Mortgage After Bankruptcy Guidelines

This guide on mortgage after bankruptcy guidelines will cover qualifying for a mortgage after bankruptcy. Homebuyers can qualify for a traditional and non-QM mortgage after bankruptcy.

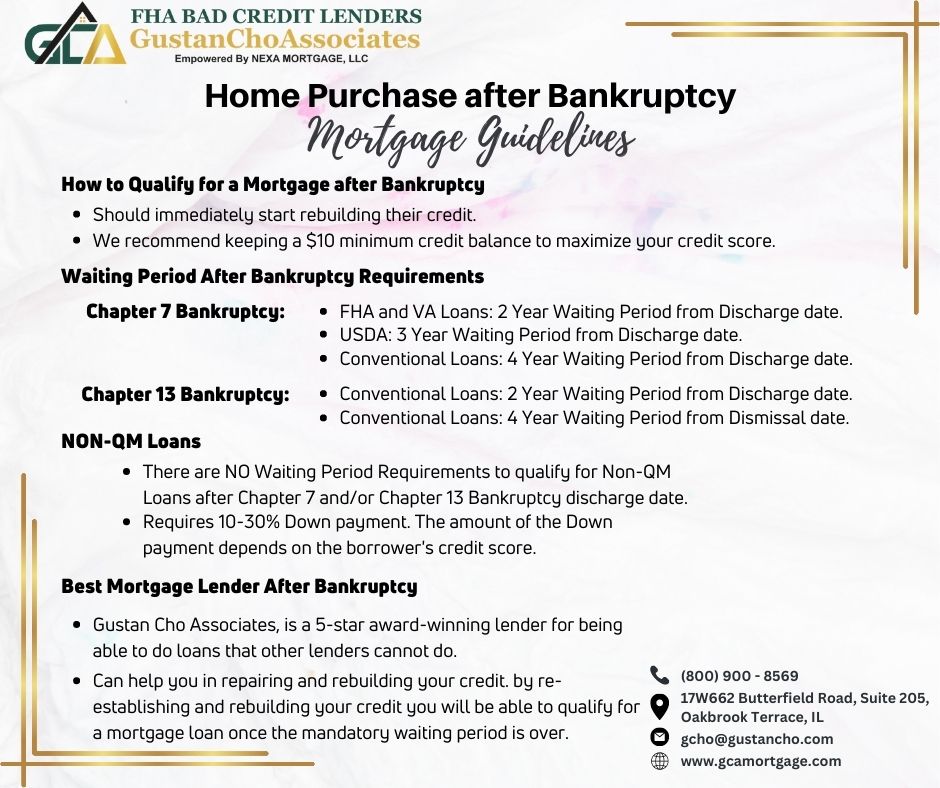

Both traditional and non-QM mortgage after bankruptcy requires borrowers to have rebuilt credit. Lenders expect borrowers have re-established their credit with new credit and no late payments after bankruptcy.

We will further detail the various mortgage loan options homebuyers have. There are frequently asked questions by many viewers who are first-time homebuyers about the down payment requirements and mortgage rates on a mortgage after bankruptcy. We will cover all the important points in the following sections.

How To Buy a House and Get a Mortgage After Bankruptcy

The FHA Bad Credit Lenders team are experts in helping borrowers qualify for a mortgage after bankruptcy. In this blog, we will cover the following points:

- How to qualify for a mortgage after bankruptcy.

- The waiting period after bankruptcy requirements

- Traditional government and conventional loans versus non-QM loans.

How Do I Prepare For Home Purchase After Bankruptcy

Both Chapter 7 and Chapter 13 Bankruptcy filings soared to record numbers during and after the 2008 real estate and financial meltdown.

Millions of Americans filed Chapter 7 and Chapter 13 Bankruptcies to protect themselves against creditors and debt collectors.

Filing Chapter 7 Bankruptcy or Chapter 13 Bankruptcy gave millions of Americans a fresh start. Folks can get credit after bankruptcy and qualify for home purchases. Government and conventional loans have mandatory waiting period requirements after bankruptcy.

Non-QM Loans After Bankruptcy

FHA Bad Credit Lenders offers Non-QM Loans. There are no waiting period requirements on non-QM loans after Bankruptcy and Foreclosure. In the following sections, we will discuss Home Purchase After Bankruptcy Mortgage Guidelines, its waiting period requirements, and loan programs with no waiting period after bankruptcy.

Non-QM loans are alternative lending mortgage programs. Non-QM mortgages are often referred to as non-conforming loans or alternative lending programs. Non-QM loans are portfolio loans and use alternative income options to calculate qualified income.

Non-QM Mortgages have no waiting period requirements after bankruptcy and housing event.

Qualifying for Mortgage After Chapter 7 Bankruptcy

Chapter 7 bankruptcy is the most common form of consumer bankruptcy. Bankruptcy is a federal law for consumers to start a new fresh financial life. Old debts can get discharged in bankruptcy. Once you file Chapter 7 Bankruptcy, the debts normally get discharged in 90 days.

