Bank Statement Loans For Self-Employed Borrowers

This blog will cover qualifying for bank statement loans for self-employed borrowers. Many profitable well-to-do business owners can’t qualify for a traditional mortgage loan.

The reason self-employed wage earners cannot qualify for mortgage loans is due to the way traditional conforming mortgage loans calculate qualified income for mortgage loans. Bank statement loans are non-QM loans where lenders average the most recent 12 months of bank statement deposits and use the average monthly deposit as the qualified monthly income.

Income tax returns are not required. Therefore, self-employed borrowers with many unreimbursed business expenses and insufficient adjusted gross income are eligible for a mortgage loan. The following paragraphs cover bank statement loans for self-employed borrowers and how bank statement mortgage loans work.

What Are Bank Statement Loans

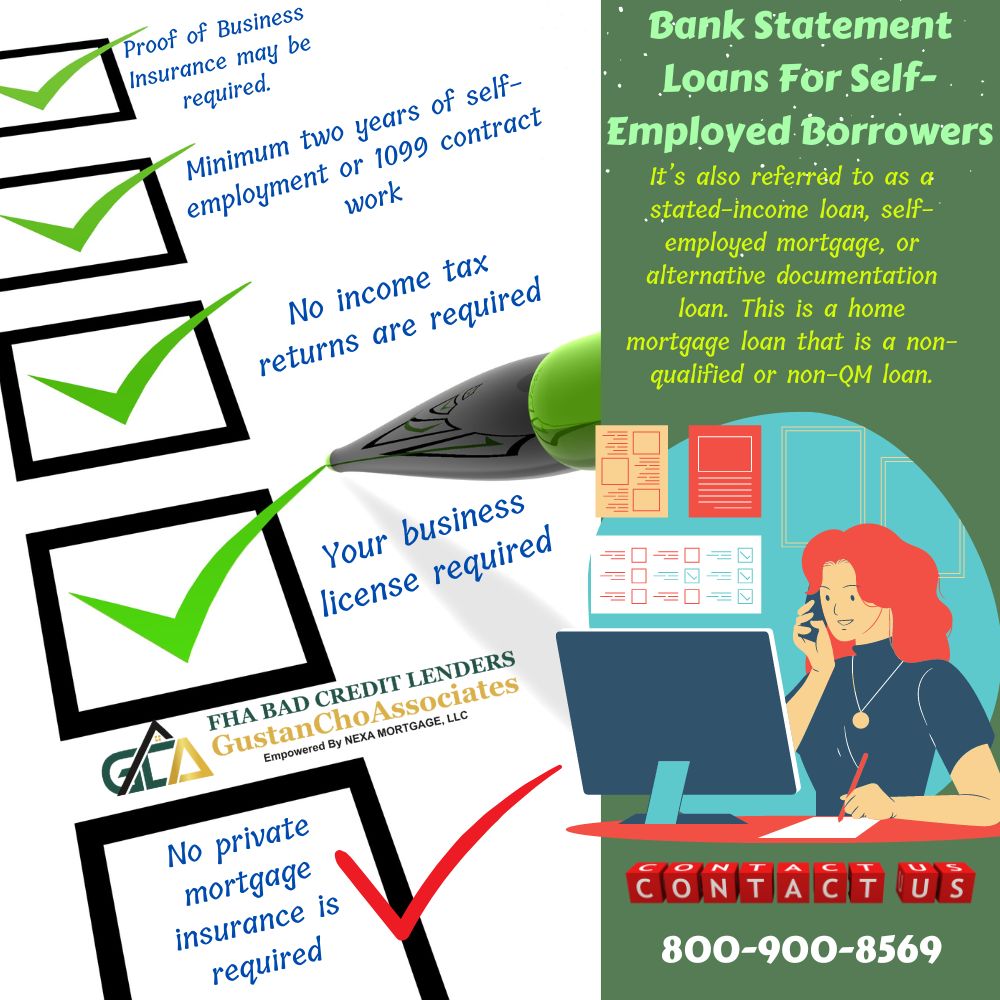

What is a bank statement loan? It’s also referred to as a stated-income loan, self-employed mortgage, or alternative documentation loan. This is a home mortgage loan that is a non-qualified or non-QM loan.

With bank statement loans, because it’s non-qualified, it allows using bank statements instead of traditional tax returns. A non-QM loan doesn’t have to follow the traditional loan rules.

These Bank Statement Loans are outstanding for self-employed borrowers and business owners. This is especially true if they cannot qualify for a mortgage due to the sizeable unreimbursed business expenses they deduct from the gross income on their federal income tax returns.

Bank Statement Loans vs. Traditional Conforming Mortgages

The underwriters will ask for a traditional loan’s pay stubs and tax returns. A mortgage underwriter uses the adjusted gross income as qualified income on government and conventional loans. Adjusted gross income is the net income after all deductions. The benefit of owning and being self-employed is that you can deduct substantial business expenses. The problem with this, however, is that your tax returns do not show the actual truth about how much you earned.

