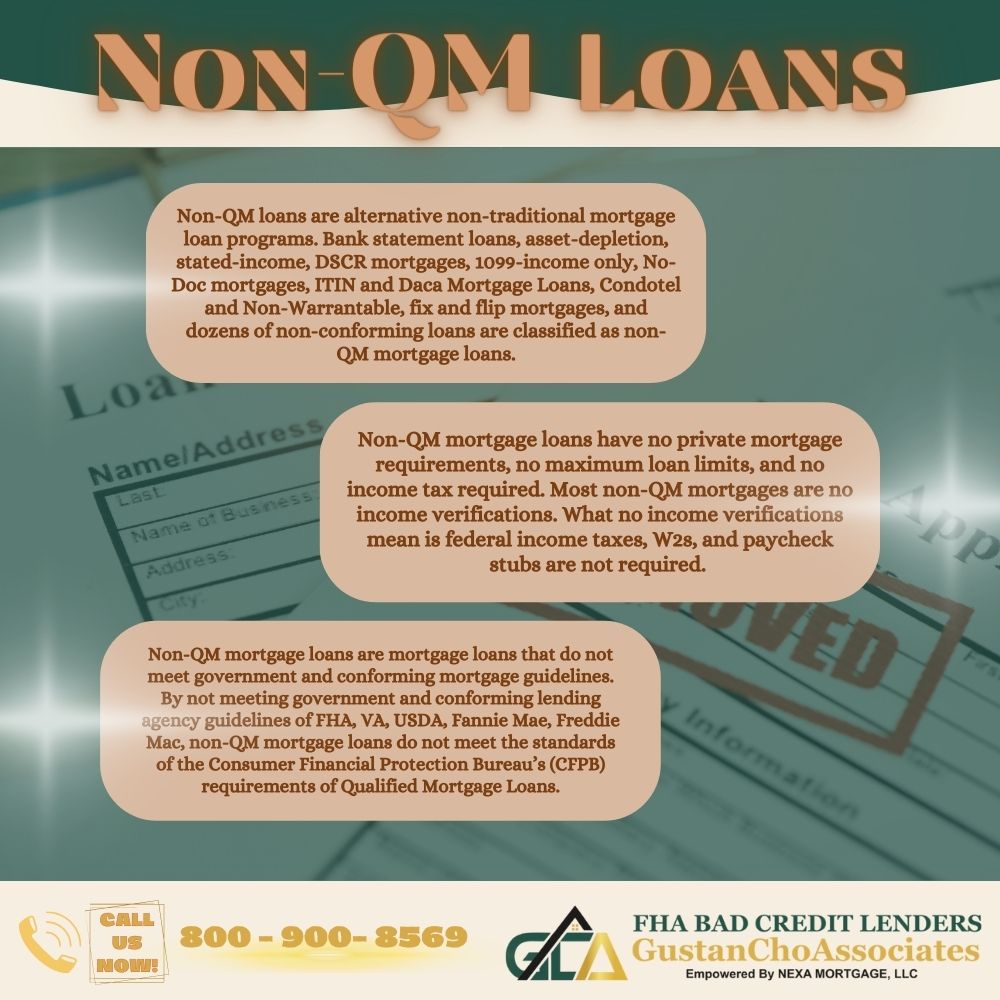

Non-QM loans are alternative non-traditional mortgage loan programs. Bank statement loans, asset-depletion, stated-income, DSCR mortgages, 1099-income only, No-Doc mortgages, ITIN and DACA Mortgage Loans, Condotel and Non-Warrantable, fix and flip mortgages, and dozens of non-conforming loans are classified as non-QM mortgage loans.

Non-prime loans have completely disappeared after the 2008 financial crash. Non-QM mortgage loans, also referred to as non-prime and non-QM mortgage loans, have returned. There are dozens of non-QM mortgage loans in today’s mortgage market place. Non-QM loans does not require income verification or federal income tax returns. Business owners and self-employed borrowers can now qualify for a 12-month bank statement loan program at FHA Bad Credit Lenders.

Non-QM loans have no private mortgage requirements, no maximum loan limits, and no income tax required. Most non-QM loans are no income verifications. What no income verifications mean is federal income taxes, W2s, and paycheck stubs are not required. In the following paragraphs, we will cover non-QM loans.

What Are Non-QM Loans?

