Getting Approved For FHA Loan Bad Credit With 500 FICO

In this article, we will cover and discuss qualifying for an FHA loan bad credit with credit scores down to 500 FICO and high debt-to-income ratio. FHA and conventional loans are the two most popular mortgage loan program in the nation. FHA loans are the most popular loan program for first-time homebuyers, borrowers with high debt-to-income ratio, homebuyers with low credit scores, and borrowers with prior bad credit.

FHA loans are the best mortgage loan option for borrowers with bad credit and credit scores down to 500 FICO. Borrowers with no credit tradelines and no scores are eligible for FHA loans with non-traditional credit.

Conventional loans are geared towards borrowers with higher credit scores with stronger credit profiles. FHA loans is more a more popular loan program for homebuyers with bad credit. All primary owner-occupant home mortgage programs allow outstanding collections and charged-off accounts. Outstanding collections and charged-off accounts do not have to be paid to qualify for FHA, VA, USDA, and owner-occupant conventional loans.

How Hard Is It To Get FHA Loan Bad Credit

It is much easier to get an approve/eligible per automated underwriting system with bad credit on FHA loans than any other home mortgage program. To qualify for a 3.5% down payment home purchase FHA loan, borrowers need a 580 credit score. FHA Bad Credit Lenders are experts in helping borrowers qualify for a mortgage with bad credit and lower credit scores.

Per HUD agency guidelines, the lowest credit score you can have and qualify for an FHA loan bad credit is 500 FICO score with a 10% down payment. The down payment requirements is 10% for borrowers with credit scores under 580 FICO. To qualify for a 3.5% down payment home purchase FHA loan, borrowers need at least a 580 credit score.

The lowest credit score you can have and still qualify for an FHA loan is 500 FICO. However, if you have under a 580 credit score and down to a 500 FICO, HUD Agency Guidelines requires a 10% down payment on a home purchase. The best way to improve your chances to get an approve/eligible per automated underwriting system (AUS), you need timely payments in the past 12 months on all of your monthly debt payments.

