HUD Mortgage Programs and Guidelines on FHA Loans

This article will cover HUD mortgage programs and guidelines on FHA loans. HUD, the parent of FHA loans, has HUD mortgage programs on FHA specialty home loans. If you have been following FHA Bad Credit Lenders for a while, you will know we are the experts in FHA mortgage financing.

The Federal Housing Administration, overseen by the U.S. Department of Housing and Urban Development, offers aggressive low-down-payment mortgage options to Americans. Most mortgage borrowers have heard of FHA. But they are not aware of the different loan programs available.

FHA Bad Credit Lenders offer FHA loan programs without LENDER OVERLAYS. The team at FHA Bad Credit Lenders are experts in FHA MANUAL UNDERWRITING. This blog will briefly describe some of the specialty programs offered by the Federal housing administration.

The Types Of HUD Mortgage Programs On FHA Home Loans

When it comes to FHA mortgage financing, there are a lot more options than a 30-year fixed FHA mortgage. Most clients understand that you may take out an FHA loan in a 10-year, 15-year, 20-year, 25-year, or even 30-year term. You may have a fixed interest rate for an adjustable-rate mortgage; this is a familiar scene. But most potential mortgage borrowers do not know of the specialty programs offered by the FHA. In the following paragraphs, we will dive into the basics of these specialty programs.

FHA 203k HUD Mortgage Programs

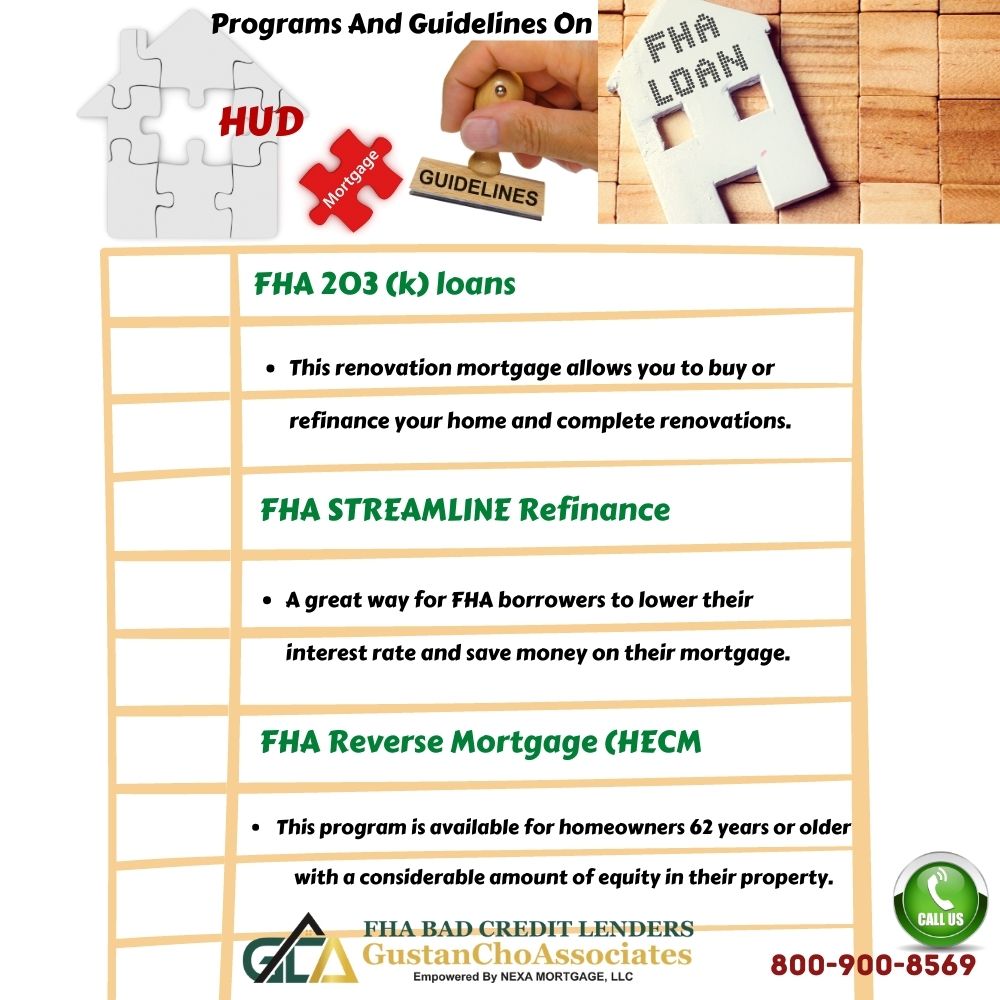

FHA 203 (k) loans are one of the most popular HUD mortgage programs for homebuyer or homeowners who needing an all in one acquisition and renovation mortgage loan. Many borrowers do not know of the 203K renovation loan program. This renovation mortgage allows you to buy or refinance your home and complete renovations.

