FHA Loan With High Debt-To-Income Ratios Mortgage Guidelines

This blog will cover and discuss FHA loan with high debt-to-income ratios. Borrowers can qualify for an FHA loan with high debt-to-income ratios with lenders with no overlays. Many folks believe that all lenders have the same FHA loan requirements. However, that is not the case.

All lenders originating and funding FHA loans must meet the minimum HUD Guidelines. However, a lender can have their lending requirements above and beyond the minimum HUD mortgage requirements called lender overlays.

The additional requirements by individual mortgage lenders are called FHA Lender Overlays. There are two types of debt-to-income ratios. In the following paragraphs, we will discuss qualifying for an FHA loan with high debt-to-income ratios.

Types Of Debt To Income Ratios

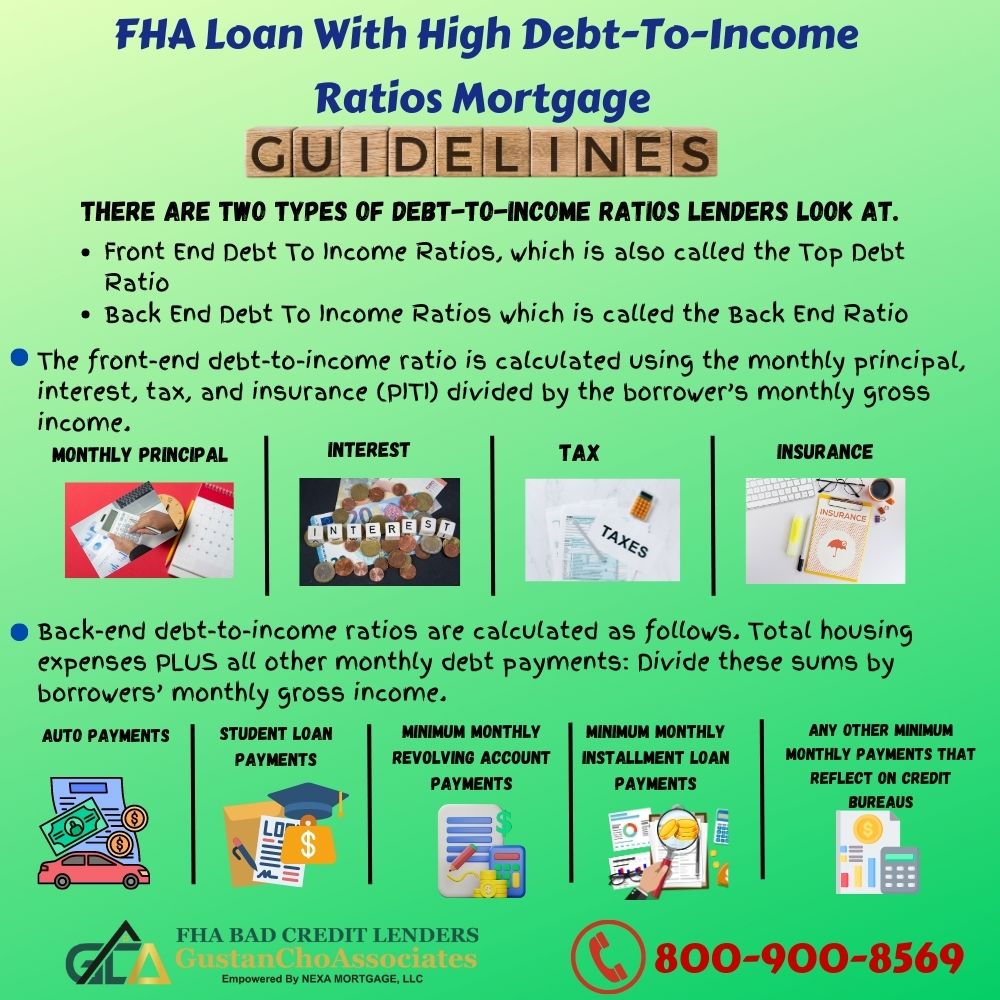

The two types of debt-to-income ratios lenders look at are the following:

- Front End Debt To Income Ratios, which is also called the Top Debt Ratio

- Back End Debt To Income Ratios which is called the Back End Ratio

What Are Debt-To-Income Ratios

There are two types of debt-to-income ratios lenders look at. Most lenders do not require front-end debt-to-income ratios. They only go by the back-end debt-to-income ratios.