Credit Repair Can Backfire During Mortgage Process

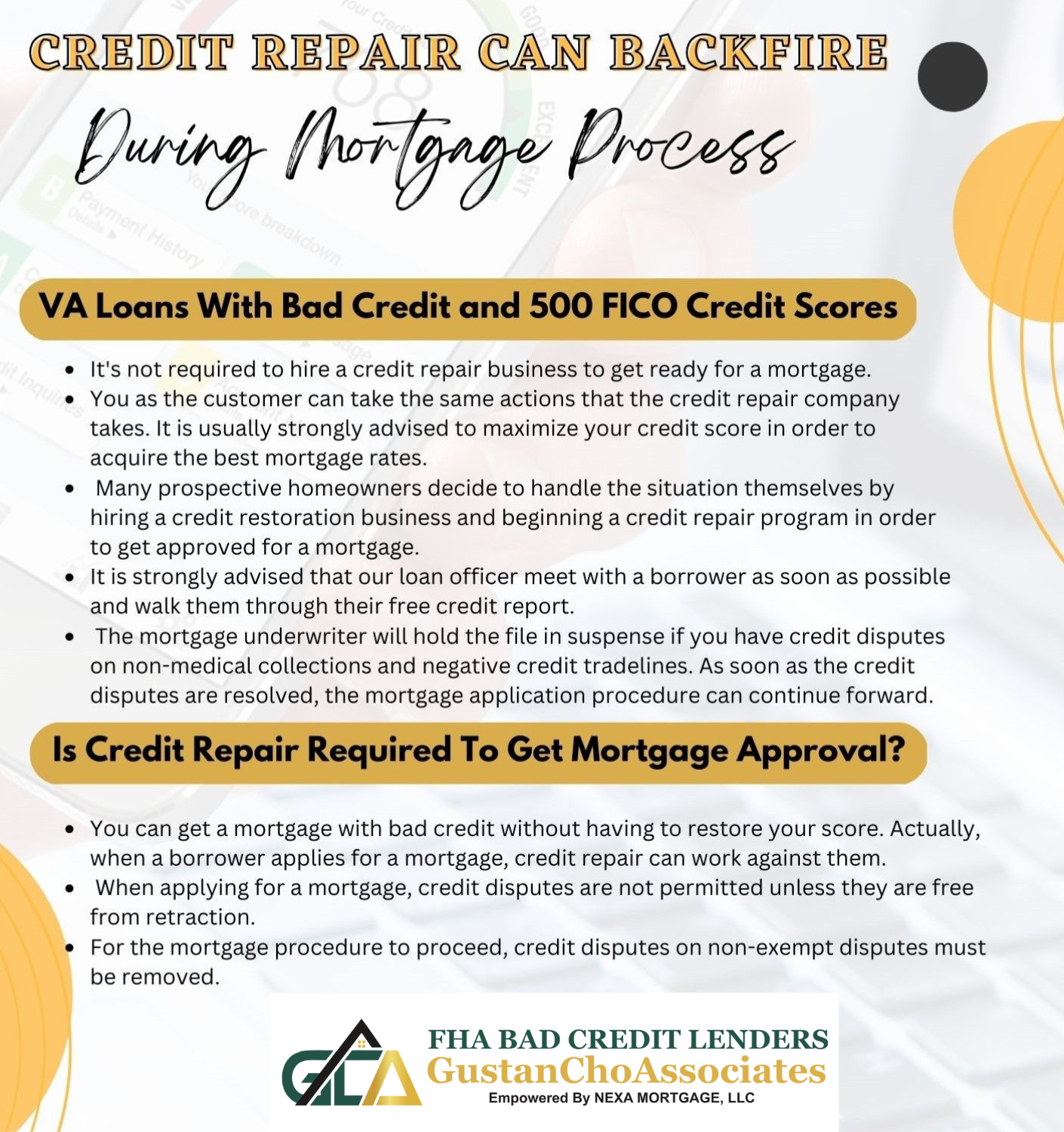

Hiring a credit repair company is not necessary to prepare for a mortgage. Whatever the credit repair company does, you as the consumer can do the same same. Our loan officers are experts in helping you rebuild your credit so you can qualify and get pre-approved for a mortgage. It will not cost you a penny for our credit rebuild program and consultation. Do not misunderstand our statement here. It is always highly recommended to optimize and have the maximum credit score to get the lowest mortgage rates. However, a credit repair consultant is not needed.

If you are looking to get pre-approved for an FHA loan bad credit, please contact us at FHA Bad Credit Lenders as soon as possible. One of our loan officers will walk through your credit profile and credit report at no cost. If you have credit disputes on non-medical collections and derogatory credit tradelines, the file will get in suspense by the mortgage underwriter. Once the credit disputes are removed, the mortgage process is out of suspense the mortgage process restarts.

Most people are under the assumption you need good credit and no derogatory credit tradelines to qualify for an FHA loan. Many future homebuyers take matters in their own hands and hire a credit repair company and start a credit repair program so they can qualify for a mortgage. It is highly recommended for you to contact one of our expert loan officers who can help you evaluate your credit profile analysis. It does not cost you a penny. The team at FHA Bad Credit Lenders are experts in helping borrowers rebuild and boost their credit scores so they can qualify for an FHA loan bad credit.

Is Credit Repair Required To Get Mortgage Approval?

Credit repair is not required to qualify for a mortgage with bad credit. Whatever a credit repair company does for a fee, you can do it yourself. There is no magic credit repair companies have to rebuild credit. Credit repair can do more damage than good for borrowers who need to get pre-approved for a mortgage.

If you are trying to get pre-approved for a mortgage, do not hire a credit repair company before you consult with a loan officer. The oldest trick in the book credit repair companies use is disputing derogatory credit tradelines in the hopes of getting it removed. You cannot have credit disputes on non-medical collections, charge-offs, late payments, and other derogatory credit tradelines during the mortgage process.