The advantage of this program is the loan amount is based on the after-renovation value or ARV. You may add items such as new flooring and windows, add an extension on a property, redo a kitchen or bathroom, and more.

This is a great program to increase the value of your property and the area around you. An FHA 203 (K) loan is one of the only ways to finance renovations to your mortgage loan. Depending on the amount of work completed, 203(K) LIMITED and STANDARD programs are available.

Qualifying For and Using FHA (H) Loans

The FHA 203 (H) Disaster Mortgage Loans are FHA specialty loans for borrowers who need financing in disaster areas. This is a little-known section of FHA financing designed to help victims during a major disaster.

The FHA 203h mortgage loan program helps borrowers whose homes were destroyed in a natural disaster such as a flood or hurricane. This program can offer 100% financing in declared natural disaster areas.

The FHA mortgage insurance is collected to protect lenders in these disaster areas. If your home was destroyed or severely damaged in a disaster area, you could apply for mortgage insurance under this program.

Fast-Track Refinance HUD Mortgage Programs

FHA STREAMLINE Refinance is a streamline, fast-track refinance loan program with no appraisal and no-income verification for homeowners with an FHA loan.

FHA streamlined mortgage is a great way for FHA borrowers to lower their interest rate and save money on their mortgage. This loan program allows you to refinance your current loan balance at the current interest rates. This loan program must lower your effective interest rate by at least 0.5% and pass a net tangible benefit. These loans are easy because they do not require income verification.

HUD requires you’ve made at least six on-time payments to your FHA-insured mortgage, and 210 days have elapsed since closing your FHA loan. This is a popular program for our team because many clients do not have the highest credit score when they take out their FHA mortgage.. Mortgage debt helps increase your credit scores quickly. So, after six on-time payments, chances are you have a much higher credit score. Allowing you to lower your rate and save money over the life of your mortgage.

Buying REO From HUD

HUD REO (real estate owned): When a HUD-insured property enters into a short sale or a foreclosure, the home is now the property of the U.S. Department of Housing and Urban Development.

HUD will sell these phones directly to the general public. Many times, as a great deal! This can attract many home buyers, and these homes can start bidding wars.

It is important to know these homes are sold in an as-is condition and do not offer warranties. For a database of homes available for sale in your area, please visit the HUD HOME STORE.

HUD Good Neighbor Next Door Home Purchase Program

HUD Good Neighbor Next Door: The Good Neighbor Next Door offers law enforcement officers, teachers (pre-kindergarten – 12th grade), firefighters, and EMTs up to 50% list price of a HUD REO property.

Eligible single-family homes must be located in a revitalization area and seen on the Good Neighbor Next Door Sales program. When you see the property on this list, it will only be available for seven days. After you submit an offer, the buyer will be randomly selected through a lottery process.

Assuming you meet law enforcement, teachers, firefighter, or EMTs requirements, you will sign a second mortgage for the discounted amount. This “silent second” mortgage will collect no interest or payments. But you must live in the home for at least three years, or you will owe the second mortgage back to HUD.

HUD Mortgage Programs For Seniors: Reverse Mortgages

FHA Reverse Mortgage (HECM): Reverse mortgages are becoming increasingly popular with senior citizens. It allows them to utilize the equity in their home to supplement their income.

The only reverse mortgage insured by the federal government is called a home equity conversion mortgage (HECM) and is offered through FHA. This program is available for homeowners 62 years or older with a considerable amount of equity in their property.

The amount of equity available for withdrawal depends on the age of the youngest borrower on the loan, current interest rates, and the appraised value of your property. With a home equity conversion mortgage, you can make a principal and interest payment, interest-only payment, or no payment at all. Allowing many Americans to enjoy their retirement years.

HUD Manual Underwriting Guidelines

FHA Manual Underwriting: FHA manual underwriting is something FHA Bad Credit Lenders are experts in. If you have followed our reviews, you will know this.

Many of our clients are in an active Chapter 13 Bankruptcy or less than two years discharged from their repayment plan, meaning their file is automatically downgraded to a manual underwrite.

We are experts in manual underwriting guidelines. If you feel your lender is not giving you accurate information, please call 630-659-7644 to review manual underwriting guidelines. Please click the link above for FHA manual underwriting requirements. After reading this blog, we hope you understand FHA specialty mortgages better. For questions surrounding a specific FHA option, please call Mike Gracz at 630-659-7644. If you prefer to communicate via email, please email mgracz@gustancho.com.

FHA Bad Credit Lenders are experts on FHA financing and can help your family without any overlay restrictions getting in the way. We are only one phone call away and are available seven days a week, so give us a call to see what you qualify for.

If, for some reason, you do not qualify today, our loan officers will come up with a customized financial plan for you to qualify as soon as possible. We look forward to helping you with your FHA financing needs.