quick fixes to help potential homebuyers who do not qualify for a home loan now get qualified within a matter of a short period.

What Do Secured Credit Cards Do?

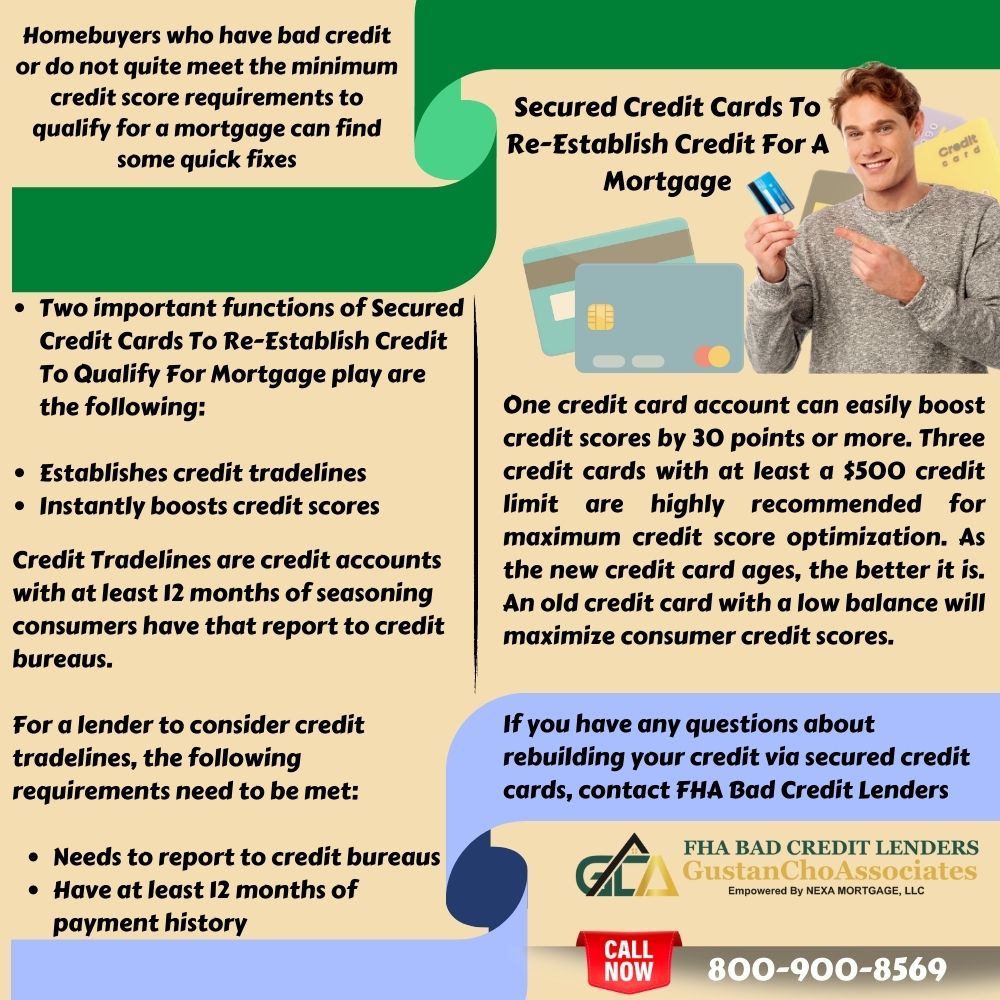

Two important functions of Secured Credit Cards To Re-Establish Credit To Qualify For Mortgage play are the following:

- Establishes credit tradelines

- Instantly boosts credit scores

Importance Of Credit Tradelines

Credit Tradelines are credit accounts with at least 12 months of seasoning consumers have that report to credit bureaus.

For a lender to consider credit tradelines, the following requirements need to be met:

- Needs to report to credit bureaus

- Have at least 12 months of payment history

Active revolving credit accounts with low utilization ratios instantly boost credit scores for consumers with no credit accounts on their credit reports. One credit card account can easily boost credit scores by 30 points or more. Three credit cards with at least a $500 credit limit are highly recommended for maximum credit score optimization. As the new credit card ages, the better it is. An old credit card with a low balance will maximize consumer credit scores.