Any derogatory credit tradelines such as collections and charge-off accounts older than two years old will have little to no impact on your credit scores. Actually, credit repair can backfire on borrowers when applying for a mortgage. Credit disputes are not allowed during the mortgage process unless the credit dispute are exempt from retraction. Credit disputes need to be removed on non-exempt disputes for the mortgage process to process.

Are Credit Disputes Allowed During The Mortgage Loan Process?

One of the first things a loan officer need to do before moving forward with the mortgage pre-approval process is thoroughly review the borrower’s credit report. The loan officer needs to thoroughly go over every page of the credit report and make sure there are no credit disputes that is non-medical collections, and other derogatory credit tradelines.

One of the main reasons for stress during the mortgage loan process or a last-minute mortgage loan denial is because the mortgage loan application has credit disputes. Once the mortgage underwriter notices credit disputes on derogatory credit items, the file will be suspended and gets kicked back to the mortgage process.

Pre-approvals letters that are issued with outstanding credit disputes are null and void. When a consumer disputes a derogatory credit tradeline, the credit bureaus will automatically discount the negative factors from the credit scoring model. Therefore, whenever a consumer disputes a derogatory credit tradeline, the consumer credit scores will go up.

Why Do Lenders Not Allow Credit Disputes During The Mortgage Process

When a consumer files a credit dispute on a negative credit tradeline, their credit scores will increase. because the credit bureaus will automatically negate the negative tradeline from the FICO scoring model. When a consumer retracts a credit dispute, the negative credit factor gets factored back into the credit scoring formula.

The mortgage process cannot move forward with outstanding credit disputes. The mortgage underwriter will kick the file back to the mortgage processor where it gets back in the que. Therefore, delays in the mortgage process and possibly closing can happen. This is why it is very important to scrub the file thoroughly prior to submitting to underwriting.

Since the negative scoring factor is factored back into the FICO scoring formula, your credit scores will drop. It can drop significantly because the negative factor is reported as a brand new derogatory. Therefore, many borrowers may no longer qualify for a mortgage for not meeting the minimum credit score requirements after they retract the credit disputes.

Can I Qualify For a Mortgage With Bad Credit

Homebuyers who do not qualify for an FHA loan bad credit, we can guide you on the steps to take to rebuild your credit. You do not need to pay an expensive credit repair company to rebuild your credit. Borrowers who consult with us will qualify for a mortgage loan. It is not IF they will qualify but WHEN they will qualify and get pre-approved.

Borrowers who need a professional credit consultant, we have a network of preferred real estate professionals which include credit counselors and consultants we recommend. The referred credit repair company is totally independent of our services and are by no way and means an affiliate of FHA Bad Credit Lenders.

The key in getting an approve/eligible per automated underwriting system is to have timely payments in the past 12 months. We will show you step by step on how to rebuild and boost your credit scores sooner than later. We have helped countless borrowers rebuild their credit and increase their credit scores.

How To Get Automated Underwriting System Automated Approval With Bad Credit?

You can have outstanding collections and charge-off accounts and get an approve/eligible per AUS profiles. Both sides of the transaction, buyers and sellers, need to work closely together here. A mortgage company can easily fire licensed and support staff at FHA Bad Credit Lenders.

Over 80% of our borrowers at FHA Bad Credit Lenders are folks who got denied by a mortgage lenders due to lender overlays or because they were getting the runaround over and over and got fed up.

Alex Carlucci also known as the Chicago Three Legged Blind Deaf Dog said borrowers with credit scores under 580 and down to 500 FICO can easily qualify for an FHA loan even with late payments if you put more money down. Besides FHA loan bad credit, FHA Bad Credit Lenders has other mortgage loan options for borrowers with bad credit. Non-QM loans with no income verification is the easiest and a faster form of financing.

How Hard Is It To Get an FHA Loan With Bad Credit?

