Facts Every Veteran Should Know on VA Loans

VA Home Loans Facts Every Veteran Should Know About Eligibility Requirements

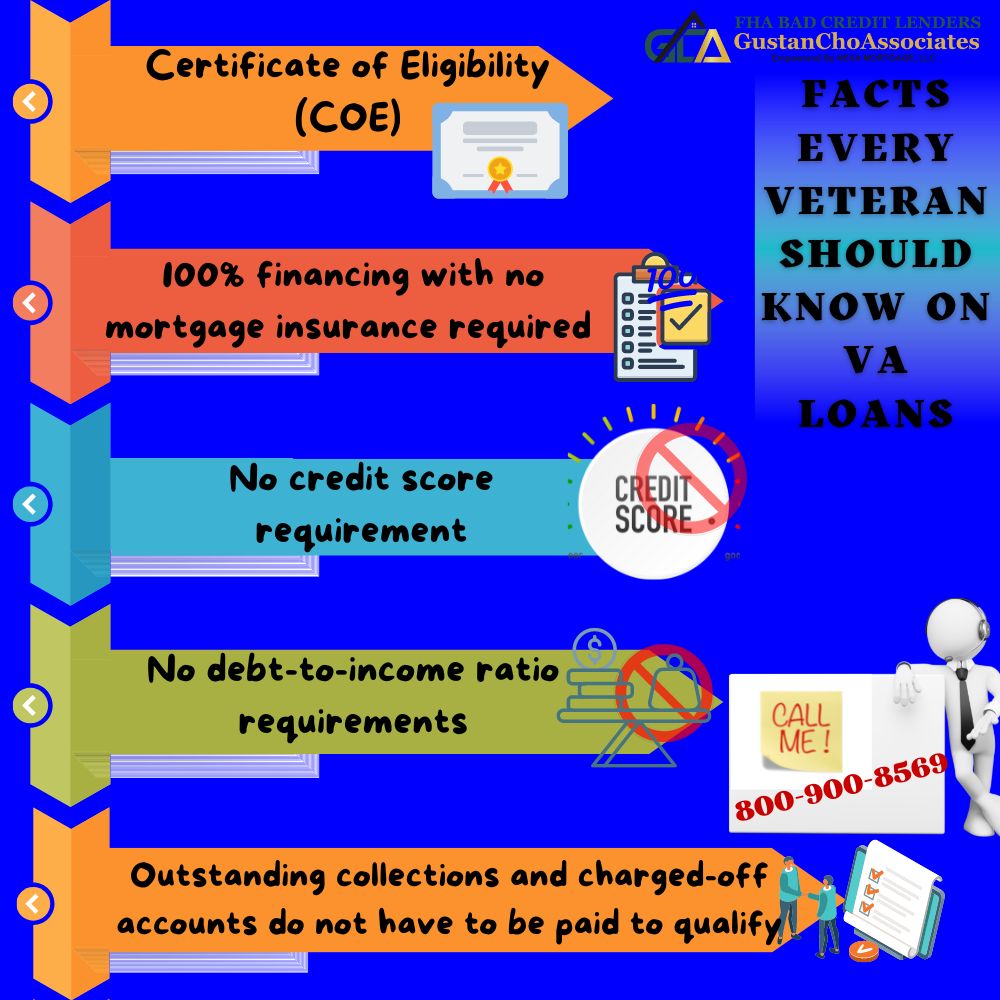

Active, retired, reservist, and National Guard members of the U.S. Military with a Certificate of Eligibility (COE) can qualify for VA Loans. Married spouses of veterans who passed while on active military duty service and as a result of a military service-related disability may also qualify.

Active members of the U.S. The military can normally qualify for VA Loans after six months of active duty. There is a six-year wait period for reserve and National Guard members to become eligible. However, if they are assigned and transferred to active duty, reservists and active National Guard members are eligible to qualify after 181 days of active full-time service.

Suppose reservists and active duty National Guard members serve or serve for at least 90 continuous days during wartime serving on foreign soil. In that case, they may be eligible and qualify for VA Mortgages. All veterans who qualify for VA Home Mortgages must obtain a COE from the Department of Veterans Affairs. Home Buyers can start the VA Mortgage Process without the COE. However, the COE will be required sometime in the mortgage process.