FHA loans are hands down the best mortgage loan program for borrowers with high debt-to-income ratios. No other mortgage loan program will allow a 46.9% front-end and 56.9% back-end debt-to-income ratio. Plus, why FHA loans makes the best mortgage loan program for borrowers with high debt-to-income ratios is because HUD allows multiple non-occupant co-borrowers to be added to the main borrower.

Most lenders do have overlays on debt-to-income ratios. Lenders with FHA Lender Overlays will require a front DTI cap.

How Do You Calculate The Front-End Debt-To-Income Ratios

The front-end debt-to-income ratio is calculated using the monthly principal, interest, tax, and insurance (PITI) divided by the borrower’s monthly gross income. The borrower monthly proposed housing payment is divided by the borrower’s monthly gross income.

The front-end debt-to-income ratio is often referred to as the housing ratio. The PITI divided by the monthly gross income is the front-end debt-to-income ratio.

The borrower’s housing payments consist of the following breakdowns. The first mortgage of the proposed home is principal and interest. Monthly property taxes, which are the annual property taxes divided by 12. Monthly homeowners insurance payment:. This figure is derived from the annual homeowners’ insurance premium divided by 12 months. The monthly homeowners association dues, if applicable. If the borrower has a second mortgage payment. The monthly second mortgage payment is part of the front-end debt-to-income ratios.

What Is P.I.T.I.?

Mortgage borrowers often run into the term of P.I.T.I. This term refers to the following:

- (P)principal

- (I)interest

- (T)taxes

- (I)insurance

P.I.T.I. is not equivalent to monthly housing expenses for folks who have homeowners association dues and second or third mortgages.

What Are The Requirements In Qualifying For FHA Loan With High Debt-To-Income Ratios

Home Buyers and Homeowners needing refinance on their home loans can qualify for FHA loans with high debt-to-income ratios. This cannot be very clear to explain, so we will walk through this step-by-step.

To get an approve/eligible per Automated Underwriting System, there is a correlation between credit scores and debt-to-income ratios. To get an approve/eligible per DU/LP FINDINGS PER AUS with credit scores below 620 FICO, the maximum debt-to-income ratio permitted is 46.9% front-end and 56.9% back-end DTI with compensating factors. Otherwise, the automated underwriting system may cap it at 43%. There are no front-end debt-to-income ratio requirements if the automated underwriting system caps you at 43$.

The lender can have overlays on the front-end DTI. Most with overlays will cap the front-end DTI to 31% to 33%. To get an approve/eligible per DU/LP FINDINGS PER AUS with credit scores higher than 620 FICO, the maximum debt-to-income ratios permitted is 46.9% front-end DTI and 56.9% back-end DTI.

How To Calculate Back-End Debt To Income Ratio

Back-end debt-to-income ratios are calculated as follows. Total housing expenses PLUS all other monthly debt payments: Divide these sums by borrowers’ monthly gross income. Monthly Debt Payments That Is Included in the back-end debt-to-income ratio calculations are the following:

- Auto Payments

- Student Loan Payments

- Minimum Monthly Revolving Account Payments

- Minimum Monthly Installment Loan Payments

- Any other minimum monthly payments that reflect on credit bureaus

Debts Not Included In DTI Calculations

Home buyers should keep this in mind when buying a home:

How Much Home Can I Afford?

Home buyers can qualify for FHA loan with high debt-to-income ratios, as high as 56.9%, with lenders with no overlays on DTI. Mortgage underwriters do not count the following when calculating DTI. Monthly utilities such as water bills, electric bills, and gas bills. Internet bills, home phone bills, cell phone bills, and cable bills. Scavenger service. Medical insurance. Child Care. Elderly care. School Tuition. After-School Activities. Family Vacations. Weekly/Monthly Groceries. Deductions from payroll, such as 401k/Pension

Borrowers need to consider their personal finances and judge if they are buying too much home. Nobody wants to be in a situation where they are house poor because all of the income they make will go to their housing payments.

Mortgage underwriters will not take personal expenses into account when calculating how much you qualify for. The amount you qualify for is not as important as how much house you can afford. That is why you need to go over your personal finances rather than what the lender tells you how much you qualify.