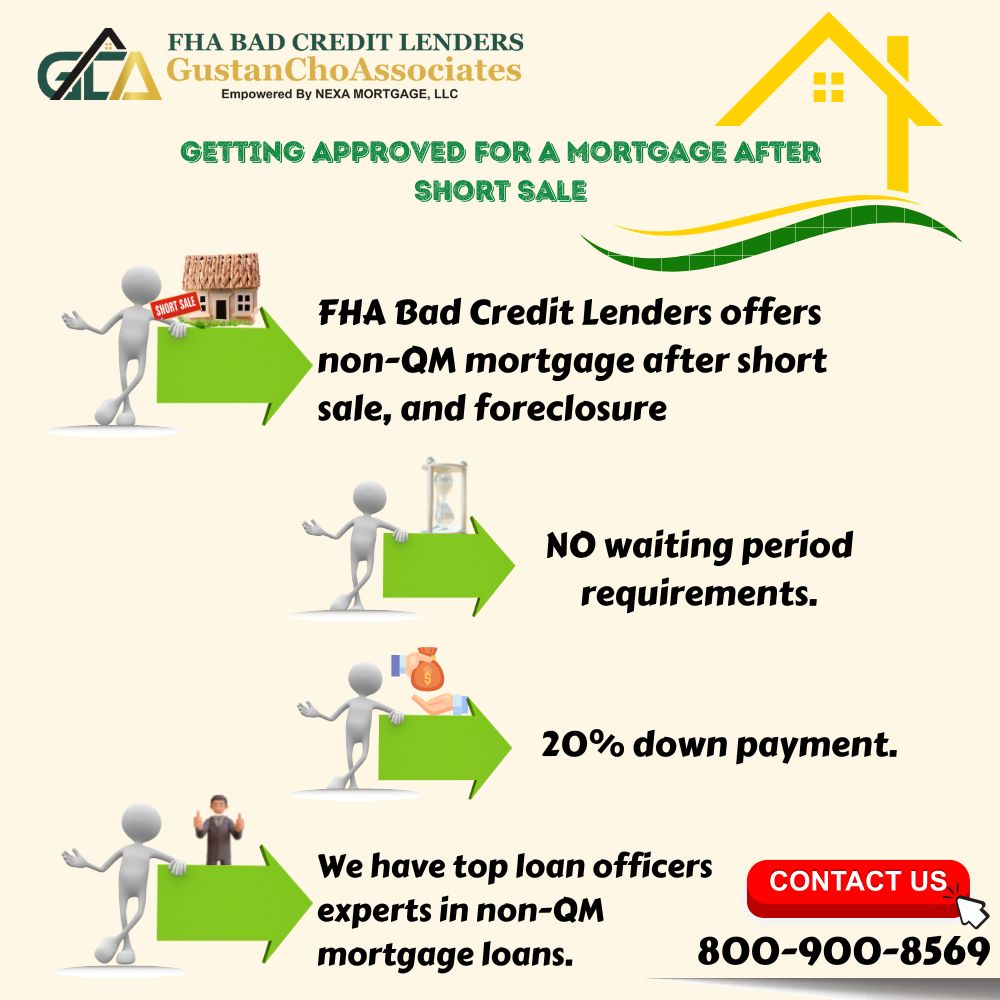

Getting Approved For a Mortgage After Short Sale

This blog will cover qualifying for a mortgage after short sale. Imagine you are in the market for a new home after scouring the MLS (Multiple Listing Service).

You are going to countless showings. You finally lay your eyes on the house of your dreams. You see this house where you can grow your family and possibly grow old.

Your realtor tells you it is indeed a short-sale property. Your heart drops. What is next? What will you do? Many homebuyers have heard about not just buying a short sale but getting a mortgage on a short sale home. There are also restrictions in qualifying for a mortgage after short sale. Traditional mortgage loans requires waiting period requirements to qualify for a mortgage after short sale. The following paragraphs cover getting approved for a mortgage after short sale at FHA Bad Credit Lenders. Here is my story….

Buying a House After a Short Sale

In December 2013, I started looking for a home to get our family out of the rental home we were currently in. I was on real estate websites for hours, looking for that perfect home in our price range.

After viewing 20+ homes, we finally came across this home that was available via short sale for $230,000. After walking through, our realtor put in a full-price offer of $230,000, which was submitted the next day.

The listing agent initially told us that the bank would accept our offer. So we put the wheels in motion in ordering the appraisal, which came in with a mid-$230 value which was perfect. Then the waiting game started….

Stressful Waiting Period With Short Sale Purchase

January, February, and March came without a word in response. The only answer we got from the listing agent was, “banks take a long time to respond.”

Now, I can understand, but they gave absolutely no indication if we would have our offer approved.Finally, in April, we got a verbal that the bank would approve our offer as they had zero other offers on the property for the full asking price.

In May, I went to my landlord, gave her the mandatory 60 days notice that I would be moving out, and began packing our belongings.

Outcome With Short Sale Purchase Experience

A few weeks later, our realtor calls with bad news, “the bank has determined that $230,000 wasn’t a high enough purchase price and the new price to keep the home was $250,000, take it or leave it.” What! How can this happen? We were shocked as the rug had been pulled out from under us.

We had an FHA Appraisal in the $ 230s, so there was no way we could get it to $250,000; we didn’t have the down payment to bridge that gap.

After going back and forth with the listing agent and bank, we were forced to walk away from the property. As a result, we didn’t have a home to move into and were forced to live with our in-laws for 3.5 months until we finally purchased our current home, which is a story for another day….

Why Choose FHA Bad Credit Lenders For Mortgage After Short Sale

With traditional loans, there are waiting period requirements to qualify for a mortgage after short sale. FHA Bad Credit Lenders offers non-QM mortgage after short sale, and foreclosure with no waiting period requirements with a 20% down payment. Alex Carlucci is one of our top loan officer experts in non-QM mortgage after short sale. We are pleased to introduce Alex Carlucci as one of our top producers for FHA Bad Credit Lenders. Alex Carlucci is a senior loan officer for FHA Bad Credit Lenders. Alex is an accountant by trade and has vast experience in all areas of accounting, auditing, finance, real estate, and lending. Due to Alex Carlucci’s expertise, FHA Bad Credit Lenders has been promoted.

Alex Carlucci to be our regional managing partner. Alex has had a reputation for being able to do mortgage loans other loan officers cannot. Alex Carlucci also helps recruits in the final stages of preparing for the national NMLS mortgage examination. Once new loan officers pass the national federal NMLS exam, they will go through the licensing phase once he gets their NMLS license. New loan officers will be officially part of our growing team.

Alex Carlucci also looks forward to a new loan officer joining us. Our whole staff benefits from new loan officers joining FHA Bad Credit Lenders. Alex’s extensive work experience, especially in accounting and recruiting talents, makes him a great addition to our growing team. We look forward to the regular blogs and videos by Alexander Thomas Carlucci that will be published in the coming weeks. FHA Bad Credit Lenders are one of the very few mortgage brokers in the country that offer non-QM mortgage after short sale with no waiting period requirements with a 20% down payment.