Benefits Of VA Mortgage Loans

VA Home Loans Facts Every veteran Should Know is its many benefits. VA Loans are the best home loan program in the United States.

- The U.S. Department of Veterans Affairs rewards our fine men and women of our U.S. Military with this precious benefit of being eligible for VA Loans for their sacrifice in serving in our Armed Services.

- Private lenders love originating and funding VA Loans because VA partially guarantees home loans if borrowers default on their mortgages and the property forecloses.

- Due to this guarantee by the government, lenders can offer VA Loans to veterans of our military with no money down, no closing costs, no private mortgage insurance required, and mortgage rates lower than conventional loans.

- Department of Veterans Affairs does not have any credit score requirements

- Veterans Affairs does not have debt-to-income ratio caps

- Qualifying for VA Loans after a housing event such as foreclosure or short sale, the waiting period is two years versus three years for USDA and FHA Loans and 4 to 7 years for conventional loans

Outstanding collections and charged-off accounts do not have to be paid to qualify.

VA Home Loans Facts Every Veteran Should Know On Fees And Costs

VA Home Loans Facts Every Veteran Should Know is that homebuyers do not need to cough up any money for the down payment and closing costs with VA Loans. How much do veterans need to purchase a home?

There is no down payment required on a home purchase. However, there are closing costs on all purchase or refinance mortgage transactions. Veterans do not have to worry about closing costs. Home Buyers can purchase a home with zero money out of pocket. VA offers 100% financing. Closing costs can be covered with seller concessions or lender credit.

Some out-of-pocket money buyers may need to advance when purchasing a home. Sellers would want an earnest money check. Earnest money deposits are promissory deposit to sellers that is refundable if the transaction does not close. Earnest money deposits range between $500 to $1,000 or more. The earnest money deposit will get applied towards the down payment or closing costs.

Costs Associated With Purchasing A Home With A VA Loan

Since there is no down payment requirement and closing costs will be paid with seller concessions or lender credit, the earnest money deposit will be refunded to the buyer at closing. Most companies will request that borrowers pay for home appraisal costs upfront before ordering the appraisal. This is normally just under $500.

Home inspections are another cost that buyers pay upfront. VA does not require annual mortgage insurance, a huge benefit for veterans. However, there is a one-time VA Funding Fee that can be rolled into the balance of the loan. This one-time fee will vary depending on the down payment, type of veteran, and service.

A first-time home buyer may pay a 2.15% VA Funding Fee. However, the funding fee may be reduced to 1.25% for veterans putting more than a 10% down payment on a home purchase. National Guard and Reservist members pay 0.25% more in funding fees than active duty service members. Veterans using their VA Entitlement for the second time with 100% financing would pay a 3.3% VA Funding Fee. For disabled veterans on service-connected disability compensations, the upfront VA Funding Fee is waived.

Not All VA Lenders Have Same Credit Requirements

One of the most important VA Home Loans Facts Every Veterans Should Know is that not all lenders have the same credit and underwriting requirements.

- VA does not require a minimum credit score.

- VA also does not have a debt-to-income ratio requirement

- I have closed countless multiple veterans with credit scores under 600 and over 60% debt-to-income ratios

- As long as veterans have high residual income, the Automated Underwriting System can render an approve/eligible per AUS Findings

- FHA Bad Credit Lenders Mortgage Group has no overlays on VA Home Loans

- However, most lenders have overlays and may not qualify veterans with credit scores under 620 and debt-to-income ratios higher than 43%

- Just because veterans get turned down by one lender does not mean they will qualify with another lender

- Over 75% of our borrowers at FHA Bad Credit Lenders Mortgage Group are folks who are stressing during the mortgage process or have gotten last-minute mortgage denials due to having overlays

- We close 100% on all of our pre-approvals because all of our pre-approvals are fully underwritten and signed off by our mortgage underwriters

All of our pre-approvals are loan commitments.

Maximum VA Loan Limit Effective 2020

There is no longer a maximum VA loan limit as of January 2020. To start the VA Mortgage Process with FHA Bad Credit Lenders Mortgage Group, please get in touch with us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The team at GCA Mortgage Group is available seven days a week, evenings, weekends, and holidays.