Home Loan With Mortgage Late Payment Guidelines

This blog will cover qualifying for a home loan with mortgage late payment in the past 12 months. Mortgage borrowers can qualify for home loans with prior bad credit. The automated underwriting system (AUS) requires timely payments in the past 12 months. with up to one home loan with late mortgage payment for approve/eligible per AUS. Alex Carlucci of FHA Bad Credit Lenders said the following on how lenders think about getting approval on a home loan with mortgage late payment in the past 12 months:

Late Payments are extremely frowned upon by lenders. It is alright to have prior bad credit. Unpaid collection and charge-off accounts do not have to be paid.

Mortgage lenders do expect timely payments in the past 12 months. VA loans are more strict with timely payments than FHA loans in getting an automated underwriting system approval. Mortgage late payments in the past 12 months are the worst type of late payment.

Can You Get a Home Loan With Mortgage Late Payment?

You can have one mortgage payment to qualify for a home loan and still get approve/eligible per the automated underwriting system (AUS). However, multiple mortgage late payments in the past 12 months can become an issue in getting approve/eligible per the automated underwriting system.

In the following paragraphs, we will cover qualifying for a home loan with mortgage late payment.

Home Loan With Mortgage Late Payment Versus Other Types of Late Payments

The worst type of late payment anyone can have is a mortgage late payment. One 30 days mortgage late payment in the past 12 months may be okay. However, multiple mortgage late payments in the past 12 months are a no-go. Alex Carlucci said the following:

Many lenders consider 120-day late payments on a mortgage the same as a foreclosure. This is not the case.

Lenders will mandate the waiting period to qualify for a mortgage after foreclosure. Although it is not a foreclosure, that is how seriously lenders take on mortgage late payments. This article will discuss qualifying for a mortgage with recent late payments.

Difficulty In Qualifying for Home Loan With Mortgage Late Payment

A late mortgage payment should be avoided at all possible costs. Qualifying for a home loan with mortgage late payment will be challenging. Most lenders require 12 months of timely mortgage payments to qualify for a mortgage loan.

A late mortgage payment will appear on the credit report for seven years. You should always make sure to make monthly mortgage payments on time.

Mortgage late payment normally occurs when a homeowner transitions from one home to another. It is common when the original mortgage payment is paid off, and the homeowner waits for the new payment book.

One Late Payment Can Drop Credit Scores by 50 Points

Timely mortgage payments have a great deal of weight on credit scores. One mortgage late payment will devastate credit scores by 80 points or more.

When it comes to refinancing a current mortgage loan with a mortgage late payment, it will show up on the credit report. The new mortgage lender will not favorably consider the mortgage’s late payment.

Impact of Mortgage Late Payment

No matter how old the mortgage late payment was, a late payment on a mortgage does not look good. Some lenders will understand one 30-day mortgage late payment. Angie Torres, the National Operations Director at FHA Bad Credit Lenders, said the following about how mortgage lenders feel about late mortgage payments in the past 12 months.

Many mortgage lenders would not touch borrowers if they had a mortgage late payment within the past 24 months.

Mortgage late payment on the credit report from the lender needs to be addressed whenever possible. Contact the lender to see if they can do a one-time correction.