Homebuyers can qualify for FHA Loan Bad Credit: Borrowers do not need perfect credit nor higher credit scores to qualify for FHA Loan Bad Credit. Outstanding collections and/or charged-off accounts do not have to be paid to qualify for FHA Loan Bad Credit.

The team at FHA Bad Credit Lenders has a national reputation of being able to do the mortgage loan other lenders cannot do. We are experts in helping borrowers who could not qualify at other lenders due to their overlays.

HUD, the parent of FHA, has created and implemented very lax mortgage guidelines for homebuyers with less than perfect credit. FHA loans are the most popular loan program for first-time homebuyers, borrowers with high debt-to-income ratio, collections and charge-off accounts, judgments, tax liens, and late payments.

What Type of Homebuyers Benefit from FHA Loans?

FHA loans benefit first-time homebuyers, as well as borrowers with little to no credit, homebuyers with prior bad credit higher debt to income ratio to qualify and get approved for FHA Loan Bad Credit. FHA loans is one of the top mortgage loan programs. The other lender who does the most loans.

FHA loan bad credit benefit first-time homebuyers, borrowers with high debt-to-income ratios, borrowers with large collections and charge-offs, homebuyers with bad credit, and borrowers with credit scores down to 500 FICO.

The reason we are asking is because we believe in true transparency and not what you want to hear, the rather we would tell you the facts on a particular mortgage loan option best suited for you. We work for you. Without our loyal review of word by month and would love to talk with you soon and get a conference call.

The Federal Housing Administration

FHA does not originate, process, underwrite, fund, or service loans. FHA is a government agency under The United States Department Of Housing And Urban Development, HUD, whose role is to insure and guarantee FHA Loans originated and funded by private lenders. FHA insures loans that are defaulted and foreclosed and offers insurance against lender’s loss due to foreclosure. In order for FHA to insure lenders, mortgage lenders need to follow HUD 4000.1 FHA Handbook Guidelines.

Reason Why FHA Loans Are So Popular

As mentioned earlier, FHA is the most popular loan program in the United States. Due to the government guarantee, private lenders can offer owner occupant loans with 3.5% down payment at very low mortgage interest rates. HUD sets the mortgage guidelines for FHA loans. Home Buyers with prior bankruptcy and/or housing event and bad credit can qualify for FHA loans. FHA’s mission is to promote homeownership to all hard working Americans.

Qualifying For FHA Loans After Bankruptcy

Many consumers who filed bankruptcy think they can never qualify for a home loan. This is not true. Consumers can file Chapter 7 Bankruptcy and qualify for FHA loans after two years of their discharged date. Re-established credit and no late payments after Chapter 7 Bankruptcy is preferred by lenders. One or two late payments after the Chapter 7 Bankruptcy discharged date is not a deal killer.

Homebuyers can qualify for an FHA or VA loan after 12 months of filing Chapter 13 Bankruptcy. Must have made 12 timely payments and not be late on their payments to the bankruptcy trustee. The Chapter 13 Bankruptcy does not need to be discharged. There is no waiting period after Chapter 13 Bankruptcy discharge date on FHA and VA loans.

Homebuyers can qualify for FHA Loans one year into a Chapter 13 Bankruptcy repayment plan with Trustee Approval. It needs to be a manual underwrite. There is no waiting period after the Chapter 13 Bankruptcy discharged date to qualify for FHA Home Loans. Anyone with less than a two year seasoning period after Chapter 13 Bankruptcy discharged date needs to be manually underwritten.

What Is The FHA Waiting Period Guidelines After Foreclosure

A housing event can be any of the three following scenarios: Foreclosure, a deed-in-lieu of foreclosure, or short-sale. A homebuyer with a previous foreclosure will have a mandatory waiting period requirement. The waiting period start date is the date the housing event has been finalized.

Homebuyers have a three year waiting period requirement to qualify for an FHA loan after foreclosure, deed-in-lieu of foreclosure, or short sale. The waiting period start date is the date the deed was turned over to the new owner or the date of the sheriff’s sale.

