In this article, we will cover the HUD guidelines on debt-to-income ratios on FHA loans. HUD, the parent of FHA, has the most lenient guidelines for debt-to-income ratios when it comes to government and conventional loans.

HUD Guidelines on Debt-to-Income Ratios on FHA loans are very generous when it comes to debt-to-income ratios. The maximum front-end debt-to-income ratio is capped at 46.9% front-end and 46.9% back-end on FHA loans.

Buying a home, especially your first home, can be a thrilling experience. However, the process can be daunting, especially when obtaining funds to finance the investment. Now, the Department of Housing and Urban Development (HUD) did provide a few guidelines on the DTI ratios that every borrower applying for an FHA mortgage should meet to be eligible. In this article, we will explore these guidelines, looking at how they impact the mortgage application process. Let’s get to it.

The HUD Guidelines on Debt-To-Income Ratios on FHA Loans

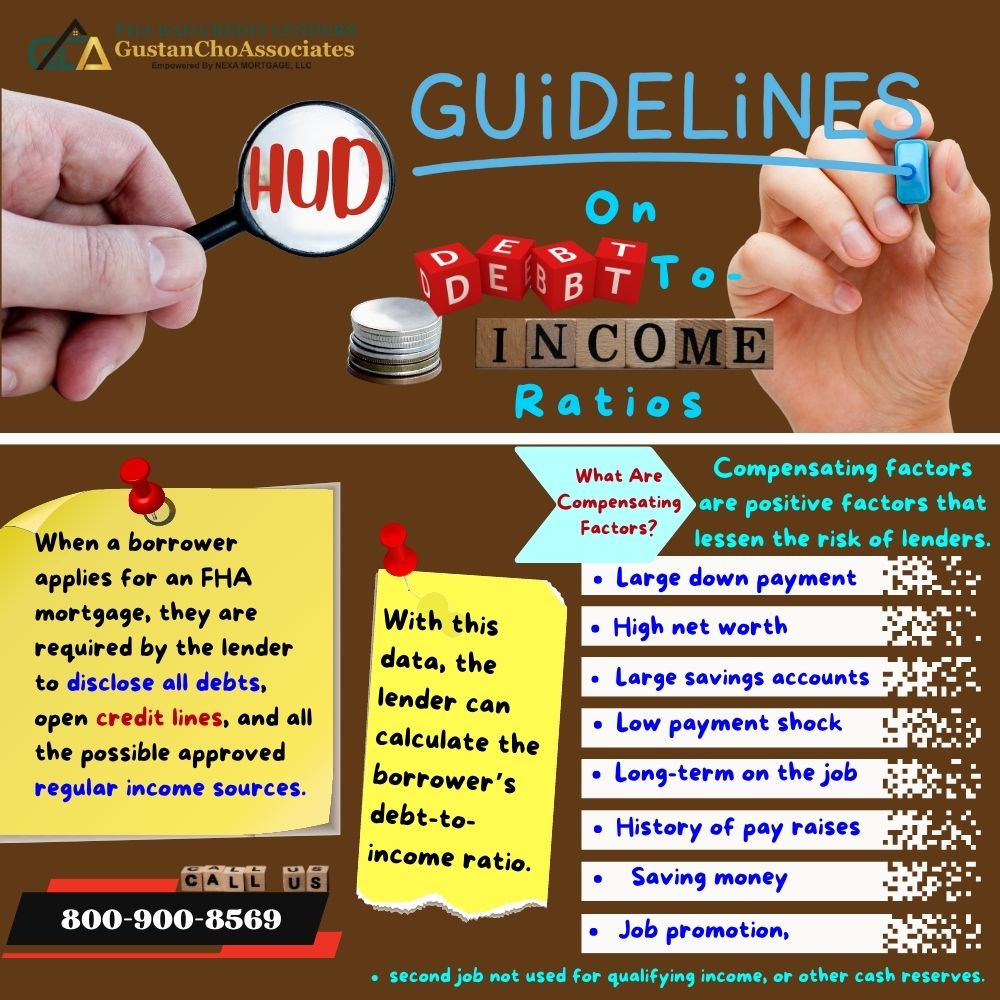

For starters, when a borrower applies for an FHA mortgage, they are required by the lender to disclose all debts, open credit lines, and all the possible approved regular income sources. With this data, the lender can calculate the borrower’s debt-to-income ratio. The maximum debt-to-income ratios on manual underwriting on FHA loans depend on the number of compensating factors.

According to the FHA official site, the borrower can only use 31% of the income towards housing costs and 43% on housing expenses and other long-term debt. with no compensating factors.

These percentages are examined alongside the DTI ratio requirements of housing costs, housing expenses, and other debts for borrowers who need to go through manual underwriting on FHA loans.

HUD Guidelines on Debt-To-Income Ratios Compared To Compensating Factors

However, based on the guidelines, FHA offers some flexibility regarding DTI requirements under specific circumstances. For instance, when an applicant has compensating factors.

The only difference between automated underwriting system approved FHA loans and manual underwriting files is the cap and restriction on debt-to-income ratios based on compensating factors.

For borrowers with one compensating factor, the front-end debt-to-income ratio is 37% and the back-end debt-to-income ratio is 47%. Two compensating factors, the front-end debt-to-income ratio is 40% and the back-end debt-to-income ratio is 50%.

What Are Compensating Factors?

Compensating factors are positive factors that lessen the risk of lenders. Examples of compensating factors are a large down payment, high net worth, large savings accounts, low payment shock, long-term on the job, the habit of saving money, history of pay raises and job promotion, second job not used for qualifying income, or other cash reserves.

