Do All Lenders Have The Same Guidelines on FHA Loans

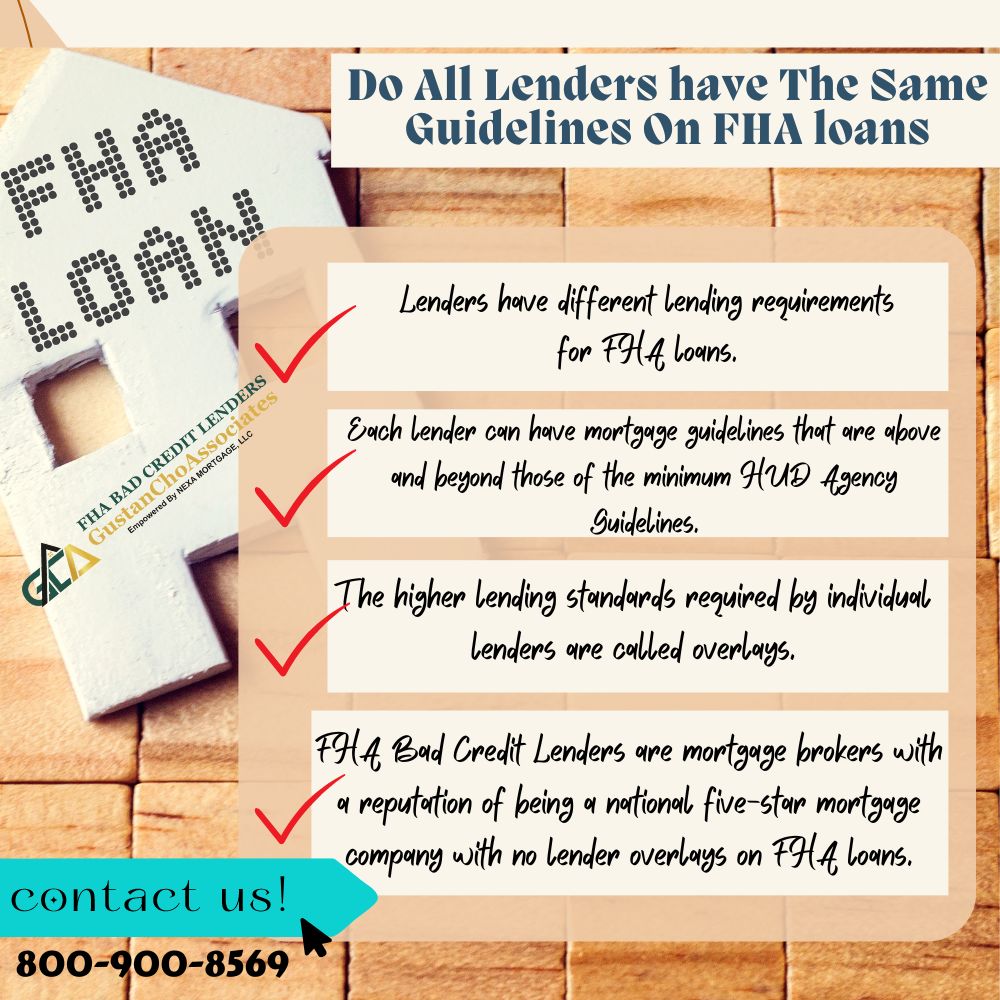

In this article, we will cover the frequently asked question at FHA Bad Credit Lenders about do all lenders have the same guidelines on FHA loans. Do all lenders have the same guidelines on FHA loans is one of the most common questions we get from our viewers at FHA Bad Credit Lenders. The answer is NO. Lenders have different lending requirements for FHA loans.

All lenders need to have their borrowers the minimum lending agency mortgage guidelines by the U.S. Department of Housing and Urban Development (HUD). HUD is the parent of FHA. FHA is not a lender. HUD is a federal government agency in charge of insuring and guaranteeing FHA loans to mortgage lenders.

FHA will insure and partially guarantee lenders on FHA loans that are in default and being foreclosed. Due to this government guarantee by FHA, lenders can offer FHA loans with only a 3.5% down payment with lower credit scores at great mortgage rates.

What Are FHA Loans and How Do They Work?

FHA loans are one of the most popular loan programs in the United States. HUD created and launched FHA loans to promote homeownership in the United States with low down payment and lenient credit guidelines.

One thing borrowers need to realize is that not all lenders have the same credit guidelines on FHA loans. Each lender can have mortgage guidelines that are above and beyond those of the minimum HUD Agency Guidelines. The higher lending standards required by individual lenders are called overlays.