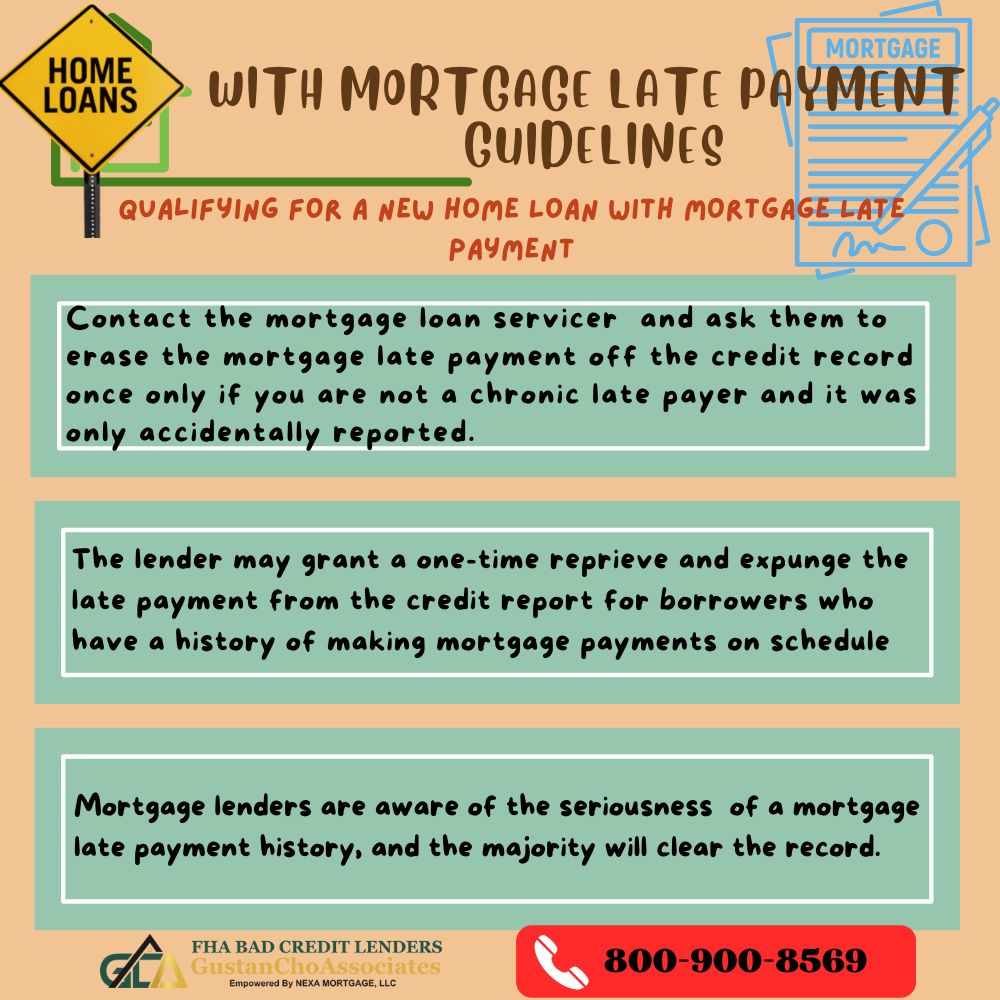

Qualifying For New Home Loan With Mortgage Late Payment

Those who are not habitual late payers and the mortgage late just got reported due to an error, contact the mortgage loan servicer and ask them if they can remove the mortgage late payment from the credit report on a one-time basis. For those with a track record of paying mortgage payments on time, the lender can give a one-time reprieve and remove the late payment from the credit report.

For borrowers who are consistently late and have multiple mortgage late payment records, the chances are that they will not remove any mortgage late payments from the credit report. Mortgage companies do understand the severity of a mortgage late payment record, and most will remove the late payment record.

Ask Creditor To Remove Late Payment Off Credit Report To Qualify For Home Loan With Mortgage Late Payment

If the mortgage company representative refuses to remove the one-time mortgage late payment history off a credit report, ask to speak to a supervisor. Please be extremely polite because the mortgage company is not obligated to remove the mortgage late payment record from the credit report.

If everything goes well and the lender agrees to remove the mortgage late payment of a credit report, you must consider yourself extremely lucky. Make sure always to make mortgage payments on time. Check credit reports periodically to ensure no errors in qualifying for a home loan with mortgage late payment.

When Mortgage Lender Makes Mistake In Reporting You Late

There are many instances where new mortgage loan borrowers are late on their first mortgage payments due to the mortgage lender. Mortgage companies need to send payment coupons to the new borrower.

There is often confusion about where the mortgage company sends the statements. Borrowers normally will request for mail to be sent to the new address. Or old mailing address in cases where the new homeowner remodels the house before moving in.

Reason For Late Payments on Mortgage Payments

There are cases where the lender sends it to the wrong address. Due to this matter, the mortgage payments get recorded late. Other times, since it is a new lender, the mortgage loan borrower sends their mortgage payments to a different location of the lender other than the bill payment center.

For all the above examples, make sure to check your credit report. See that lender did not report late on the credit report. If the lender reported late, in almost 100% of the cases, the lender would remove the late payment from the credit report due to being a brand new mortgage loan.

Getting Approved For Home Loan With Mortgage Late Payment

One late payment in the past 12 months is not a deal killer for qualifying for a home loan with mortgage late payment. GCA Mortgage Group is a mortgage company licensed in 48 states with no mortgage lender overlays on government and conventional loans. We have zero FHA, VA, USDA, and Conventional loan overlays. We go off Automated Underwriting System Findings. The best way to get approved for a home loan with mortgage late payment in the past 12 months is to have higher credit scores and timely payments in the rest of your credit tradelines.

Best Mortgage Lenders For Recent Late Payments

We have helped countless borrowers qualify for a home loan with late mortgage payments. To qualify for a mortgage with a national lender with zero overlays, please get in touch with us at The Team at FHA Bad Credit Lenders at 800-900-8569 or text for a faster response.

The team at FHA Bad Credit Lenders are experts in helping borrowers with recent late payments on their mortgage payments with non-QM loans. Non-QM loans are alternative mortgage loan programs that requires a 20% to a 30% down payment.

You can email us at FHA Bad Credit Lenders at gcho@gustancho.com. FHA Bad Credit Lenders is licensed in 48 states, including Washington DC, Puerto Rico, and The U.S. Virgin Islands, with a network of over 190 wholesale mortgage lenders.