For those who lost their jobs and have substantial unsecured debts like credit cards with little to no assets, Chapter 7 Bankruptcy might be the best option. Chapter 7 Bankruptcy can wipe out most of the consumer’s debts except for government loans, child support payments, and tax liens.

The team at FHA Bad Credit Lenders is not a law firm. FHA Bad Credit Lenders are mortgage brokers licensed in 48 states. We are not attorneys or bankruptcy experts, so you should consult a bankruptcy attorney if you are contemplating bankruptcy.

Going Through Chapter 7 Bankruptcy

Many of my business consists of clients who have filed for bankruptcy or had prior bad credit.

A Chapter 7 bankruptcy eliminates a person’s debt. Chapter 7 Bankruptcy is a federal law that gives a person a fresh financial start. A bankruptcy will drop a person’s credit score by more than 100 points.

Credit drop after filing bankruptcy is temporary. Consumer credit scores will sustain a big drop once bankruptcy is filed. Their credit scores will naturally increase as months go by. This holds even if they do nothing to re-establish their credit.

Rebuilding Credit After Bankruptcy For Mortgage

A person who just filed for bankruptcy should immediately start rebuilding their credit. Three to five secured credit cards with at least $500 credit limit on each card are best recommended for the highest and maximum optimization.

The fastest and best way of rebuilding and reestablishing their credit is by getting three secured credit cards with $500 credit limits. Each credit card will likely increase its credit scores by at least 20 to 50 points if the cardholder leaves at least a $10 credit balance on each card.

Use the card regularly but never have a credit balance of over 25%. The lower the balance, the better, but the balance should not be zero. Keep the 10-dollar minimum balance every month.

Low Credit Card Balance Will Maximize Credit Scores

We recommend keeping a $10 minimum credit balance between maximizing your credit scores. The basic formula the credit reporting agencies to optimize this portion of your credit score is by dividing the balance of your credit card by the credit card credit limit. The smaller the number, the better, but it cannot be zero.

Minimize Credit Utilization Ratio

For example, if you have a $900 balance on your credit card and the credit limit is $1,000, you would divide the $900 by $1,000 and get a factor of 0.90 which is a high factor. However, if you had a $100 balance on your $1,000 credit limit credit card, you get a factor of 0.10, which is a lower factor. However, if you have a zero balance on your credit card balance and the credit limit is $1,000, anything divided into zero will yield zero, so there will be no positive credit score impact. That is the reason we recommend a $10 credit limit.

Waiting Period After Bankruptcy to Qualify for Home Loan

Mandatory waiting period requirements to qualify for home loans after bankruptcy depends on the particular loan program. There is a 2-year mandatory waiting period for a home buyer to be able to apply for a mortgage loan from the discharge date of Chapter 7 bankruptcy on FHA and VA Loans. The waiting period is three years after bankruptcy to qualify for USDA Loans.

Fannie Mae Chapter 13 Bankruptcy Guidelines on Conventional Loans

The waiting period after the Chapter 7 Bankruptcy discharge date to qualify for conventional loans is four years.

There is a two-year waiting period to qualify for Conventional loans after the Chapter 13 Bankruptcy discharge date. To qualify for Conventional Loans after the Chapter 13 Bankruptcy dismissal date is four years.

There are no waiting period requirements to qualify for Non-QM Loans after Chapter 7 or Chapter 13 Bankruptcy discharge date. However, Non-QM Loans require a 10% to 30% down payment. The amount of the down payment depends on the borrower’s credit score.

Waiting Period After Chapter 13 Bankruptcy

VA and FHA Loans allow borrowers to qualify for VA and FHA loans during Chapter 13 Bankruptcy Repayment Plan with Trustee Approval.

Chapter 13 does not need to be discharged. It needs to be a manual underwrite and does not have to be discharged. There is a one-year mandatory waiting period for a home buyer to be able to apply for FHA and VA loans during the Chapter 13 bankruptcy Repayment Plan.

There are no waiting period requirements after the Chapter 13 Bankruptcy discharge date. However, any Chapter 13 Bankruptcy that has not been seasoned for two years after the Chapter 13 Bankruptcy discharged date must be manually underwritten.

Best Mortgage Lenders After Bankruptcy

FHA Bad Credit Lenders is an award-winning five-star lender for being able to do loans other lenders cannot do. We are a Better Business Bureau (BBB) member with an A+ rating. If you filed Chapter 7 or Chapter 13 bankruptcy and are interested in being a homeowner, please get in touch with me at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. You can also visit me at www.gustancho.com. You can contact us even though your waiting period is not over.

Best Mortgage Lenders For Bad Credit

The FHA Bad Credit Lenders team can help repair and rebuild your credit.

By re-establishing and rebuilding your credit earlier, you will be able to qualify for a mortgage loan once the mandatory waiting period is over. FHA Bad Credit Lenders is a mortgage company licensed in multiple states.

We have a national 5-star reputation for not having any lender overlays on government and conventional loans. We are experts in Non-QM Loans and bank statement loans for self-employed borrowers. There is no income tax required with bank statement loans for self-employed borrowers.

This guide on a home purchase after the bankruptcy was updated on January 27, 2023.