There is a three year wait period to qualify for FHA Mortgages after a housing event. The waiting period start date starts from the recorded date of foreclosure and/or deed in lieu of foreclosure. Wait period after the short sale starts from the short sale date reflected on the Closing Disclosure.

HUD Guidelines on Prior Mortgage Included in Bankruptcy

If the borrower had a mortgage included in Chapter 7 Bankruptcy, there is a three year waiting period after the recorded date of the housing event on FHA loans. With conventional loans, the waiting period starts from the discharged date of Chapter 7 Bankruptcy.

If you had a prior mortgage included in bankruptcy, the waiting period start date on FHA loans is the date of the finalization of the housing event. What this means is the date your name was transferred out of the deed or the date of the sheriff’s sale. Conventional loans is quite different. If you had a mortgage included in bankruptcy, the four year waiting period to qualify for a conventional loan starts from the date of the discharge of the bankruptcy. The foreclosure or housing event finalization does not matter.

The foreclosure, deed in lieu of foreclosure, short sale needs to be finalized. However, the housing event date does not matter on Conventional loans. The mortgage cannot be reaffirmed after Chapter 7 Bankruptcy.

HUD Credit Guidelines For FHA Loans

The minimum credit scores to qualify for 3.5% down payment FHA home loans is 580. Homebuyers with credit scores between 500 and 579 can qualify for FHA Loans but need a 10% down payment and an approve/eligible per Automated Underwriting System. Borrowers do not have to pay outstanding collections and charged-off accounts. However, key in getting approve/eligible per Automated Underwriting System Approval is to have been timely in the past 12 months.

Can I Buy a House With Late Payments After Bankruptcy?

Late Payments after bankruptcy and/or housing event is really frowned upon by lenders. However, one or two late payments after bankruptcy and/or foreclosure is not a deal killer. FHA Bad Credit Lenders has a national reputation for its no lender overlays on government and conventional loans and being able to do mortgage loans other lenders cannot do.

Most lenders have lender overlays where they will automatically disqualify borrowers with late payments after bankruptcy and/or foreclosure. FHA Bad Credit Lenders has zero overlays on FHA loans. The team at FHA Bad Credit Lenders are experts in qualifying and approving borrowers with credit scores down to 500 FICO.

FHA Loan Bad Credit Lender With No Overlays

We just go off automated underwriting system approval findings. Borrowers with judgments and/or tax liens can qualify for FHA loans as long as they can pay the outstanding judgment and/or tax lien prior to or at closing. If not, consumers can have a written payment agreement with the judgment creditor and/or IRS.

FHA Bad Credit Lenders are mortgage brokers licensed in 48 states with a network of over 210 wholesale mortgage lenders. We have dozens of wholesale lenders of government and conventional loans with no overlays.

Once a written payment agreement has been executed, the borrower needs to make timely monthly scheduled payments and not be late. Three months of payments are required to the judgment creditor or Internal Revenue Service. Need to provide three months canceled checks and/or bank statements showing proof of payment. Borrowers cannot pre-pay the three months upfront to qualify for FHA Mortgages.

Do All Lenders Have The Same FHA Loan Bad Credit Requirements?

Over 75% of our borrowers are folks who could not qualify at other lenders due to their lender overlays. Most mortgage lenders have lender overlays on FHA loans. Mortgage overlays are additional lending guidelines above and beyond those of HUD Guidelines. FHA Bad Credit Lenders has no overlays on FHA loans. We just go off AUS approval findings.

The team at FHA Bad Credit Lenders is always available. You can reach us seven days a week, evenings, weekends, and holidays. FHA Bad Credit Lenders are mortgage brokers licensed in 48 states including Washington, DC and Puerto Rico.

All of our pre-approvals are full loan commitments that have been fully underwritten and signed off by our mortgage underwriters. Please contact us at FHA Bad Credit Lenders , at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at FHA Bad Credit Lenders is available 7 days a week, evenings, weekends, and holidays. FHA Bad Credit Lenders has a national reputation for being able to do what other mortgage lenders cannot do.