Government-backed loans and conforming mortgages use adjusted gross income from income tax returns. As a business owner, independent contractor, or 1099 wage earner, you can use the U.S. tax code to write off unreimbursed business expenses. Unreimbursed business expenses get deducted from the gross income on tax returns.

A lot of unreimbursed business expenses affect adjusted gross income. Due to low adjusted gross income, many self-employed borrowers do not qualify for mortgage loans unless they get co-borrowers or amend their income tax returns.

How Is Income Calculated on Traditional Versus Bank Statement Loans

Because business owners and self-employed individuals can deduct so much on their taxes, it minimizes how much you owe.

The more unreimbursed business expenses you deduct, the lower your adjusted gross income. The lower your adjusted gross income, the lower the mortgage loan amount you will qualify for.

With Bank Statement Loans, underwriters will not even ask for anything other than your bank statements, no paystubs, or W2!

Adjusted Gross Income Versus Bank Statement Deposits As Qualified Income

Because Bank Statement deposits will be used to determine your income, self-employed buyers can take advantage of the tax benefits allowing them to pay less. Your bank statements are used to qualify!

If you show negative income due to substantial losses on your income tax returns, this is not a problem with Bank Statement Loans. It doesn’t matter if you declare zero or high income; it can still work. Some brilliant business owners will show negative income due to substantial losses on their income tax returns, negatively impacting their chances of qualifying for a loan. This is where bank statement loans come in!

The underwriters who review your ability to qualify only use the bank statements. They will want to see that you are the business owner, have regular monthly deposits, and you will be on your way!

Calculating Income And Expenses On Bank Statement Loans

Income is calculated by looking at your deposits on your bank statements- either 12-24 months’ worth.

We will require either 12 or 24 months’ worth of bank statements. There is a business bank statement questionnaire that the borrower (not LO/processor) must complete and e-sign. The bank statement questionnaire will give a breakdown of their business.

It requires you to answer questions about your business, such as how many locations you own, the number of employees, and what expenses the business incurs.

Mortgage Underwriting On Bank Statement Loans

The mortgage underwriter will look at that and other factors to determine what they will use as expenses against the business. There are four expense percentages they will get from the questionnaire. The percentages are either 30%, 50%, 70%, or 90%, leaving the remainder of the deposits to determine income.

You can also use personal bank statements! If the borrower uses personal bank statements, the borrower must be at least 25% owner of the business. Or the borrower needs to be a 1099 employee.

If the borrower owns the business 100%, the borrower gets to use the total amount of the remaining deposits. But if they are 50% owners, they only get to use 50%. This will then be divided by the number of months of bank statements; we are using either 12 or 24 bank statements. If the borrower is a 1099 wage earner, the borrower needs to have been a 1099 employee for at least two-plus years with the same employer.

Bank Statement Loans Using Combination Of Personal And Business Bank Accounts

Is there a benefit to using both? There can be! Suppose the borrowers use their personal bank statements and have a business account, and they get two months’ worth of business account statements. In that case, the borrower can use 100% of their deposits.

100% of the borrower’s deposits coming into their personal bank account from their business can be used as income. No expenses will count against the borrower.

If you have one borrower who is self-employed and their spouse who is W2, you can use both income sources. This holds as long as the Self-Employment income makes up at least 30% of the income.

How Is Qualified Income Determined On Bank Statement Loans

The average monthly deposits over the past 12 months are the qualified income that is used for debt-to-income ratio calculations by the mortgage underwriter. Withdrawals do not matter.

Only deposits matters on bank statement loans. If the borrower makes a $100,000 deposit every month and withdraws $99,999.00 the same day the $100,000 deposit will be used. The withdrawal and balance do not matter. To qualify, the borrower must have been self-employed for at least two years. Since bank statement loans are non-conforming loans, lenders can make exceptions individually.

Generally, the following terms and conditions apply to bank statement mortgage loan programs. Bank statements should not show overdraft charges, and the individual must be self-employed for two years. There could be exceptions to this if the individual worked in the same industry before becoming self-employed. There is no maximum loan limit. A 10% Minimum Down Payment is required.

Key Points on Bank Statement Loans

- Proof of Business Insurance may be required.

- Minimum two years of self-employment or 1099 contract work

- Your business license required

- No income tax returns are required

- No private mortgage insurance is required

There are no maximum loan limits. Underwriters will check to see if there are any large irregular deposits or abnormal activities. Self-employed borrowers have trouble being eligible for traditional loans due to taxable income making it difficult to qualify for conventional government and conforming loans. Our 12 and 24-month bank statement mortgage allows business owners to enjoy home ownership.