FHA Loans With Collections and Charge-Offs

This article will cover FHA loans with collections and charge-offs. The Federal Housing Administration allows unpaid collection and charged-off accounts to qualify for an FHA-insured mortgage loan. Homebuyers do not have to pay outstanding derogatory collection accounts to qualify for FHA loans with collections and charge-offs.

Many lenders may require that collection accounts be paid before a mortgage loan approval. Having a collection account be paid off is not necessary to qualify for FHA loans with collections and charge-offs. Homebuyers can qualify for FHA loans with collections and charge-offs. It is up to the individual mortgage lender to accept a mortgage applicant with an unpaid and unsatisfied collection account.

Borrowers with unsatisfied collection accounts told they do not qualify for FHA Loans with collections and charge-offs by lenders is because those lenders have overlays. In this article, we will discuss and cover FHA loans with collections and charge-offs.

Agency Guidelines Versus Lender Overlays

Lenders can have higher lending requirements above and beyond those of HUD, the parent of FHA. Borrowers might not be qualified with that particular mortgage lender.

Mortgage borrowers can qualify with a lender like FHA Bad Credit Lenders, where we do not have any mortgage overlays. As long as borrowers meet the bare minimum FHA and Fannie Mae mortgage guidelines.

Borrowers can get Fannie Mae and Freddie Mac automated approval. Their loan will get approved and closed with a lender with no mortgage overlays. FHA Bad Credit Lenders has no overlays on FHA, VA, USDA, and Conventional loans.

FHA Guidelines On Outstanding Collection Accounts And Charge-Offs

Before FHA Guidelines On Outstanding Collection Accounts allowed unpaid collection accounts. There were no restrictions on the amount of the unpaid collection balance. However, in 2018, The Federal Housing Administration implemented tougher new rules and regulations.

