Loans For Real Estate Investors and Lending Guidelines

This blog will discuss and cover loans for real estate investors and property flippers. At FHA Bad Credit Lenders, we understand the goals and mission of short-term property fix and flip investors.

We are the lender of choice for real estate investors and developers rather than any other private and hard money lender. FHA Bad Credit Lenders understands hard money borrowers more than private lending companies. This is because many borrowers of FHA Bad Credit Lenders are real estate investors.

A commercial real estate investor founded FHA Bad Credit Lenders Commercial Lending Division. We have over 25 years of real estate experience in buying, financing, rehabbing, renting, and selling commercial real estate properties. This includes single-family homes, apartment buildings, to apartment complexes. In the following sections, we will cover loans for real estate investors.

Hard Money Loans For Real Estate Investors

FHA Bad Credit Lenders Commercial Lending Division differs from other hard money and private lenders. This is because there is no minimum investment requirement.

Most private money lenders in this country have $100,000 minimum loan amounts. This is because whether you process a $20,000 hard money loan or a $4,000,000 hard money or private money loan, the time it takes is the same.

The management staff at FHA Bad Credit Lenders understand that not many hard money lenders want to give a beginner investor a chance, so with that in mind. We do not maintain a minimum loan requirement. Whether you are seeking a $20,000 private money loan or a $5 million Hard Money Loan, we will be your private money lender of choice.

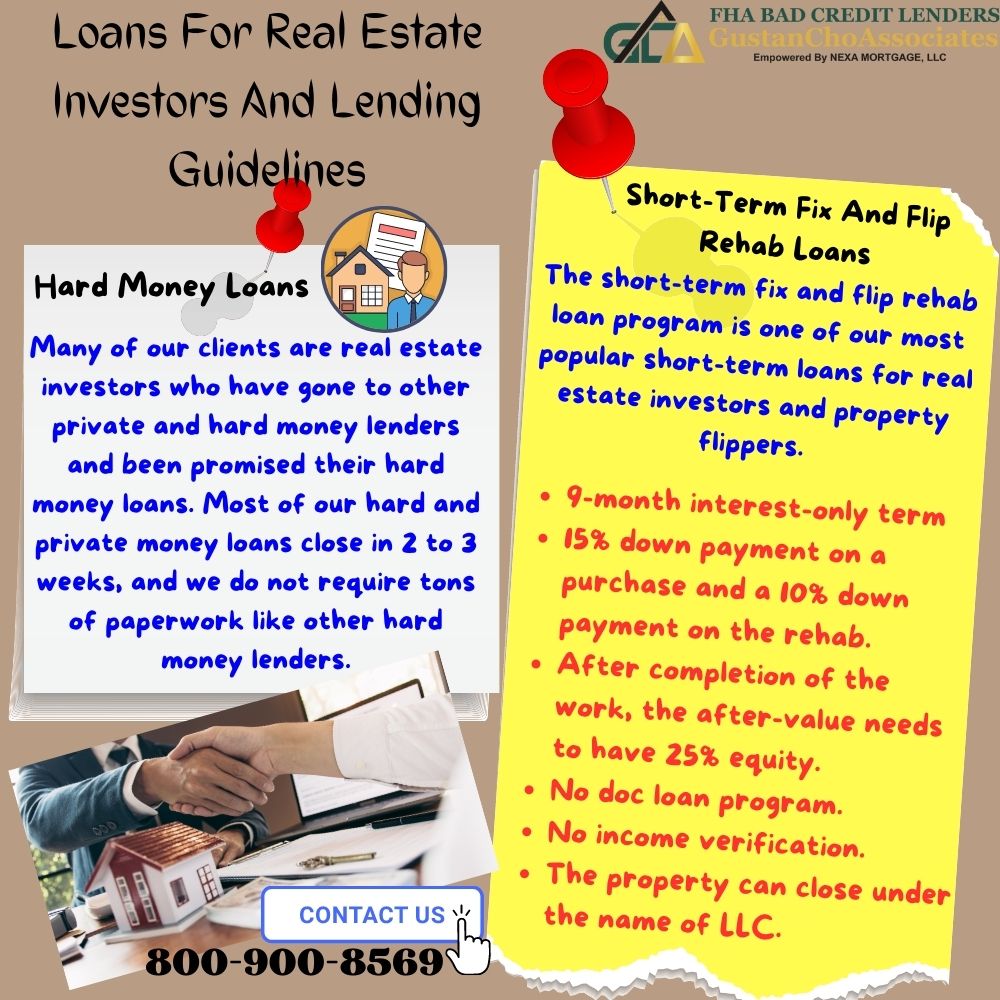

Hard Money Loans

Many of our clients are real estate investors who have gone to other private and hard money lenders and been promised their hard money loans. Many have wasted weeks to be told at the last minute that the hard money lender will not fund their private loans. With us, if a loan officer tells you that he will do your loan, that means that you will close your loan. Most of our hard and private money loans close in 2 to 3 weeks, and we do not require tons of paperwork like other hard money lenders.

Types Of Alternative Funding Available

FHA Bad Credit Lenders offers the following types of private money and hard money loans. Private Money Loans from $10,000 to $3,000,000 with 6 to 36 months mortgage loan terms. Single-family homes, multi-family properties, commercial properties, raw land, fix rehab flip loans, bridge loans, and new construction.

Hard Money Loans typically require up to 65-75% Loan To Value of the purchase price or appraised value. Higher LTV, ARV-based, and participation loan options are available.

Always competitive rates and fees – among the lowest in the country and other competitors. Creative financing where cross collateral is allowed and co-borrowers are welcomed. Majority of our hard money loans close in less than 30 days. Short-term fix and flip rehab loans. Investment Property Loans and lines of credit. No doc investment property loans.

Short-Term Fix And Flip Rehab Loans For Real Estate Investors

The short-term fix and flip rehab loan program is one of our most popular short-term loans for real estate investors and property flippers.

- 9-month interest-only term

- 15% down payment on a purchase and a 10% down payment on the rehab.

- After completion of the work, the after-value needs to have 25% equity.

- No doc loan program.

- No income verification.

- The property can close under the name of LLC.

FHA Bad Credit Lenders are experts in originating and funding no-doc fix and flip rehab loans. If you are interested in investment property loans with FHA Bad Credit Lenders, contact us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The FHA Bad Credit Lenders team is available seven days a week, evenings, weekends, and holidays.

This guide on loans for real estate investors and lending guidelines was published on February 18th, 2023.