Mortgage Underwriters can extend debt-to-income ratios higher than the recommended 40% front-end and 50% back-end HUD guidelines on debt-to-income ratios on manual underwriting using underwriter discretion if borrowers have strong compensating factors.

When you apply for a mortgage, the lender will review your DTI ratio to determine your ability to repay the loan. If the DTI ratio is too high, the lender might deny you the loan unless you meet the compensating factors we have mentioned above.

Manual Underwriting Guidelines on Debt-To-Income Ratio

Compensating Factors determine how high your debt-to-income ratios can go up on manual underwrites. FHA DTI ratio caps depend on the number of compensating factors you have as well as underwriter discretion. Angie Torres, the national operations director at FHA Bad Credit Lenders and a veteran mortgage underwriter on FHA manual underwrites, said the following on FHA manual underwriting files versus compensating factors:

HUD publishes recommended front-end and back-end debt-to-income ratio guidelines based on compensating factors. However, mortgage underwriters can use their underwriter discretion and go higher on debt-to-income ratio.

The HUD guidelines permit FHA lenders to allow a higher DTI ratio if the borrower can meet certain compensating factors. These factors help offset any risks associated with approving borrowers with higher debt-to-income. In the following paragraphs, we will cover examples of common compensating factors.

Compensating Factors For Strong Credit Payment History

A strong credit history – a borrower’s credit history is a pretty significant factor when it comes to determining their creditworthiness. A higher credit score indicates to the lender that the borrower has a track record of meeting their bills and debts on time and they can manage their credit responsibly.

One of the most critical factors lenders consider when applying for a home loan is the debt-to-income (DTI) ratio, which measures the amount of the borrower’s income that goes into debt payments.

With a higher credit score, the lender deems this borrower less risky, even with a higher debt-to-income ratio. And for FHA loans, a credit score of 580 or higher is required, even though this requirement may differ from lender to lender.

Compensating Factors For Cash Reserves

Significant cash reserves – this refers to the money that the borrower has set aside as savings or investments meant for emergencies or unexpected expenses. Significant reserves will offset a higher DTI ratio because it will prove to the lender that you have the financial cushion to manage mortgage payments, even when faced with a temporary setback like a medical emergency or job loss.

Compensating Factors For Job Longevity

Long-term employment – lenders prefer borrowers with a long and stable job employment history as it indicates that the borrower has a steady income and is less likely to experience a sudden loss. So, even when a borrower has a higher DTI ratio but has a steady job or has been employed by the same company for years, it can offset the risk that would otherwise be associated with the higher DTI ratio.

Compensating Factors For Low Loan-To-Value

Low loan-to-value (LTV) means when a homebuyer puts a larger down payment. Loan-to-Value means the amount of the loan balance compared to the property value. Dale Elenteny of FHA Bad Credit Lenders explains loan-to-value as follows:

When the LTV ratio is low, it indicates that the borrower is putting a lot more money into the property, which then minimizes the lender’s risk.

Now, when it comes to FHA loans, the maximum LTV ratio is about 96.5%, which means that the borrower must have a down payment of at least 3.5% of the property’s price. So, even if a borrower has a higher DTI ratio but a larger down payment, it will again offset the risk associated with the higher DTI ratio.

HUD Guidelines on Non-Occupant Co-Borrowers

Non-occupying co-borrower – simply put, a non-occupying co-borrower is someone who is on the mortgage but doesn’t reside in the property. The lender considers such a borrower a lower risk, especially if they have a strong credit history and a steady income. So, they will approve of the mortgage, even when they have a high DTI ratio. How can you lower your DTI ratio? If you want to improve your DTI ratio to meet the level set under the FHA guidelines, there are two

main ways to achieve it.

Meeting The Minimum HUD Guidelines on Debt-To-Income Ratios

Increase your income – one of the best ways to improve your DTI ratio would be by increasing your income. So, try to get a promotion at work, or if you are self-employed or earn cash tips, maybe try including them as income when you apply for a mortgage.

Just because you do not meet the minimum HUD guidelines on debt-to-income ratios does not mean you do not qualify for an FHA loan. A savvy experienced loan officer can find a way of getting you in line to be withing the HUD guidelines on debt-to-income ratios.

Many people leave out the small incomes they earn on the side, which is a mistake. The lenders want to see the money that goes into your account every month, and it doesn’t matter how you earn it and whether you withdraw the funds afterward immediately. All you need to do is document all the cash coming in and present it to the lender to compute your DTI ratio, which will be lower if your gross income increases.

Lowering Your Monthly Debt To Meet HUD Guidelines on Debt-To-Income Ratios

Lower your monthly debt – this is the second way you can improve your DTI ratio. In DTI calculations, the monthly payments usually drive up the ratio. So, the best way would be to pay down the debt, starting with the ones with the highest monthly installment, before applying for the mortgage. By paying these debts, you are simply eliminating the monthly payments from your credit

portfolio, which means fewer monthly payments and lowers the DTI ratio.

How To Get Approved For an FHA Loan With High Debt-To-Income Ratio

FHA Bad Credit Lenders has no lender overlays on the debt-to-income ratio on FHA loans. As we conclude, the HUD guidelines on debt-to-income ratios play a vital role in ensuring that borrowers can comfortably manage their mortgage payments without necessarily putting their financial stability at risk.

By setting super clear benchmarks for acceptable DTI ratios, HUD aims to promote responsible mortgage lending practices while also ensuring that the borrowers don’t face any potential financial hardship.

One thing about the HUD agency guidelines set is that they are not absolute and vary based on personal circumstances. However, they can be very helpful for lenders and borrowers, especially when determining a manageable loan amount. You can talk to a mortgage broker or a financial expert if you need further clarification on the HUD guidelines on debt-to-income ratios and what you can do to increase your chances of qualifying for a mortgage.