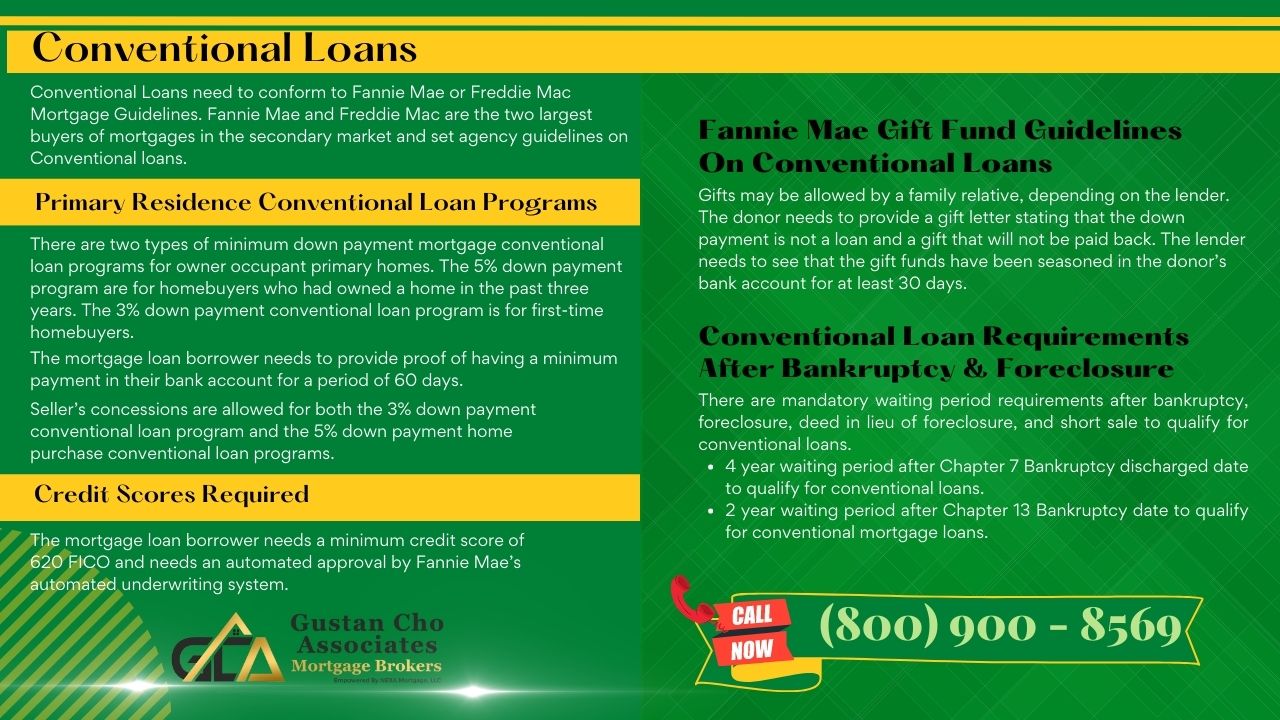

In this article, we will cover all about conventional loans. We will go over how conventional loans work and the benefits for borrowers. Conventional Loans need to conform to Fannie Mae or Freddie Mac Mortgage Guidelines. Fannie Mae and Freddie Mac are the two largest buyers of mortgages in the secondary market and set agency guidelines on Conventional loans.

Conventional loans are not backed by a government agency such as HUD, VA, and USDA. Conventional loans need to conform to Fannie Mae or Freddie Mac if lenders want to sell them in the secondary mortgage market after it funds. Fannie and Freddie will not purchase conventional loans that do not conform.

Conventional loans are not insured by the government like FHA, VA, USDA Loans are. Fannie Mae and Freddie Mac set the agency lending guidelines on Conventional loans. Since conventional loans need to conform to Fannie Mae and/or Freddie Mac agency guidelines, they are often referred to as conforming loans. Conforming loans are private loans originated and funded by banks and mortgage companies.