How To Get Credit Through Secured Credit Cards To Re-Establish Credit To Qualify For Mortgage

Consumers with the following will experience a difficult time obtaining new credit:

- Bad Credit

- No Credit

- Limited Credit

- New Credit

- Bankruptcy

- Short Sale

- Deed-In-Lieu Of Foreclosure

- Foreclosure

- Collections

- Charge Offs

- Judgments

- Tax Liens

- Late Payments

Credit Scores And Credit Report

Lenders will review two aspects when reviewing borrowers’ credit. Credit Scores to see if borrower meets the minimum credit score requirement

Overall payment history, especially after bankruptcy and housing event such as a deed in lieu of foreclosure, or deed in lieu of foreclosure, short sale.

Having timely payments on all consumer debts in the past 12 months is key in getting an approve/eligible per an automated underwriting system (AUS).

Bad & Low Credit & How It Affects Consumers

A bankruptcy, short sale, deed in lieu of foreclosure, or foreclosure can instantly plummet credit scores over 100 plus points. Late payments will cause your credit scores to plummet the following month. Too many credit inquiries will also drop your credit scores dramatically.

A poor credit score can cost you your job. Many employers check an applicant’s credit score as part of the employment application process. A low credit score can also cost you more in insurance premiums. When issuing an insurance policy, all insurance companies run an insurance credit report for their insurance prospects.

The insurance credit score determines the premium consumers will pay for homeowners, auto, health, and life insurance. People with bad credit can start rebuilding their credit and improving their credit scores using secured credit cards.

How To Qualify For a Mortgage

FHA loans are the most popular mortgage program in the United States for first-time homebuyers. FHA loans are also very popular for borrowers with higher debt-to-income ratios and homebuyers with less-than-perfect credit. Creditors are unwilling to extend credit to people with bad credit or no credit.

Whenever consumers apply for credit, it shows up as an inquiry on their credit report. Every hard credit inquiry will lower consumer credit scores temporarily. Multiple inquiries are not viewed favorably by creditors. Consumers who get rejected by half a dozen unsecured credit card companies stop applying for more credit. This is because getting an unsecured credit card approved is next to impossible. Plus, the many inquiries that are posted on your credit report will worsen your credit score than it already is.

The easiest and fastest way to start the credit rebuilding process is to get three to five secured credit cards with at least $500 limits. Any credit limits under $500 will have little impact on boosting credit scores but are better than no credit.

Secured Credit Cards As A Powerful Tool To Build Credit

Secured credit cards are an excellent way of building and rebuilding credit. Secure credit cards work because consumers must put down a cash deposit with a secured credit card company.

In lieu, the secured credit card company will grant a credit limit equivalent to the deposit. Ensure the secured credit cards are reported to the three major credit reporting agencies.

I strongly recommend getting three $500 limit-secured credit cards. By utilizing three secured credit cards, consumers will see credit scores improve by at least 20 to 30 points per secured credit card.

Types Of Secured Credit Cards

Shopping for secured credit cards is shopping for anything else. Try to get the best deal for the money.

There is a processing fee, annual fee, and credit card interest on credit balances even though consumers have deposits. The purpose of a secured credit card is to establish or rebuild credit.

They must report it to all three major credit reporting agencies. Always read the fine print, so there are no surprises.

Using Secured Credit Cards To Maximize Credit Scores

Use secured credit cards regularly, pay the balances off monthly, and leave a $10 credit balance on each card.

Always pay your monthly credit card bill on time and make a point to pay them early.

Secured credit card companies will report consumer payment history on credit reports. So do not ruin your credit again by being late on secured credit card payments.

Importance Of Credit Tradelines

Getting an unsecured credit card will be the ultimate goal. After the three secured credit cards have been seasoned for about six months to a year, apply for a few unsecured credit cards.

Apply for just one, and the chances are it will get approved. Wait 90 days and apply for a second unsecured credit card; the chances are good that the second unsecured credit card will get approved. Keep using both secured and unsecured credit cards. Pay minimum payments religiously every month. Never close out active revolving credit accounts. Secured and unsecured credit card companies will increase credit limits consistently as the secured credit card ages without asking cardholders for additional deposits.

If you have any questions about rebuilding your credit via secured credit cards, contact FHA Bad Credit Lenders at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. FHA Bad Credit Lenders is a five-star national mortgage company licensed in multiple states with no lender overlays. Over 75% of our borrowers at FHA Bad Credit Lenders could not qualify at other lenders. The FHA Bad Credit Lenders team is available seven days a week, evenings, weekends, and holidays.