FHA manual underwriting is similar to FHA approve/eligible per automated underwriting system approved FHA loans. However, the main difference between FHA manual underwriting versus approve/eligible per AUS FHA loans is the cap on debt-to-income ratio caps. FHA manual underwriting has lower front-end and back-end debt-to-income ratio cap versus AUS approved FHA loans.

The main difference between approve/eligible per AUS versus manual underwrites on FHA loans is the front-end and back-end debt-to-income ratio is lower on manual underwrites. The maximum debt-to-income ratio on approve/eligible per AUS FHA loans is 46% front-end and 56.9% back-end debt-to-income ratio. On manual underwrites, the front-end and back-end debt-to-income ratio is 31/43 with one compensating factor, 37/47 with two compensating factors, and 40/50 with two compensating factors.

The front-end and back-end debt-to-income ratio cap depends on the number of compensating factors the borrower has. Compensating factors are positive of borrowers that offset risk the lender has. There is a list of acceptable compensating factors by lenders. In this blog, we will cover FHA manual underwriting guidelines.

What Is FHA Manual Underwriting?

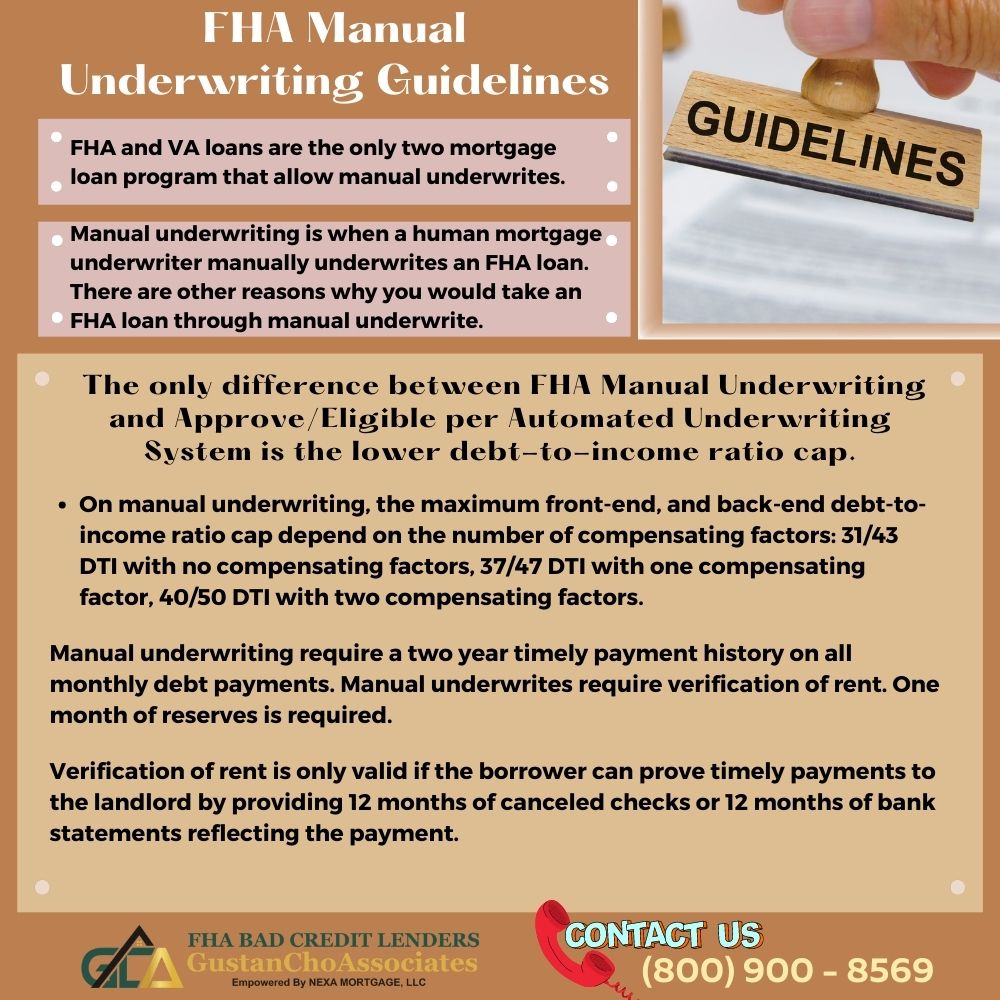

If a borrower cannot get an approve/eligible per automated underwriting system (AUS) and the AUS renders a refer/eligible per AUS, the borrower can be eligible for an FHA manual underwriting. Manual underwriting is when a human mortgage underwriter manually underwrites an FHA loan. There are other reasons why you would take an FHA loan through manual underwrite.

Borrowers who get a refer/eligible per automated underwriting system (AUS) are eligible for manual underwrites. FHA and VA loans are the only two mortgage loan program that allows manual underwrites. FHA and VA loans has the exact manual underwriting guidelines.

FHA and VA loans are the only two mortgage loan program that allow manual underwrites. FHA manual underwriting is different than approve/eligible per AUS approved FHA loans in respect on lower front-end and back-end debt-to-income ratio caps. Manual underwriting require a two year timely payment history on all monthly debt payments. Manual underwrites require verification of rent. One month of reserves is required.

FHA Manual Underwriting Guidelines on Debt-To-Income Ratio

FHA loans allow for manual underwriting. The only difference between FHA Manual Underwriting and Approve/Eligible per Automated Underwriting System is the lower debt-to-income ratio cap.

The maximum debt-to-income ratio on FHA manual underwriting is 40% front-end and 50% back-end with two compensating factors. On approve/eligible per automated underwriting system (AUS) is 46.9% front-end and 56.9% back-end debt-to-income ratio on FHA loans.