Non-QM mortgage loans are mortgage loans that do not meet government and conforming mortgage guidelines. By not meeting government and conforming lending agency guidelines of FHA, VA, USDA, Fannie Mae, Freddie Mac, non-QM mortgage loans do not meet the standards of the Consumer Financial Protection Bureau’s (CFPB) requirements of Qualified Mortgage Loans.

Mortgage lenders of non-QM loans are portfolio lenders. Non-QM lenders do not have a uniform agency mortgage guidelines like HUD, VA, USDA, Fannie Mae and Freddie. Many exceptions can be made on non-QM loans.

Non-QM Loans are becoming increasingly popular among homebuyers and homeowners. Mortgage lenders of non-QM loans have their own lending requirements. Not two non-QM mortgage lenders have the same lending guidelines on non-QM loans.

What Are The Lending Guidelines on Non-QM Loans

There are no two lenders with the exact same guidelines on non-QM loans. Each non-QM lender of non-QM loans have their own lending requirements. Non-QM loans are non-conforming loans. Each wholesale mortgage lender of non-QM loans sets their own lending requirements.

Lenders of non-QM loans set their own lending requirements on non-QM loans. Non-QM mortgage lenders are portfolio lenders and can make their own lending requirements.

Non-QM wholesale mortgage lenders either keep the loans they fund in their own portfolio or they sell it on the secondary market to insurance companies, hedge funds, or institutional investors of portfolio loans. Non-QM lenders are often referred to portfolio lenders.

What Type of Non-QM Loans Are There?

I often am asked, “who are your clients?” This is a great question and providing a clear picture can help all real estate and mortgage professionals better serve their clients’ needs- understanding those needs is vital to providing a positive experience. Most of our borrowers come to us after being told by other lenders they cannot qualify.

Why Non-QM Loans?

A great deal of these consumers are self-employed and writing too much off on their tax returns to qualify for the home they want and can afford. That is where we come in. Using bank statements, or even 1099 income, we can take the gross deposits/income from the last one or two years minus expenses and use that to qualify. This is the type of common sense approach that is out there for borrowers who fall just outside of conventional guidelines.

What Type of Borrowers Benefit From Non-QM Loans

Many homebuyers who do not qualify for traditional conforming loans can qualify for non-QM mortgages with no income tax returns. FHA Bad Credit Lenders is the nations larger lender of non-QM mortgages . Licensed in 48 states including Washington, DC, FHA Bad Credit Lenders has an army of over 210 wholesale lending partnerships with non-QM and alternative lending partners.

FHA Bad Credit Lenders has a national reputation of being a one-stop shop. Licensed by 210 wholesale mortgage lenders, we are the largest mortgage broker in the nation. There is no other mortgage broker than NEXA mortgage brokers out there.

Borrowers who can benefit for non-QM mortgages are consumers who are small/large business owners, contractors, beauty professionals, borrowers who are 1099 wage earners, retirees, low credit score borrowers, borrowers one day out of bankruptcy and foreclosure, and other non-traditional borrowers who are outside of the box of traditional and non-conforming lending box.

Non-QM borrowers are not necessarily borrowers with bad credit and poor credit scores. There is no such things as a dead beat borrowers. On the contrary, most borrowers of non-QM mortgages but the market has no mortgage loan options that these borrowers can qualify for. For example, business owners can now qualify for non-QM mortgages loans with no income tax returns. Prior to non-QM mortgage business owners and self-employed borrowers had a difficult qualifying borrowers with no income docs.

Non-QM jumbo loans are non-traditional jumbo loans for lower credit score borrowers. You may need non-QM jumbo mortgage loans for borrowers who do not have qualified income. Non-QM jumbo lenders will offer bank statement loans, DSCR mortgages, No-Doc Jumbo Loans, and dozens of other type of non-traditional jumbo loan options for homebuyers.

The Best Lenders For Non-QM Mortgages

A growing section of the US economy as more and more of the populace have multiple streams of revenue that is self-generated. If we can be resource for you, your clients, or referral partners, we would be glad to be of service here at FHA Bad Credit Lenders. If you want to qualify and get pre-approved for non-QM loans with a mortgage broker licensed in 48 states including Washington, DC, can contact us at FHA Bad Credit Lenders at 262-716-8151. Text us for a faster response. Or email us at gcho@gustancho.com. The team at FHA Bad Credit Lenders is available 7 days a week, evenings, weekends, and holidays.