The Role of Fannie Mae and Freddie Mac on Conventional Loans

In order for lenders to be able to re-sell conventional loans they originate to Fannie or Freddie, it needs to conform to Fannie Mae and/or Freddie Mac Guidelines. If they do not conform, Fannie and Freddie will not purchase the conventional loans. There are various types of conventional loan programs.

Fannie Mae and Freddie Mac are the two largest mortgage giants that purchase mortgage loans on the secondary market. The role of Fannie and Freddie is to provide liquidity in the housing market by buying mortgages on the secondary market from lenders.

Home Buyers who need second home loans or investment property loans cannot qualify with government loans. FHA, VA, USDA Loans are for owner-occupied properties only. Conventional loans offer second home financing as well as investment property loans. In this article, we will discuss and cover Conventional loans and lending requirements.

Pricing Adjustments On Second And Investment Home Loans

Fannie Mae and Freddie Mac have implemented loan level pricing adjustments of 300 basis points on second and investment homes earlier this year. What this means is Fannie Mae and Freddie Mac have increased the back-end pricing on second and investment home mortgage rates.

Second homes and investment homes can be finance with conventional loans. Second or vacation homes require a 10% down payment and investment homes require at least a 15% down payment.

Typical second home and investment home rates went up by 1.5% and borrowers had to pay 1.5% in discount points. This was earlier this year. However, Fannie Mae and Freddie Mac removed these pricing adjustments on second and investment homes on September 16th, 2021. This is a relief for real estate investors and second-home buyers.

Primary Residence Conventional Loan Programs

There are two types of minimum down payment mortgage conventional loan programs for owner occupant primary homes. The 5% down payment program are for homebuyers who had owned a home in the past three years. The 3% down payment conventional loan program is for first-time homebuyers.

Per Fannie Mae and Freddie Mac guidelines, a first-time homebuyer is defined as a homebuyer who did not have ownership in any real estate in the past three years.

The 3% down payment conventional loan program is for first-time homebuyers or home buyers who did not own a home for the past three years. Fannie Mae allows the 3% down payment conventional home purchase loan program to first-time homebuyers only.

3% Down Payment First-Time Homebuyer Conventional Loans

Freddie Mac will allow homebuyers who have not owned a property in the past three years to be eligible for the 3% down payment Conventional Loan Program Seller’s concessions are allowed for both the 3% down payment conventional loan program and the 5% down payment home purchase conventional loan programs.

Homebuyers can get up to a 3% seller concession for closing costs on conventional loans on owner-occupant homes. Investment homes restrict seller concessions up to 2% seller concession.

The maximum amount of seller’s concessions allowed on primary and second home financing per Fannie Mae and Freddie Mac guidelines are 3% seller’s concession. FHA and USDA allow 6% sellers concessions. VA Loans allow up to 4% sellers concessions.

3% Down Payment Conventional Loan Programs

Conventional Loans require private mortgage insurance premiums for any homeowner who has higher than 80% Loan To Value. There is a minimum down payment requirements on conventional loans.

The 3% down payment conventional loan program are for first-time homebuyers with higher credit scores. Private mortgage insurance is required. Debt-to-income ratio caps on conventional loans is capped at 50%.

To qualify for the 3% down payment conventional loan program, the mortgage loan borrower needs to have a minimum of 3% down payment seasoned for at least 60 days in their bank account. 3% down payment is for first-time homebuyers. First time home buyers are home buyers who did not have ownership on a property for the past three years.

Fannie Mae Gift Fund Guidelines on Conventional Loans

Gifts may be allowed by a family relative, depending on the lender. The donor needs to provide a gift letter stating that the down payment is not a loan and a gift that will not be paid back.

Homebuyers can use gift funds for the down payment and closing costs on a home purchase conventional loans. However, the automated underwriting system does not view gift funds favorably.

The lender needs to see that the gift funds have been seasoned in the donor’s bank account for at least 30 days. Need to show the transfer leaving the donor’s bank account and into the account of the receiver via bank statements.