How Does HUD Categorize Collection Accounts

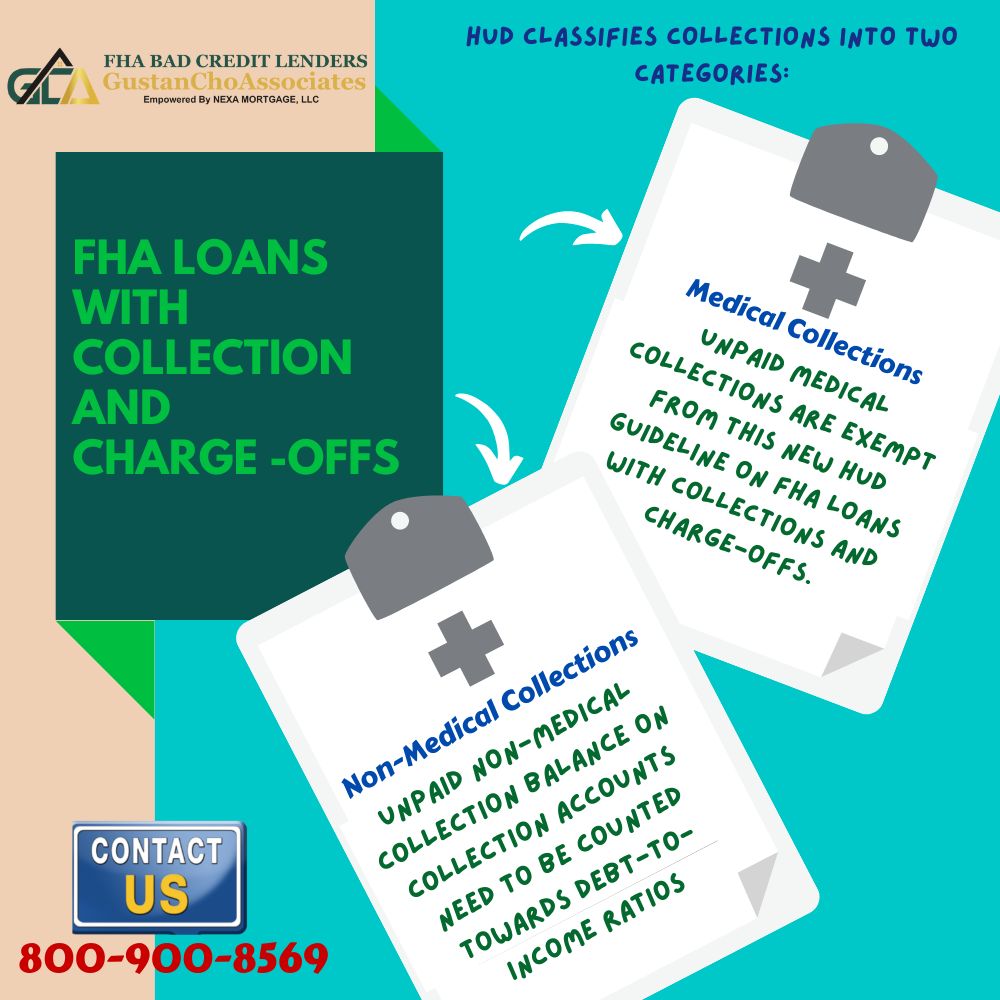

HUD classifies collections into two categories:

- Medical Collections

- Non-Medical Collections

There are stipulations on non-medical collections concerning unpaid collection account balances per FHA guidelines on outstanding collection accounts.

HUD guidelines on FHA loans with collections and charge-offs now require that any unpaid non-medical collection balance on collection accounts need to be counted towards debt-to-income ratios. 5% of the balance on any unpaid non-medical collection account balance will be used as a monthly expense. This will be used for the calculation of debt-to-income ratio calculations. This rule applies only to non-medical collection accounts.

The total aggregate unpaid collection balance must exceed $1,000 or more for the 5% rule of the outstanding collection accounts to be used as hypothetical debt in debt-to-income ratio calculations. If borrowers have only a $500 unpaid collection account, this HUD guideline on unsatisfied collection accounts will not apply since the aggregate unpaid collection account is less than $1,000. Those with thousands of dollars in unpaid collection accounts can be affected due to the 5% of the unpaid collection balance being counted towards the debt-to-income ratios.

FHA Loans With Collections and Charge-Offs On Medical Versus Non-Medical Collections

Unpaid medical collections are exempt from this new HUD guideline on FHA loans with collections and charge-offs. Per HUD mortgage guidelines, medical collections can have high balances. No portion of the unsatisfied balanced will be used per HUD guidelines on unpaid collection accounts. However, many mortgage lenders have overlays with medical collection accounts with credit balances. Some Lenders will require all collections and charged-off accounts to be paid off.

Why Are Lenders Concerned With Older Unpaid Collection Accounts

Mortgage lenders are extremely concerned with unpaid collection accounts because unpaid collection accounts can turn into judgments. Judgments are one of the worst derogatory items borrowers can have on a person’s credit report. A judgment is normally good for ten years. But the judgment creditor can renew the judgment for another ten years.

Those with multiple judgments are forced into bankruptcy. The only thing to clear a judgment is bankruptcy or settling the judgment. There are other ways of clearing an unsatisfied judgment. One way is to vacate the judgment in court due to improper service of the summons. Another way of clearing a judgment is to negotiate the judgment amount with the judgment creditor for less than the face value of the judgment.

Borrowers can qualify for FHA Loans with outstanding judgments. Need written payment agreement and three months of payments. Borrowers cannot prepay the three months of judgment payments upfront. You need to wait for three months of seasoning. Or, borrowers can pay judgment at closing. Proof of funds on how they are paying the judgment is required.

Best FHA Bad Credit Lenders With No Overlays on Collection Accounts

Homebuyers who need to qualify for a mortgage with a mortgage company license in multiple states with no lender overlays can contact us at FHA Bad Credit Lenders at 800-900-8569. Or text us for a faster response. Or email us at gcho@gustancho.com. We have zero lender overlays on FHA, VA, USDA, and Conventional loans. We are mortgage bankers on government and conventional loans. However, we also can broker non-QM and alternative financing mortgage loans on owner-occupant, second homes, and investment properties. The team at FHA Bad Credit Lenders are experts in helping borrowers with lower credit scores, bad credit, outstanding collections, and charge-off accounts.