On manual underwriting, the maximum front-end, and back-end debt-to-income ratio cap depend on the number of compensating factors: 31/43 DTI with no compensating factors, 37/47 DTI with one compensating factor, 40/50 DTI with two compensating factors.

FHA Manual Underwriting Guidelines on Verification of Rent

Verification of rent is normally required by most lenders on manual underwriting on FHA loans. Verification of rent is only valid if the borrower can prove timely payments to the landlord by providing 12 months of canceled checks or 12 months of bank statements reflecting the payment.

Cash rental payment is not a valid form of rental verification. Many people pay rent in cash and get a cash paid receipt for rent. Unfortunately, any forms of cash, whether it is cash in hand or cash payments, cannot be used as verified funds.

A verification of rent form provided by the lender needs to be completed, dated, and signed by the landlord. Verification of rent, also referred to as rental verification or VOR, is only valid if the renter can provide proof of payment via canceled checks or bank statements. Paying cash for rent with a rental receipt is not a valid form of verification of rent.

Renting Property From Registered Property Management Company

Renters renting an apartment or home from a registered property management company are exempt from providing 12 months of canceled checks or 12 months of bank statements showing rental payments.

If a homebuyer is living rent-free from family to save money for the down payment, FHA Bad Credit Lenders will waive verification of rent on manual underwrites. A living rent-free with family form needs to be completed by the landlord, signed, and dated.

A rental verification form provided by the lender needs to be completed, dated, and signed by the the property manager of the property management company. You cannot have any late payments in the past 12 months.

Why Is Verification of Rent Important on Manual Underwriting

Verification of rent is important on manual underwriting because it shows the borrower has a history of paying rent on time. In order for rental verification to be valid, the rent needs to have paid rent timely for the past 12 months.

Rental verification is important because it shows the lender the homebuyer has a history of payment rent. The smaller the gap between the proposed housing payment versus the rent payment, the payment shock is low. The lower the payment shock, the stronger the compensating factor.

One 30 day rental payment voids verification of rent. Low payment shock is the difference of the new proposed principal, interest, taxes, and insurance (PITI) less the rent payments. The smaller the gap between the new housing payment versus the rent payment, the lower the payment shock. The lower the payment shock, the stronger the compensating factor.