Credit Scores Required

The mortgage loan borrower needs a minimum credit score of 620 FICO and needs an automated approval by Fannie Mae’s automated underwriting system. The maximum loan amount is $726,200 on conventional loans. Higher loan limits are allowed on high-cost areas like many counties in California. Reserves may be required on two to four-unit properties and if the automated findings conditions reserves as part of the automated underwriting system approval.

5% Down Payment Conventional Loan Programs

The 5% down payment conventional loan program is the minimum down payment required on conventional loans unless the home buyer is a first time home buyer. First time home buyers qualify for 3% down payment conventional loans. Minimum credit scores of 620 FICO are required on all conventional loans.

If you had ownership in a home in the past three years, you need a 5% down payment on conventional loans on owner-occupant primary homes.

The mortgage loan borrower needs to provide proof of having a minimum of the 5% down payment in their bank account for a period of 60 days. Some mortgage lenders might allow borrowers to get a gift from a relative or family member. But then the donor needs to provide proof of the funds via providing the lender seasoned funds for the past 30 days.

Using Gift Funds For The Down Payment on Conventional Loans

Homebuyers can use gift funds on conventional loans for the down payment and closing costs. The money transferring the donor account into the receiver account as well as provide a gift letter needs to be provided to the lender.

You can use gift funds for the down payment and closing costs. You cannot use gift funds for reserves if reserves are required by the mortgage lender. Gift funds cannot be repaid back and cannot be a loan. It needs to be a gift from a family member.

As with the 3% down payment conventional loan program, an automated approval via Fannie Mae’s automated underwriting system is required with an approved eligible. Reserve requirements may be required for those who own other rental or investment properties. Maximum loan sizes on 5% down payment purchase conventional loan programs is $726,200.

Financing Requirements On Vacation Homes

On vacation homes and second homes, a minimum of a 10% down payment is required along with a minimum credit score of 620 FICO. Those seeking a vacation home must meet debt to income ratio requirements of 50% or an approved eligible via the automated underwriting system.

Second homes can be financed with a conventional loan with a 10% down payment. Potential rental income cannot be used on second home financing.

10% down payment requirements on second homes. Again, the maximum loan size for a conventional loan for vacation homes and second homes is $726,200.

Financing Requirements On Investment Homes

For borrowers seeking investment home conventional loans, the maximum loan to value allowed is 85% with a minimum credit score of 620 FICO with single-family homes. Multi-Unit requires a 25% down payment. Borrowers with two or more properties wanting to purchase a third or fourth home are considered investment home borrowers.

Investment property loans require a 15% to 25% down payment on conventional loans depending on the number of units. Investment property mortgages require reserves. Mortgage rates are higher on investment property loans versus single-family homes.

So the investment conventional loan program will apply. Lenders will also require three months reserves on investment properties financing. One month’s reserves are equivalent to one month of principal, interest, taxes, and insurance or commonly called PITI. Investment home buyers can also get sellers concessions by the investment home seller. The maximum amount of sellers concessions allowed on investment homes is 2% per Fannie Mae and Freddie Mac guidelines.

Conventional Loan Requirements After Bankruptcy & Foreclosure

There are mandatory waiting period requirements after bankruptcy, foreclosure, deed in lieu of foreclosure, and short sale to qualify for conventional loans. 4 year waiting period after Chapter 7 Bankruptcy discharged date to qualify for conventional loans. 2 year waiting period after Chapter 13 Bankruptcy date to qualify for conventional mortgage loans.

The waiting period after Chapter 7 Bankruptcy, deed in lieu of foreclosure, and short sale is four years. The waiting period after foreclosure is seven years from the recorded date. There is a two year waiting period after Chapter 13 Bankruptcy discharged date. There is a four year waiting period after a Chapter 13 Bankruptcy dismissal date.

There is a four-year waiting period to qualify for conventional loans after a deed in lieu of foreclosure and/or short sale. There is a seven-year waiting period to qualify for conventional loans after the recorded date of a standard foreclosure. Borrowers who need to qualify for Conventional Loans with a direct lender with no lender overlays please contact us at FHA Bad Credit Lenders at 800-900-8569 or text for faster response. Or email us at gcho@gustancho.com. We are available 7 days a week, evenings, weekends, and holidays.