FHA Bad Credit Lenders are mortgage brokers with a reputation of being a national five-star mortgage company with no lender overlays on FHA loans. FHA Bad Credit Lenders is also licensed in 48 states. Over 80% of our borrowers at FHA Bad Credit Lenders are folks who could not qualify at other lenders due to their lender overlays. This article will discuss, and cover do all lenders have the same guidelines on FHA loans.

Do All Lenders Have The Same Guidelines On FHA Loans: Understanding Lender Overlays

To answer the question of do all lenders have the same guidelines on FHA loans, one must understand what lender overlays are on FHA loans. As mentioned earlier, all lenders need to have their borrowers meet the minimum HUD Agency Mortgage Guidelines.

Each lender can have higher requirements on FHA loans called lender overlays. For example, to qualify for a 3.5% down payment FHA loan, the borrower needs a 580 credit score. However, many lenders may require a 620, 640, 660, or 680 credit score on FHA loans. The higher credit score requirement is called lender overlays. Lenders can have lender overlays on just about anything.

Remember that just because you get denied an FHA loan from one lender does not mean you cannot qualify for an FHA loan with another. Most lenders have lender overlays. There are lenders like FHA Bad Credit Lenders with no lender overlays on government and conventional loans. FHA Bad Credit Lenders does not have any lender overlays. We go off of the automated findings of the automated underwriting system (AUS).

Minimum HUD Agency Mortgage Guidelines To Qualify For FHA Loans

You will qualify for an FHA loan if you meet the minimum HUD Agency Mortgage Guidelines. FHA Bad Credit Lenders has no lender overlays. We go off the automated findings of the automated underwriting system (AUS). We have zero lender overlays on FHA and other government and conventional loans.

FHA Loan Requirements

This section will cover the minimum HUD Guidelines to qualify for FHA loans. One to four-unit residentially zoned owner-occupied properties only. The minimum credit score requirement to qualify for a 3.5% down payment FHA loan is 580 FICO. Borrowers with under 580 credit scores down to 500 FICO are eligible to qualify for an FHA loan but need a 10% down payment. There is a two-year waiting period requirement after the Chapter 7 Bankruptcy discharge date. There is a three-year waiting period after foreclosure, a deed in lieu of foreclosure, short sale.

Outstanding collections and charged-off accounts do not have to be paid to qualify for FHA loans. Borrowers can get gift funds for the down payment and closing costs. Non-Occupant Co-Borrowers allowed. Borrowers can have a debt-to-income ratio of 46.9% front end and 56.9% back end to get an approve/eligible per automated underwriting system.

If borrowers meet the above basic HUD lending guidelines, they will qualify for an FHA loan. If told by one lender you do not qualify, then go to a lender with no lender overlays like FHA Bad Credit Lenders.

Typical Lender Overlays

Mortgage lenders can have lender overlays on just about anything. In this section, we will cover the typical lender overlays that are very common among lenders. Lenders may impose higher credit score requirements as part of their lender overlays, such as 620, 640, 660, and 680 credit scores, when the FHA minimum credit score requirement is 580 on a 3.5% down payment home purchase FHA loan.

Under HUD guidelines, borrowers do not have to pay outstanding collections and charged-off accounts no matter how large, but many lenders will have overlays where they will require borrowers to pay them off. The maximum debt-to-income ratio to get an approve/eligible per automated underwriting system (AUS) is a front end of 46.9% and a back end of 56.9%. However, many lenders will cap debt-to-income ratios to lower levels.

Many lenders will not accept manual underwriting as part of their lender overlays. Some lenders will have lender overlays on gift funds where they will not accept gift funds for borrowers under 640 credit scores. Lenders can impose lender overlays on just about anything.

Qualifying For An FHA Loan With A Lender With No Overlays

If you are told by a lender you do not qualify for one reason or another, study the basic FHA guidelines. If you meet all the minimum HUD guidelines to qualify for an FHA loan but are told you do not qualify by a lender, then go to a different lender with no overlays, like FHA Bad Credit Lenders.

FHA Bad Credit Lenders has no lender overlays on FHA loans, other government, and conventional loans. We go off the agency minimum mortgage lending guidelines. Over 80% of our borrowers could not qualify at other lenders due to their lender overlays.

To qualify for a mortgage, please get in touch with us at 800-900-8569 or text us for a faster response. Or email us at gcho@gustancho.com. The FHA Bad Credit Lenders team is available seven days a week, evenings, weekends, and holidays.